- November 9, 2022

- Posted by: Shane Daly

- Category: Trading Article

Options offer investors the ability to speculate on the direction of a security or to hedge an existing position. But with this increased flexibility comes increased risk. One of the factors that can have the biggest impact on options prices is volatility.

Key Points

In volatile markets, use limit orders rather than market orders when placing options trades

A limit order is an order to buy or sell a security at a specified price or better

For buying/selling options, start with the mid-price of the bid/ask and adjust from there if your initial limit order isn’t filled

Be careful when adjusting limit orders not to move the price too high or low, or you may end up paying too much for the option and disrupt your risk/reward profile

In this blog post, we’ll take a look at what volatility is, how it’s measured, and how it impacts options prices. We’ll also offer some tips on how to place your options orders in volatile markets.

What Is Volatility and How Does It Affect Options Prices?

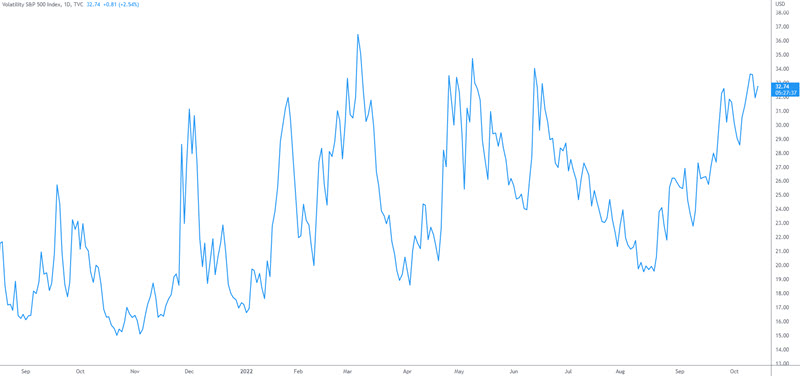

Volatility is a measure of the amount by which a security’s price tends to fluctuate. There are many ways to measure volatility, but one of the most popular is the CBOE Volatility Index (VIX).

The VIX is a real-time index that measures the expected volatility of the options on the S&P 500 index over the next 30 days. The VIX is often referred to as the “fear index” because it tends to rise when markets are declining and fall when markets are rising.

The impact of volatility on options prices can be significant. That’s because option prices are directly affected by changes in the underlying security’s price, and by changes in the expectation of future price movements (i.e., changes in volatility). When markets are volatile, option prices tend to be more expensive because there is greater uncertainty about the future direction of prices.

The impact of volatility on options prices can be significant. That’s because option prices are directly affected by changes in the underlying security’s price, and by changes in the expectation of future price movements (i.e., changes in volatility). When markets are volatile, option prices tend to be more expensive because there is greater uncertainty about the future direction of prices.

On the flip side, when markets are less volatile, option prices tend to be cheaper because there is less uncertainty about the future direction of prices.

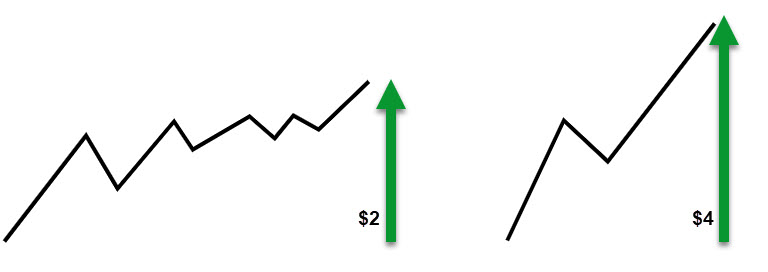

For example, let’s say you’re considering buying a call option on XYZ stock with a strike price of $50 and an expiration date of one month from today. The current price of XYZ stock is $49, and historical data shows that it has a standard deviation of $2 over the past month. Based on this information, you would expect XYZ stock to move up or down by $2 (on average) over the next month.

Now let’s say that you’re considering buying a call option on ABC stock with a strike price of $50 and an expiration date of one month from today. The current price of ABC stock is also $49, but historical data shows that it has a standard deviation of $4 over the past month. Based on this information, you would expect ABC stock to move up or down by $4 (on average) over the next month.

Now let’s say that you’re considering buying a call option on ABC stock with a strike price of $50 and an expiration date of one month from today. The current price of ABC stock is also $49, but historical data shows that it has a standard deviation of $4 over the past month. Based on this information, you would expect ABC stock to move up or down by $4 (on average) over the next month.

As you can see from this example, all else being equal, options on ABC stock will be more expensive than options on XYZ stock because ABC stock is more volatile than XYZ stock.

Placing Options Orders In Volatile Markets?

So how do you place your options orders in volatile markets? The key is to use limit orders rather than market orders. Limit orders, for us at Netpicks, are the standard order entry type we use.

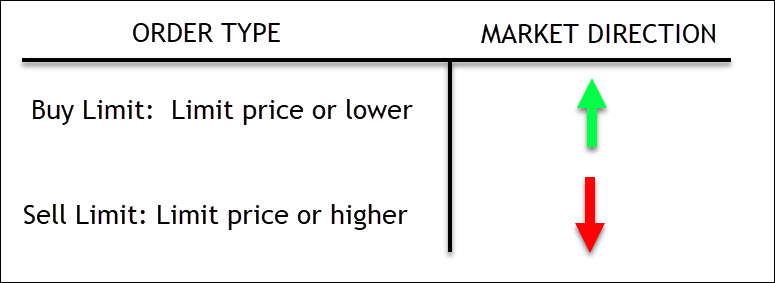

A market order is an order to buy or sell a security at the best available price.

A limit order is an order to buy or sell a security at a specified price or better. When you place a limit order, you’re guaranteed to get your trade filled at or below your limit price (if you’re buying) or at or above your limit price (if you’re selling).

For example, let’s say that you wanted to buy shares of XYZ stock, which is currently trading at $10 per share. You place a limit order to buy 100 shares of XYZ stock at $9.50 per share. If the stock drops to $9.50 per share, your trade will be executed and you’ll pay $950 for the 100 shares of stock ($9.50 x 100). However, if the stock never drops to $9.50 and instead continues trading at $10 per share, your trade will not be executed.

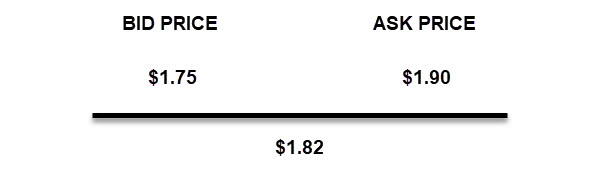

For entering options orders, we teach our traders to start with the mid-price of the bid/ask. Imagine you are bullish on a stock and looking to buy a call option.

The premium is around $1.90 with the bid price at $1.75. We’d take the average of the two prices ( (1.75+1.90)/2) and enter our initial order to buy at $1.82. If the premium drops to our price point, we will get filled.

Limit orders give traders much more control over their trades than market orders because they can specify the exact price that they want to pay (or receive) for security. This type of control can be especially helpful when placing trades in volatile markets where prices are constantly fluctuating.

How to Adjust Your Limit Orders

If your limit order isn’t getting filled, it may be because the price is too far away from the current market price. In that case, you’ll need to adjust your order.

If you’re buying options, you can adjust your order by moving the price higher. The higher you move the price, the better your chances of getting filled. However, be careful not to move the price too high, or you may end up paying too much for the contract and it skews your reward-risk scenario.

If you’re selling options, you can adjust your order by moving the price lower. The lower you move the price, the better your chances of getting filled. However, be careful not to move the price too low, or you may end up selling your options for less than they’re worth.

Summary

The volatility in the markets is something that every trader has experienced at one point or another. However, there are ways to make your trades more precise and cut down on unnecessary risk if you use limit orders instead of market ones.

Looking for a safe and reliable investment?

Dividend stocks provide stability and growth for your portfolio. Our list of 101 dividend stocks will help you find the best options for your needs.

With our list, you can explore different types of dividend stocks to find the perfect one for your portfolio.