- January 13, 2019

- Posted by: Mark S

- Category: Trading Article

When thinking and talking about their trading performance, a habit many traders tend to get into especially when they are just starting out, is using a $ value for p/l.

It’s easy to see why – a new trader is likely to keep their eye fixed on the limited amount of trading capital with which they attempt to trade for a living.

The trouble is, that if you approach the markets in this manner, it leaves you open to all kinds of psychological obstacles to overcome.

Instead, think in ticks/points and not $.

What Is A Tick In Trading?

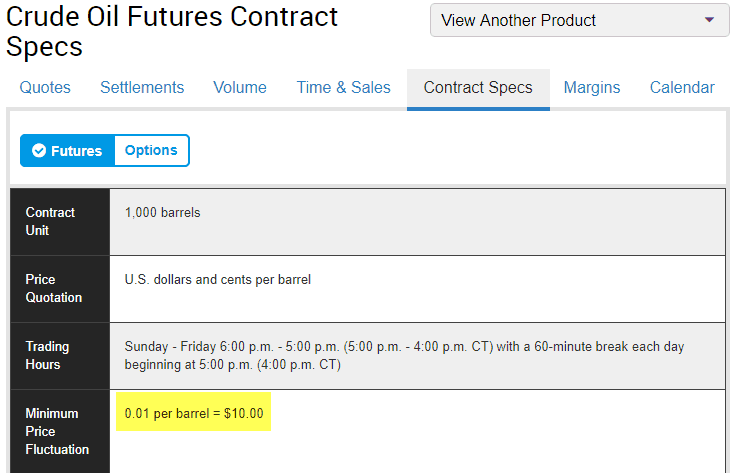

A tick (or pip for Forex traders) is the minimum price increment of a market. The value it represents to a trader depends on the specifications of the product they’re trading and the number of contracts they trade with.

For example, you might trade the 30 Bund contracts per trade.

The Bund’s tick value per contract is €10.

This means you will make or lose €300 (30 lots x €10 per price) for every price your exit price differs from your entry price.

Making And Losing Money Can Hurt

Most people have strong emotions when thinking about making or losing actual money but so many problematic and disruptive emotions can be triggered.

Of course there are the obvious fears of losing money and missing out on an opportunity, but there are other fears too.

For whatever reason, losing money can make us feel very stupid and feel that we may appear very stupid to others. One of the rather less desirable consequences of this can be the urge to prove that we’re not – and this can lead to immensely destructive bouts of fighting the markets.

Even worse is when a loved one doubted your “trading idea” and you feel a loss is them telling you, “I told you so”.

In capitalistic societies, it is assumed to some degree that the level of money you’ve made mirrors your success and your value as a person. People may argue this point by talking about sense of fulfillment and purpose being more important, but the simple fact of the matter is, I can’t recall a trader who thinks this way.

Yes, there’s the challenge of trading.

But succeeding in this challenge means making money.

If you’re not careful, you might well find that these emotions can do a psychological number with your thoughts as you trade and force you to deviate from your well-planned strategy and trading plan.

Don’t Think About Dollars Won And Lost

As simple as it might seem, part of the solution to some of the emotional issues you face can be to remove your attachment to money and think in ticks not $.

I’m not saying that you should never look at your account statement – you need to know how much capital you have in your account and how much the margin requirements are. But generally, it’s better to use ticks for all other purposes.

This means two things.

First off, you need change your onscreen p/l to display in ticks or if you can’t do that then choose to not display it at all. In all likelihood, the most heightened emotional state you’ll experience is going to be in the heat of battle – when you’re actually trading.

Removing the cue for these emotions to be activated can go a long way towards removing the issue.

The next thing you need to do is to switch all your performance analysis to be tick based.

Even better, switch it to be based on ticks per contract traded.

This means that if you make $1,000 on the ES by trading a 20 lot, your relative performance is much worse than making $1,000 trading a 2 lot (20 lot = 1 point/4 ticks per contract vs. 2 lot = 10 points/40 ticks per contract).

Seriously, Forget The $$$

Of course, you’ll probably be thinking “but it’s a really simple calculation to turn ticks into a $ value anyway” and I’d agree.

However, the goal is to start to think in terms of how much of a market move you make or lose and take away the $ value.

Thinking in terms of ticks and not the monetary value attached to a tick is something I’ve done for as long as I can remember – when will you start?