- February 2, 2023

- Posted by: Shane Daly

- Category: Trading Article

The Cboe Volatility Index (VIX) is a measure of the market’s expected near-term volatility, commonly referred to as the “fear index.” It tracks the 30-day implied volatility of options on the S&P 500 Index and provides an indication of investors’ expectations for stock market volatility over the next 30 days. The VIX is used as a tool to gauge investor sentiment and assess the level of fear or stress in the stock market.

Popularity of VIX

The popularity of the VIX has grown significantly since its introduction in 1993, making it the most commonly-quoted measure of implied volatility. The VIX reflects the market’s expectations for near-term risk and is often referred to as a gauge of investor sentiment.

A high VIX reading indicates that investors perceive heightened risks.

A low VIX reading signals that investors are feeling more optimistic about future market conditions.

How Does the CBOE Volatility Index (VIX) Work?

The VIX is calculated using options prices on S&P 500 stocks. Specifically, it looks at puts and calls from across a range of strike prices and expiration dates to determine implied volatility. This means that when option premiums for puts or calls are higher than usual, this indicates that traders are expecting higher levels of volatility in the near future. The higher these implied volatilities are, then the higher the VIX will be.

The VIX can be used by traders as a tool for determining whether they should increase or decrease their exposure to riskier assets such as stocks or commodities. When there is high fear in the market (i.e., when the VIX rises), this usually indicates that investors are selling off risky assets quickly; conversely, if there is low fear (i.e., when the VIX falls), investors tend to buy more risky assets.

By understanding how fear affects markets and trading decisions, traders can make better decisions about where and when to invest their money.

Additionally, since the VIX provides information on expected future volatility rather than actual stock performance, investors can use this information as an early warning system for potential changes in market conditions before they happen.

How Can Investors Trade the VIX?

Trading the VIX has become increasingly popular over the past few years due to its ability to provide insight into market trends. However, traders cannot directly buy or sell the actual index – instead, they must use derivatives such as futures contracts or options on futures contracts to gain exposure to it.

Trading these types of derivatives allows investors to profit from movements in either direction without having to physically buy or sell shares of any underlying security. Additionally, these types of contracts are generally leveraged which means that traders have more buying power than they would if they were trading stocks directly.

The most common way to trade the VIX is through futures contracts or options on those futures. The Chicago Board Options Exchange (CBOE) offers two types of futures contracts for trading VIX – monthly expirations and weekly expirations. These futures contracts track the movements of the VIX spot price, which means that traders who buy and sell these contracts will be able to benefit from changes in volatility without having to buy and sell stocks or other investments.

Traders can also purchase options on these futures contracts, which allows them to take advantage of more complex strategies such as straddles, strangles, butterflies, and so on. The CBOE also offers Exchange Traded Funds (ETFs) that are designed to track the performance of the underlying VIX index. These ETFs offer another way for investors to participate in volatile markets without having to directly trade individual stocks.

VIX Levels To Note

A higher VIX reading indicates greater uncertainty, with levels above 30 indicating tremendous uncertainty. Investors can use the VIX to hedge downside risk by buying put options when the VIX is relatively low and premiums are cheap.

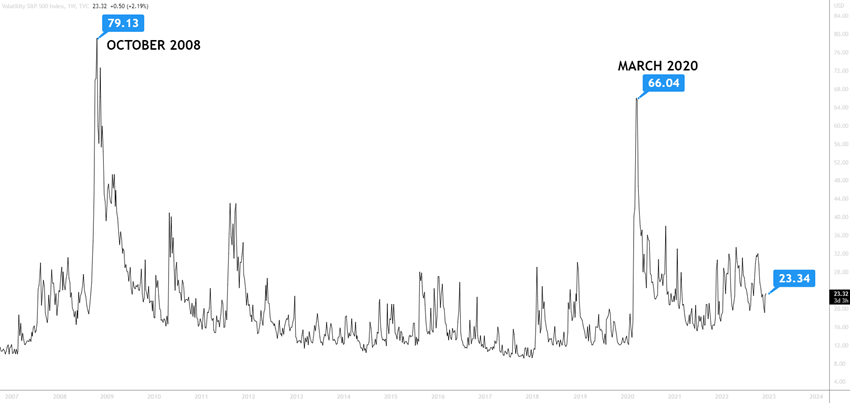

An average level of the VIX is around 21.4, with higher readings (above 30) usually associated with a bear market and increased levels of volatility and fear in the market.

Does The Level of VIX Affect Option Premiums and Prices?

The higher the VIX, the greater the implied volatility. This increase in implied volatility leads to an increase in option premiums—the amount you have to pay for an option contract. Higher premiums mean that you will pay more for both puts and calls when buying them; but also means that if you are selling an option, you will receive more money for it.

In addition, with a higher VIX comes a wider bid-ask spread on options contracts which increases transaction costs for traders.

That said, not all changes in implied volatility are caused by changes in the market’s expectation of future volatility as measured by VIX; other factors like interest rates and dividends can also play a role. Therefore, traders need to take these other factors into account when looking at how they might be affected by changes in implied volatility due to changes in VIX levels.

Is High or Low Better?

The answer depends on your strategy and goals as a trader. Generally speaking, when there’s high implied volatility resulting from high VIX levels, it may mean fewer opportunities for profit because options become more expensive.

On the other hand, low implied volatility resulting from low VIX levels often presents more opportunities for profit since options become cheaper. However, this isn’t always true as there are other factors beyond just VIX that can influence option pricing.

High Levels of VIX Points to Increased Volatility and Fear in the Market

When the VIX is relatively high (above 30), it generally indicates that markets are in a state of fear and uncertainty, as investors become more risk-averse. High levels of volatility lead to increased demand for options contracts, driving up their prices and premiums. This means that traders who want to buy options will have to pay more for them, but those selling options will receive more money.

Additionally, the bid-ask spread on options contracts widens when volatility is high, increasing transaction costs for traders.

Traders who are looking to benefit from increased volatility can purchase put options and try to mitigate downside risk by taking advantage of the higher option premiums.

On the other hand, traders who are looking to take advantage of low volatility can purchase call options or sell puts to capitalize on the cheaper option premiums during this time.

Ultimately, it’s important to remember that there are other factors besides VIX that affect option prices and implied volatility, so traders need to be aware of them to make informed decisions when trading options.

5 Important Facts

Q: What is the Cboe Volatility Index (VIX)?

A: The Cboe Volatility Index, or VIX, is a measure of expected volatility in the stock market over the next 30 days. It is calculated based on the S&P 500 Index options prices and provides a gauge of investor sentiment and market uncertainty.

Q: What does a high level of VIX mean?

A: A higher VIX typically indicates that markets are in a state of fear and uncertainty, as investors become more risk-averse. High levels of volatility lead to increased demand for options contracts, driving up their prices and premiums. This means that traders who want to buy options will have to pay more for them, but those selling options will receive more money.

Q: How does VIX affect option premiums?

A: The higher the VIX, the greater the implied volatility, which drives up option premiums. This can be beneficial for traders looking to buy options as it means they will have to pay more for them; but also means that if you are selling an option, you will receive more money for it.

Q: What factors besides VIX affect option prices?

A: In addition to VIX, other factors can also affect option prices and implied volatility. These include interest rates, dividends and the underlying stock price. Therefore traders need to take these into account when making trading decisions.

Q: What strategies do traders use in high and low VIX environments?

A: Traders who are looking to benefit from increased volatility can purchase put options and try to mitigate downside risk by taking advantage of the higher option premiums. On the other hand, traders who are looking to take advantage of low volatility can purchase call options or sell puts to capitalize on the cheaper option premiums during this time.

Are you looking for a way to make money during volatile times?

You’re in luck! Our free guide reveals a secret options strategy that can help you profit from the stock market’s ups and downs.

Download your free copy now to learn how to make money no matter what the markets are doing.