- October 4, 2022

- Posted by: Shane Daly

- Category: Trading Article

If you’re new to options trading, one of the first things you need to understand is the expiration date of your contract.

Every option contract has an expiration date. This is the last trading day for this contract and the day which the contract expires. Once it expires, neither you nor the seller of the option has any obligations or rights. If you own an options contract that expires on June 1, for example, then on June 2 it will be as if you never owned the contract at all.

Except of course, you will be out the money you paid for the contract – the premium.

In this article, I’m going to give you a brief overview of what expiration is and how it can affect your options trading success.

Option Expiration Date And What It Means

As a buyer of a call/put options, you have the right but not the obligation to buy/sell the underlying asset at the strike price before a specific date. That date is called the expiration date.

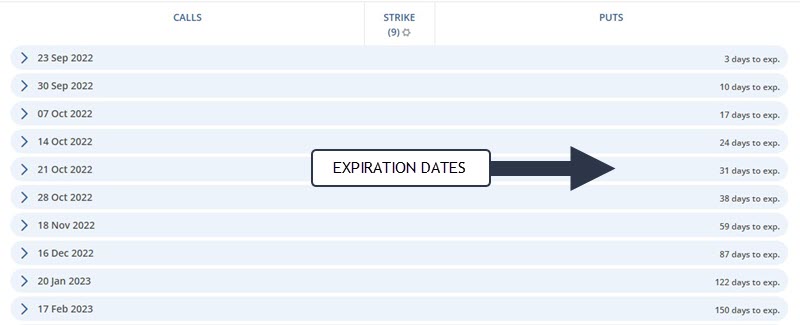

Monthly option contracts expire on the third Friday of each month. We also have weekly expirations that are listed on Thursdays and will expire the following Friday. Not all underlying assets have weekly options available.

It is important to understand that you do not have to hold your position until the expiration date. You can close your position by selling/exercising it before the expiration date. Many traders will sell their contract and once completed, they have no more rights they once had.

To do this, you’d place an order to “sell to close” which sells the contract back to the market and closes your position.

Some traders will allow their option position to expire worthless. This means that, in the case of a call option, the market price is trading below the strike price. For example, you bought a call option with a strike price of $205.00 and the market price of the stock is trading at $185.55 on the day of expiration.

Since the expiration date arrived and the stock is below the strike price of $205.00, your options position is out of the money, expiring worthless, and you lost the entire amount you paid for the contract. We don’t recommend the holder of an option let an option expire worthless. Selling it back to the market before expiration and making something to offset the loss, is our preferred approach.

There is another event that can happen with a contract and that is called Exercising.

Exercise The Contract

If you bought a call option, for example, and your strike price is below the current price of the stock, your position is In The Money. Instead of selling the contract to the market and making a profit, you decide you want to hold the shares of the underlying stock as a long-term investment.

Remember, you have the right to those shares and the options seller must sell them to you if you want them.

Imagine you bought one contract with the underlying stock of SNOW with a $150.00 strike. The strike price is the price you have the right to buy the shares at if you choose. Currently, SNOW is trading at $185.00. You exercise your right to buy 100 shares of SNOW at $150.00/per share (your strike price) or $15,000 for 100 shares. There is a profit of $35 per share if you decide to sell all or some of the shares.

Imagine you bought one contract with the underlying stock of SNOW with a $150.00 strike. The strike price is the price you have the right to buy the shares at if you choose. Currently, SNOW is trading at $185.00. You exercise your right to buy 100 shares of SNOW at $150.00/per share (your strike price) or $15,000 for 100 shares. There is a profit of $35 per share if you decide to sell all or some of the shares.

The seller of the contract is obligated to sell you those 100 shares at the price of $150.00.

Only about 7% of all contracts are exercised by the trader.

There are times when the contract is automatically exercised and a trader must be aware of the potential for this.

Going back to our example, you are in the money with your options contract and the expiration date has arrived. If you do not close your position or exercise the contract yourself, your broker may exercise the contract on your behalf. This means that you could find yourself holding 100 shares of SNOW stock and your trading account minus $15,000 (the strike price x 100 shares).

Conclusion

Expiration is an important thing to understand before trading options. Expiration is simply the date on which an options contract expires and is no longer valid.

There is the risk of your contract being exercised if it is in the money at expiration. Ensure your trading strategy has a plan on how you will exit your trades.

At Netpicks, we don’t allow the contract to expire and we take action and the appropriate time. To learn more about our approach to trading options, download our 8 Minute Options Cookbook to get an inside look at our style of trading.