- October 9, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

Having a good set of mechanics in place for creating opening and closing orders is crucial as an options trader.

While it might seem basic, done incorrectly and it can lead to lost money.

In this article, we will review the different order types that we use most often when placing our options trades.

I will be showing examples below in the Thinkorswim platform, but these orders types and procedures can be followed in any broker platform that you are using.

Types Of Orders For Options Trading

When placing an order to buy or sell an option there are 2 main orders types that you have available. You can use either a limit order or a market order.

- A limit order is a type of order to buy or sell an option at a specific price or better.

- When using a Buy Limit order your trade will be filled at the limit price or lower.

- A Sell Limit order will be filled at the limit price or higher.

The limit orders give us more control of where we get filled at on the trades.

On the downside we aren’t guaranteed to get filled at the price that we use for the limit order. If we don’t get filled at our limit price, we can always adjust the order higher or lower to increase our chances of getting filled. Doing so will cause a smaller profit or larger loss but will also get us in or out of the trade faster.

A market order is an order to buy or sell an option at the best available price in the current market.

While you will get a quick fill on your order when using a market order, you also lose control of the price you get filled at. In some cases, this can have a big impact on the P/L of the trade. If you are trading a stock or ETF that doesn’t have good liquidity in the options, the market orders can potentially produce bad fill prices.

Bad fills are well away from the levels that you were looking at when placing the trade.

When Do We Use Limit vs Market Orders?

Our first choice is to use limit orders on all trades. It will give you more control of your trades and will prevent the bad fill prices that can come with a market order from having a big impact on your bottom line.

The limit orders will take more attention as you aren’t guaranteed to get filled at your limit price.

They might require you to adjust your order higher or lower in order to get filled on your trade.

- If you don’t get filled on a limit buy order, you can adjust the order price higher

- If you don’t get filled on a limit sell order you can adjust the price lower

We only use market orders as the option of last resort. If you are in a time crunch and don’t have the ability to watch the trade to see if you get filled, then a market order can be used. Just know you will most likely be giving up some money to get the quick fill. This can add up in a big way over dozens of trades over time.

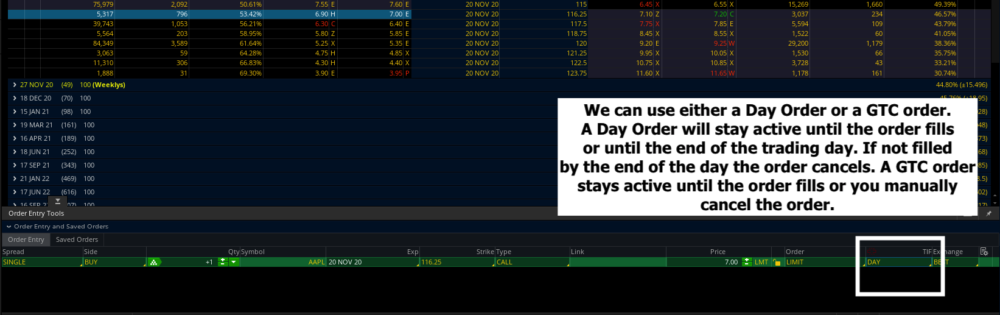

Day Orders vs GTC Orders (Good Till Cancelled)

After deciding whether to use a limit or market order, the next question becomes whether to use a day order or a GTC. A day order is an order type that will remain active throughout the day until you get filled at your price.

If you don’t get filled by the end of that trading session the order would automatically be cancelled out. If you still wanted the order in place the next day you would need to come in after the market open the following day to place the order again.

The other option is to use the GTC order. This order type stays in place until you get filled at your price or until you manually come in and cancel the order.

We prefer to use day orders when placing an entry order. This will give us the full session to try and get filled at our price.

If we use a GTC order on an entry order, we run the risk of getting a bad fill price the following day if the markets were active at the market open.

We would rather have the entry order cancel at the end of the day and then come in the following morning to re-evaluate whether we still wanted to place the trade or not. If we did then we could adjust the price and get the order working again.

When placing on order to close a position at a target or stop level we will use the GTC option.

We are willing to keep those closing orders in place as a GTC because we want to close the trades as soon as possible when a target or stop level is hit. We aren’t exposed to getting bad fill prices on a closing order like we could be on an entry order right when the market opens.

What Price Should We Use for Our Limit Orders?

We mentioned above that we like to use limit orders whenever possible. If that is the case, what price should be used for these orders? T

he goal when using limit orders is to get the best possible price on our trades. This means we want the lowest possible price when buying an option and the highest possible price when selling.

The tricky part about this is when you are looking to buy an option at the lowest possible price, there is a seller on the other side of your trade that is looking to sell you the option at the highest possible price.

There has to be give and take in order for the orders to get filled.

We like to start by placing our limit orders at the mid-price between the bid and ask prices. While this will give us a good price on our orders, we aren’t guaranteed to get filled at the mid-price.

If we are trading a stock or ETF that has liquid options, you will have a good chance of getting a fill.

If you are trading a stock or ETF that doesn’t have liquid options, you will find you have to adjust your buy orders higher and your sell orders lower in order to get fills on your orders.

Adjusting the price of your orders to get a fill isn’t a deal breaker. We just want to be slow to do so and keep the adjustments small.

- Adjusting the price of an order by a few pennies isn’t a big deal.

- Making a larger adjustment of $.50-$1.00 has a much bigger impact on the outcome of the trade.

I will typically place my limit orders at the mid-price of the bid/ask prices and then let the order sit there and work for a few minutes. If I can’t get filled and I don’t have time to sit and watch the market, then I will start adjusting the order be .01 or .02 at a time

My opinion is I would rather get filled at a good price on a trade or not at all. There will always be another trade going forward. Keeping a close eye on fill prices will help make sure I’m maximizing my return potential over time.

In Conclusion

While it’s easy to get caught up in fast moving markets and feel like if you are not participating that you are going to miss out on the trade of the century, forcing trades at bad prices can lead to bad returns over time.

Using limit orders and being picky on your prices will lead to much better results.

Once you get a routine in place and start trading the same products over and over again, this process will become much easier and you will be able to get your orders placed without overthinking things.