- June 28, 2017

- Posted by: Mark S

- Categories: Options Trading, Trading Article

It is vital when trading any instrument that you maximize the profit potential when you take your trade. You can increase your profits when trading Options if you consider the 2 simple steps I am going to outline below.

I want to ask you a question first:

“Have you ever been stuck in front of the computer screen all weekend scanning through thousands of stocks looking for the best candidates to trade the following week?”

If you answer “Yes”, has your mind started to wonder off to other things you would like to be doing with your time?

If so then join the club!

You and I are no different as I was in this very situation a number of years ago when first getting started in the markets.

It can be easy to get sucked into this scenario as there are many programs out there teaching the following approach:

- Grab a cup of coffee and fire up your trading charts

- Scan through the full universe of stocks looking for a certain price pattern

- Make a note of the stock you are going to follow for the next week

In my experience, this can lead to a number of problems that you really want to avoid.

Not only does scanning thousands of stocks on a regular basis take a lot of time, it can also lead to some common mistakes especially when trading options.

Scanning For Patterns Can Be A Suckers Play For Options Traders

In many cases, stock scans are run looking for certain price patterns on the charts. While this can lead to the discovery of some good looking charts, it doesn’t necessarily make them good products to trade when using options.

If you will be trading options then you need to pay attention to more than just price patterns.

One of the most overlooked areas of the market by traders is the liquidity in the products they are trading. This is especially true in the current market environment that we are seeing where volumes are much lower than normal historical levels.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price. – investopedia.com

It doesn’t matter how great the chart pattern looks, if there isn’t volume (and open interest if trading options) in those products, then you will find it very difficult to get in and out of trades quickly and at good prices.

You might find yourself adjusting the price of your orders numerous times in order to get filled. While this doesn’t seem like a big deal to adjust the price of your order by a few pennies, it can add up to a big number over a whole series of trades.

For example, if you are trading options and find that over time you have to adjust the price of your orders by $.05-$.10 on every trade to get in and out, that can lead to a huge cost at the end of the year. Let’s say you place 100 trades over the course of 1 year and with each of those trades you are using 10 options contracts.

Adjusting Your Price Can Cost You

If you have to adjust the price of your orders by $.05 on every trade in order to get filled because of the lack of liquidity you are giving up $5000 right there just on trade costs! Five cents doesn’t seem like a big deal on one trade but when you do the math over dozens of trades it can be a huge loss long term.

Even if you play around with the numbers on the example above and only take each trade with 1 contract, you are still losing out on $500 over the course of those 100 trades if you can’t get filled at good prices.

Now I realize you might not have to give up $.05 on every trade taken throughout the year but you can do the math here and see that it can add up over time quickly.

So what can be done to remedy this situation?

Scan Only A Handful Of Stocks For Option Trades

Instead of scanning thousands of stocks on a regular basis simplify things and narrow the universe of stocks down to a manageable number. For example, my universe of stocks is 40-45 names. Outside of these names I don’t care what is going on in other areas of the market.

This allows me to get to know the names on my list really well and make sure that they are liquid products.

It also cuts back on the amount of research time that is required to stay active in the markets. I don’t have to spend hours every weekend researching which products I will be trading the following week.

I don’t think any of us want to have that burden on a weekly basis.

Since the names on our list rarely change, we can gain really great experience with our small watch list of products.

Make Sure You Are Trading Liquid Options For Better Profits

How do we check to make sure the products we are trading are liquid enough so we are able to get in and out of trades quickly and at good prices?

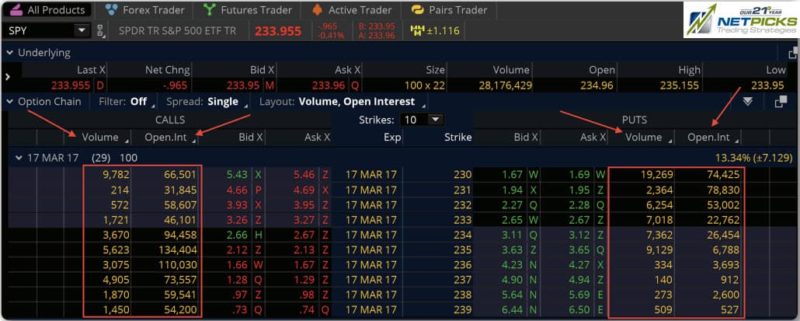

Since I like to trade options, I look at the liquidity of the options not the shares of stock. When looking at the options on a specific stock or ETF, I like to see good volume and open interest spread across multiple different strike prices.

Seeing good volume on one strike price is not enough as it most likely indicates a few big institutional trades that have gone through. Make sure you are seeing the volume and open interest spread across multiple different strikes as shown in the following graphic.

The chart above is of SPY which is the S&P 500 ETF and also happens to be one of the most liquid products in the world. You can clearly see there is good liquidity spread across numerous different strike prices.

This will make it much easier for us to get in and out of trades quickly and at good prices.

Now compare that to the picture below of STAG where you can see there is nowhere near the volume and open interest as we see on SPY. What open interest there is on STAG isn’t spread across very many strikes like we saw on SPY.

This is a name that might have a great looking chart pattern and strong price action but will most likely be difficult to trade because of the lack of liquidity in the options.

This is a product that I would shy away from trading.

My rule of thumb is:

- I typically want to see open interest on the option I am looking to trade of at least 50 x the number of contracts that I am looking to trade. So if I am looking to trade 10 contracts I would like to see the open interest of at least 500 contracts.

- I would also like to see good daily volume on that contract as well, but that is not as crucial as volume can vary depending on the time of day you are placing your trade.

It might not seem like a big deal if you are just trading 1-5 contracts to focus so much attention on the liquidity numbers of the options. In fact, you probably won’t have a difficult time in many cases getting filled on those small trades.

However, your goal should be to grow your trading account size over time so you can increase the size of your trades.

With this being the case, it is crucial to establish good habits now. This way when you go from trading 1 contract on your trades to 10 contracts you will already be programmed to look for the good liquidity.

This is a lesson that most traders have to learn the hard way. I know I had to in my own trading.

There is nothing worse then getting into a position and not being able to get out without having to adjust your price multiple times. As we showed earlier, this can lead to some pretty large trade costs over time.

Maximize Your Option Trading Profits

As traders, we want to maximize our returns so any little tweak that we can make to our trading that will increase our profitability long term is well worth the effort. Establishing a watch list of products will take some work initially as you will need to research and get to know those names.

However, since that list of products doesn’t change very often you will be able to start getting a track record of trades that you can learn from. Long term this will actually save you time and lead to better results.

Take the time now to focus on liquidity and it will lead to better returns in the long run.