Trading options is certainly a scary prospect for many individual traders.

There are so many distinct types of strategies which are seemingly so complex when compared to standard outright trading.

Even many spread traders would be less likely to want to get involved. But whilst on the face of it options strategies are complex, the degree of complexity can be varied by the strategy you choose for a given situation.

You can choose from:

- calls

- puts

- strangles

- straddles

- butterflies

- iron condors and many more.

Options strategies can allow you to trade your expectations of the market and control the level of risk you’re willing to participate with.

You can be ultra-aggressive or so much more conservative. You can trade various strategies in order to profit in all kinds of market conditions.

Watch Our Options Trading Video

How To Pick Profitable Options

Like anything in life, a little education often demystifies things greatly.

The thing is that you don’t necessarily need to trade complex options strategies at all to benefit from them. If you trade stocks normally simply by replacing your regular positions with long call or put options, you can make your money work more effectively for you.

If you already have a system that generates your entry and exit signals for you, there’s no reason why you can’t get going with options trading straight away. Just make sure you use an options profit and loss chart to keep track of your trading progress.

All you really need is to know the direction you believe the underlying stock (or anything else the option is written on) might move and have an idea of how long it might take to reach your target.

Get Your Free Options Trading System – Software, Training, Trade Plans

Why Consider Options Trading?

There is one really compelling reason for trading options and that’s the leverage you can command compared with trading the stock itself.

But options also make it really easy to take a negative view on stock prices by simply buying a put option.

Although as with any type of trading, there’s the potential to lose a great deal of capital if you employ the wrong strategy or trade too big a position relative to your account size, you can at least guarantee your maximum loss on any options you buy – the premium you originally paid plus commissions.

If the option expires beyond the strike price (price at which you have the right to exercise the option at) – below for a call or above for a put – the option is rendered worthless.

How Do You Trading Options?

All you need to trade options is to have a simple strategy to buy or sell a stock.

So let’s say for example that your strategy generates a buy signal in the stock. At this point you need to be ready to purchase either an at-the-money or in-the-money call option with enough time left until its expiry date.

Historically, most options were negotiated between the buyer and seller and were at-the-money.

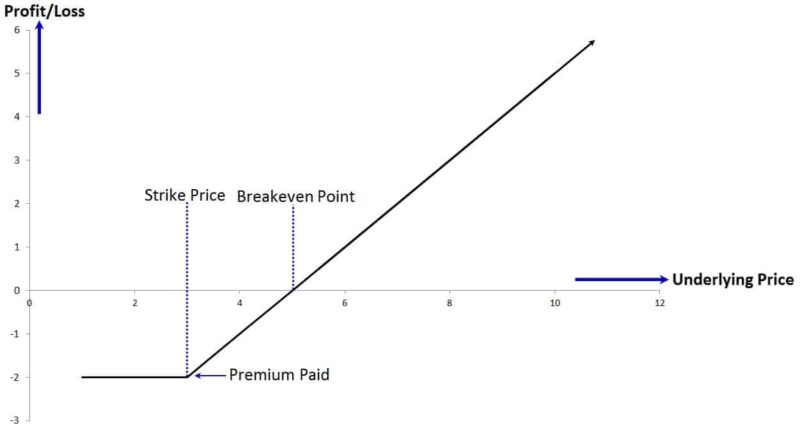

Once you’ve bought your call option, your return looks something like this:-

Clearly the thing to remember here is that in order to offset the premium you pay in order to buy the option, the underlying stock must move a minimum amount beyond the strike price.

Your strategy needs to have sufficient profit potential in order for it to be worthwhile taking the trade in the first place.

The last thing that you really need to remember is that in most cases you won’t need to exercise your options at all. As the underlying value of the stock moves in your favor, the price of the option you own will increase to reflect this fact.

Once the stock hits its profit target for your strategy, you can just sell your option back.

Caveats With Trading Options

Just because an option is there and it trades, it doesn’t mean to say that there’s going to be enough liquidity to get in and out quickly and efficiently. The cost of illiquid markets can be the difference between a winning and losing strategy so make sure that you take account for this properly.

Leverage is a wonderful and yet a terrible thing at the same time.

If you buy too many options because you think your risk is limited, you should think again. If you lose, you’re still losing a proportion of your trading capital and it’s important to limit this to a level whereby you are able to sustain a period of draw-down without going bust.

Finally, out-of-the-money options are likely to be cheap for a reason in the short term. The chances are that the party writing these options is very confident that prices won’t exceed the option strike price at expiration and hence their willingness to take a lower premium.

Either way, options are a great way to use your trading capital.

They are highly flexible, give fantastic leverage and allow you to trade in such a way that suits your current strategy. So taking the time to familiarize yourself with them could be time well spent.