- February 28, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

Turn on any type of financial media or have a conversation with a long time money manager and you will hear that trading Options is a very risky endeavor.

You will hear stats thrown around that 95% of traders fail in making money long term in the markets. It bothers me when I hear things like this because in my experience options have been an absolute great area to be in and can produce some really big profits.

So why is it that people are scared away from these products in many cases?

In my opinion it is a lack of understanding how they work. Like any other product, there is a right and wrong way to trade options.

Let’s take a deeper look.

The Common (but not the best) Way Of Trading Options

If you are a trader or investor you can probably remember back to when you first were introduced to the markets.

-

- “Buy low sell high.”

- “Invest for the long term in companies that you know and understand and who have good fundamentals.”

These are some of the common methodologies taught in schools and promoted by financial planners. As a result, in many cases traders go into trading options with the same approach.

Buying long calls and long puts as a way to play the markets moving up or down is a common starting point. The problem with this approach is that buying long calls or puts is much different than buying or selling shares of stock. The prices of these options are influenced by other factors than just stock direction.

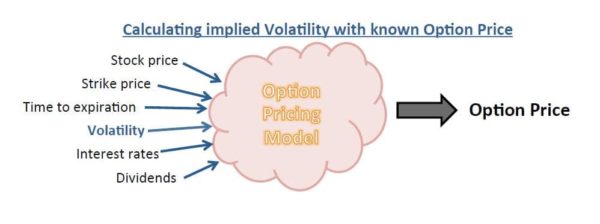

6 Inputs Of The Option Pricing Model

While stock price is a big input in the price of an option there are other factors in play that are crucial to understand if you desire to see success with your trading.

The 6 inputs in the pricing model of an option are:

- Stock Price

- Strike Price

- Time to Expiration

- Volatility

- Interest Rates

- Dividends.

We are going to talk about Volatility and Time to Expiration in more detail as these two can cause the biggest issues with the way many retail traders use options. Of the 6 inputs that go into the option pricing model 5 of them can be easily determined. Stock price, strike price, time to expiration, interest rates and dividends are easily found.

Of the 6 inputs that go into the option pricing model 5 of them can be easily determined. Stock price, strike price, time to expiration, interest rates and dividends are easily found.

Understanding Implied Volatility

The one wild card is volatility as it is constantly changing throughout each trading session. So the pricing model actually works backwards to determine which level of volatility is being used to generate the current price of an option. It takes the 5 known inputs and backs them out of the current option price being quoted to get the volatility.

This is known as Implied Volatility.

In order to trade options successfully it’s important to understand when Implied Volatility is high or low for each product that you trade.

If you don’t understand volatility then you could potentially see a directional move in your favor and still not make money. This would happen if you were long a call and got a move higher in the stock but a drop in implied volatility. The could result in a lower profit return or even worse no profit at all.

We teach our students to let the markets determine which options we decide to trade. What we mean here is we want to buy options when volatility is low and sell them when it’s high.

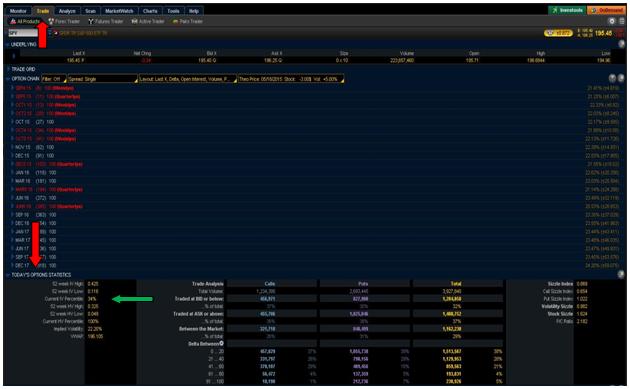

How We Figure Out Volatility

How do we know what’s high and what’s low when it comes to volatility? The way we do it in the ThinkorSwim platform is to use the IV Percentile tool. This can be found on the trade page under ‘Today’s Options Statistics’ box towards the bottom of the trade page.

This number compares the current level of Implied Volatility being used to the levels of volatility that have been seen on that product over the last 52 weeks.

- Anything above the 50th Percentile means Implied Volatility is high

- Any reading below the 50th Percentile means Implied Volatility is low.

When the volatility is high we will go to the premium collection strategies in our playbook.

This means we are looking at Option strategies like

- short vertical spreads

- iron condors

- butterflies

- straddles

- strangles.

When the volatility is low we will look to buy options using strategies like:

- long calls or puts

- vertical spreads

- calendar spreads.

Using Volatility As Our Options Guide

The reason we like to let volatility guide us is we are taking the view that over time the 50th Percentile will act as a magnet and will pull volatility towards it. When Implied Volatility is high and we sell premium we are actually increasing our odds of success if volatility drops.

This happens because as volatility drops the options will get cheaper which will allow us to close our short premium trades for more profit. It’s giving us more ways of being profitable. When Implied Volatility is below the 50th Percentile we will focus on buying premium.

This is the case because if we get volatility to expand higher towards that 50th Percentile that will actually help our options increase in value faster.

If you can program yourself to follow volatility closely you will vastly increase your chances of success. Instead of just buying a long call or put on each trade and hoping for the best you will actually give yourself a better opportunity to make money if the market doesn’t do exactly what you are hoping it will do.

Time to Expiration

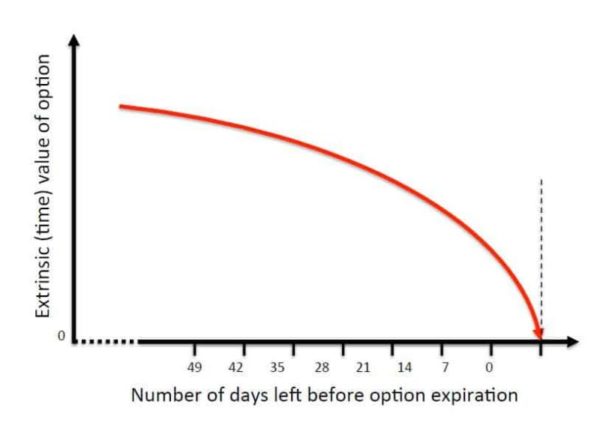

We know that trading options is much like buying an insurance policy. Each day that we don’t make a claim our policy loses value that we don’t get back.

Trading options is much the same way.

The longer you hold an option the less value it will have due to the time decay. Many traders pick the options that they trade based on what they can afford instead of focusing in on which option gives them the best odds of success.

You can actually limit the effect of time decay by going farther out in time. This is due to the fact that time decay moves in a nonlinear fashion. In other words, the closer you get to expiration the more value the option will lose each day that you hold it.

Knowing this about time decay means we can place trades with better odds of success by going farther out in time. Many traders will look to the weekly options which expire each Friday because they are very inexpensive when compared to the options that expire once a month.

However, when trading the weekly options you have to understand the time decay can have a big factor on your trades.

Instead of putting on trades that don’t have a large margin for error, I encourage our students to go out 15-35 days at a minimum. This will limit some of the effect of time decay and will allow you to hold your positions longer without the time decay eating away at those positions.

Trading Options Without A Plan

If just blindly buying calls and puts you are going to face an uphill battle over time with your options trading. Sure you will have some really great winners from time to time but ignoring factors like Implied Volatility and Time Decay will ultimately lead to frustration.

It will be hard for you to hit the consistent profits that we all want over time.

However, flip the cards around and let these factors work in your favor and I think you will be amazed at how the growth in your account will improve.

Trading Options doesn’t have to be difficult if you just take the time to educate yourself on how they move and what factors can affect that movement. Trading Options can be hugely beneficial especially in crazy market conditions that we are set to see in the coming years.

Prepare yourself now so you can battle through the wild swings with the returns we are all shooting for. Ensure you use an option trading spreadsheet to log all your trades so you can see how you progress.

2 Comments

Comments are closed.

I would like to learn more about trading options

Hey Richard. Reach out to our Options guy Mike at mike@netpicks.com