- November 11, 2016

- Posted by: Shane Daly

- Category: Trading Article

Imagine for a moment that you have a trading system and it’s now the time to start trading live. This is assuming you’ve done all your homework and know how to trade the system, back tested your trading plan and have been involved in the trading room which has built your confidence to identify and trade the system setups.

You are all set to risk real money in the live markets and begin the process of growing your trading account.

Let’s be clear that if you are not ready to jump into live trading, don’t do it. The markets are not going anywhere and you want to protect the most vital component of your trading business which is your capital. Before you begin, ask yourself:

- Which market and time frame will I trade?

- What time does my trading day start?

- What are the risk parameters I will use to protect my account?

You also want to ensure that you understand that trading is not a get rich quick scheme. Your trading account will not rocket to new highs overnight and approaching trading with that expectation will not only leave you disappointed, but also have you risking too much and getting wiped out during a losing streak. Expect a two steps forward and a one step backwards progression of your equity curve while you compound your trading account.

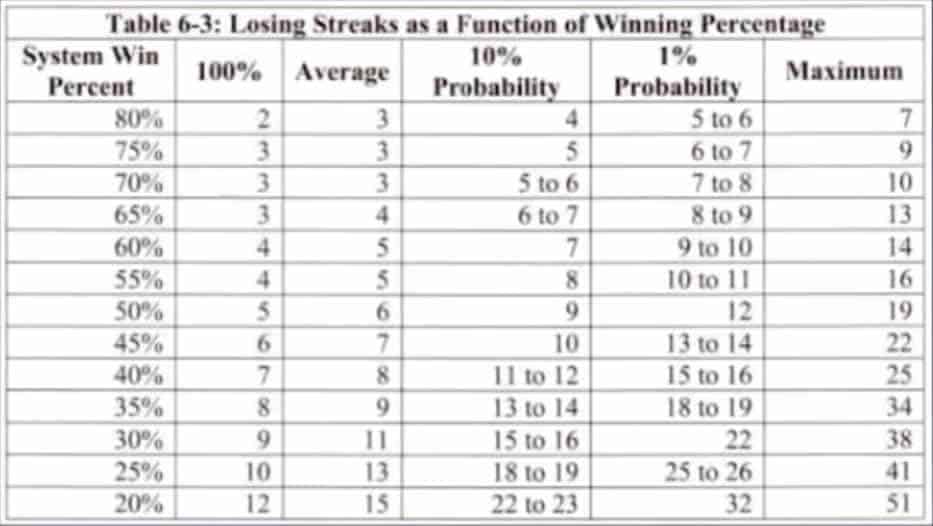

Stick to your proven trade plan and resist the urge to jump from market to market during different volatility levels. You will have a string of losing trades and while this will challenge your resolve, review your back test and the draw downs that occurred during the testing and trust in your system.

Growing Your Trading Account With These Markets

When you did your back test you chose the markets that you will consider trading and hopefully you picked markets with small trade profiles. Markets such as Nasdaq, Forex minis and the Dow are ideal for new traders. When your account begins to grow, you may want to consider giving yourself a raise (adding more contracts) which gives you a bigger profile or you may want to add another market into the mix.

There is no “one size fits all” approach however here are some rule of thumb suggestions for starting account sizes for various markets:

- $500 – trade forex micros

- $1,000 – trade one forex mini

- $5,000 – trade 1 Nasdaq (NQ) e-mini or one Dow (YM) e-mini

- $10,000 – trade one Russell (TF) e-mini, or one forex standard contract or one soybeans (S.C) contract

- $20,000 – trade one DAX (FDAX) contract

- $15,000 – trade one crude oil (CL) contract

Once you’ve doubled your trading account (using responsible risk parameters) perhaps you consider adding in another contract. This is when you will start to get the benefit of compounding profits, your trading account, to a larger size.

For example, assume you are starting with a $10,000 account and you decide to trade the Russell. Being a responsible trader, you back test the trading system and time frame you are considering and have over 100 trades logged in the spreadsheet. Assume you see the average daily return is 1.0 point or $100 and because this is an average return, it has taken into account your draw downs.

Since this is an example, let’s look at best case and assume all fees and slippage are included which they won’t be during your back test. so keep that in mind.

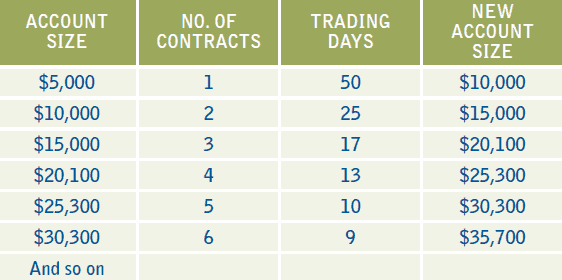

You’ve logged about 50 trading days and your account has grown from $5k to $10 000. You are now able to trade another contract while keeping in line with your risk management protocols. Add another $5000 and you have 3 contracts in play. Now it only takes 25 days to get another $5000 added to your account.

It looks really exciting that you can grow your account from $5000 to over $30 000 in about 7 months. The sky is the limit, right?

While this is possible in the real world of trading, it is not as simple as this.

Errors and Losing Trades Affect Growing Your Account

Your demo account trading might have gone well but it is harder when trading live. Your capital is real, the loss is real, and while demo trading can help perfect your trading skills, it doesn’t truly prepare you for the mind games that occur when trading live.

Fear of missing out on a “sure thing” that will add large profits to your account will cause you to jump in late and be the buyer at the top of the move.

Greed will have you pushing your trades when all signs are pointing to the exits. You will be popping out of trades when only in small profits because you are afraid of giving back anything.

During these times you find out that trading is all about the individual. You make the decisions and no talking head on CNBC, forum, or twitter feed is going to be of any help to you. It’s just you and the glow of your computer monitor. This is why your trading rules are so important to any type of long term success.

If you are afraid of losing your money it’s going to affect your ability to handle trading losses. You will be affected by the draw downs that will come and force you out of trading the plan you have tested. You may jump time frames, change markets or a number of things that is not conducive to long term trading success.

Immediate Losses And Dropping Equity Curve

One thing that seems to happen to new traders is being hit by drawn downs on the first set of trades you place. It’s almost as if the market is giving you some left jabs to see if you have the ability to stand in the ring and trade.

While I am sure there are some people who hit home runs right from the start (although I’ve never spoken to any of them) it would be a wise idea to expect your trades, especially in the early stages, to have a negative outcome. Expecting a loss is much easier to receive when it does happen plus it will force you to stick to your risk parameters.

You may experience draw downs that will set your compounding of contracts put off for a number of weeks (or months) which makes the original graphic above, obsolete.

Below is a real equity curve and while looking at it, ask yourself if you would be able to withstand that huge drop in the middle of the chart. This is the reality of trading.

What if that large drop occurred at the far left edge? What sort of thoughts would you be having? Would you change trading systems or markets? When it looks this bad, would you still be around for the massive upswing that takes the account to new highs or would you have packed in your dreams of trading? While risk management is important, nothing shows how important it is like the valleys that occur in your equity curve during a string of losing trades.

Without trust in the system and rules you have tested, you will step aside when the going gets tough and miss out on the “two steps forward” part of trading.

2% Is Still 2%

In the chart above, you can see where the advance has doubled and you would begin to add more contracts to your position sizing. What’s interesting is that even though the risk percentage remains the same, the risk is dollar terms is much higher.

Taking the Russell as an example, trading one contract will be $10/tick of price movement. If you were in a position to trade 6 contracts, you are looking at each tick being $60. When the losses come and your draw down occurs during your 6 contract position sizing, 10 points of draw down is no longer just $1000, but is $6000.

That number will scare some people but by now you should know with certainty that this will probably happen during your trading career. That said, refer back to the equity curve from earlier and if you are truly trading an edge and stick to your rules, you can bounce back from these draw downs and watch your curve hit new equity highs.

As your account continues to grow, you can look at your risk protocols and you may choose to reduce your risk per trade which will enable you to better handle the higher dollar amount losses.

When trading a small account, you may be looking at risk percentages of between 5-8 to enable you to even place a trade. In this case, ensure you start to lower your risk percentage as your account grows. While this may be a speed bump in your account growing process, it will certainly be much easier to take positions and the losses that will come.

Stay Focused On Your Journey

Growing your account and trading success is a simple process:

- Follow your rules

- Back test your trading system

- Ensure proper risk protocols

Always go back to your trade plan and your statistics during those times when things get tough. Start reducing your risk when you can so you can handle the losses and still be solvent when the uptick in your equity curve is about to happen.

Stay disciplined and with full trust in your trading system watch the two steps forward/one step backward advance of your equity curve showing you a growing trading account.

Options trading has become very popular over the last few years. Netpicks own “Options Guru” Mike has put together a hot list of some of the best names to trade in the Options market. You can click here and download your free hotlist to see what names Mike has been piling up the winners with.