- June 13, 2018

- Posted by: CoachShane

- Categories: Day Trading, Trading Article

Crude Oil Futures is not only an active market to trade but is also one of the most popular instruments available to day traders.

That makes trading Crude Oil and the crude oil inventory release, a wonderful opportunity for traders to make additional income or a stand alone income producing market.

Weekly Crude Oil Inventory Release Numbers For Today

Crude Oil Contract Specs

- Contract Units – 1000 barrels

- Product Code – CL

- Exchange – Nymex

- Minimum Price Fluctuation – $.01 per barrel

- Contract Months – Jan – Dec

What Does “Crude Oil Inventories” Mean?

Crude oil inventories refers to the amount of unrefined petroleum held in storage by governments and oil producers. Supply and demand is important to understand as the more supply that keeps with demand, leads to lower prices. If demand begins to threaten supply levels, crude oil prices increase.

When Is The Crude Oil Inventories Number Released?

The weekly EIA report release time is every Wednesday at 10:30 a.m. New York Time. This is an extremely volatile time to trade as the numbers represents the change in the number of barrels of Crude Oil held in reserve by commercial firms and the oil prices can jump which makes for some great trading action.

What is the EIA?

The U.S. Energy Information Administration (EIA) collects, analyzes, and distributes independent and impartial energy information to which helps to promote sound policy making, efficient markets, and public understanding of energy and how it interacts with the economy and the environment.

Why is the status of crude oil important?

Crude oil is a driver of price for many items given it is still the number one energy source in the world. When the supply of crude oil goes down over the long term, we can expect the price of crude to increase which will increase the cost of virtually everything we buy. If we see a higher supply of crude oil and demand is not keeping pace, the price goes down.

Crude oil prices affect the economy, inflation rates, and even the currency exchange rate between the USDCAD pair.

How The Economy Is Affected By Crude Oil Prices

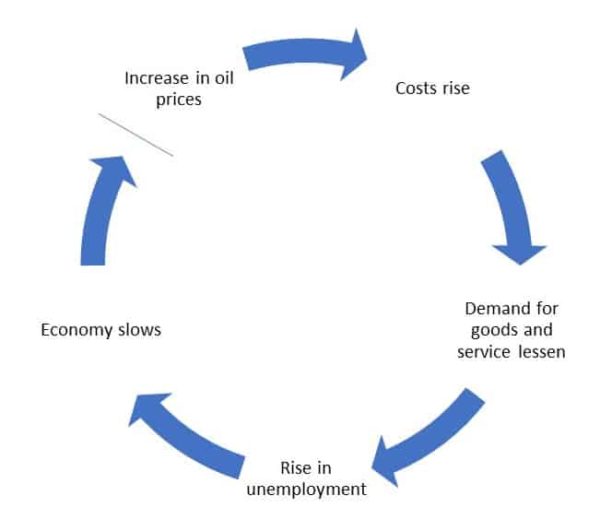

As stated, oil is an energy source used to produce/deliver virtually everything we have. From groceries to housing, when prices increase due to the rise in oil prices, people begin to spend less money and the economy begins to slow down. A slowing economy can lead to a rise in unemployment which leads to less consumer spending.

Trading crude oil on these days after the release can able you to keep your trading day short and in profit as opposed to lengthy day trading sessions.

Our Favorite Crude Oil Trade

Every trader has a favorite time to trade and at Netpicks, trading Crude Oil 2 minutes after the weekly inventory release is ours

How To Trade Crude Oil – Live Crude Oil Trading Video

Our guide to day trading crude oil is very simple, and Coach TJ recorded a crude oil inventory trading session and I want to go through some very important aspects of that trade day. Pay attention though because this is a quick one minute trade that enabled all traders that took the trade to walk away from their trading screens for the rest of the day.

Rule 1: Stand aside for 2 minutes following the inventory release

What this graphic shows is the immediate effect on price the release can have. This is a strong thrust in price with obvious highs and lows put in after the inventory release. While you may be thinking that was a quick path to profit, the fact is that you would have a very difficult time being able to trade this unless you were long the market before the release.

This is why the inventory release trading plan has our traders sitting aside for 2 minutes following the release. Getting caught wrong footed in this market during this time can have devastating effects on your trading account.

Rule 2: Get in sync with printed trade

This rule states that whatever setups has printed on the chart before our 2 minute hold time is up, we will try to get the entry price and take part in the trade.

Using the Counter Punch Trading System, you can see the dots on the charts and these represent:

- Entry price

- Dynamic and multiple exit prices

- Stop loss price

- Even trailing stop prices

The setup with the yellow arrow was the newest setup that occurred after the release and is the one traders would take. You must be quick to enter your price into your broker platform but that is the nature of trading such a volatile time in the crude oil market.

Getting in sync is all about not missing a winning trade when the setup that prints during the release is still active. Because the setup is still active, this means that the trading conditions are still “on point” for the setup and it would be foolish to not get involved in a trade that could potentially be a huge winner especially if you are able to trail your stop for bigger gains.

Rule 3: Follow the targets that are printed on the chart

One of the best things about trading where your targets are printed on the chart is that there is zero guesswork. It’s simply a “If at this level, do this” and you know in advance what those price levels are.

These price targets are dynamic which means in a wide ranging markets, your profits will be further out to take full advantage of the bigger price moves.

In slower moving markets that are trading tight, your profits (and stops) will be closer to the entry price to avoid sitting through draw down as you wait for a bigger move that never comes.

Many traders have said that seeing the prints on the chart helps keep their emotions in check.

- They don’t hold on past the dynamic targets (unless trailing) in hopes of the home run trade.

- They no longer jump into a trade because price action “looks good” but wait for the trading strategy to “invite them in”.

- Their stop loss is the line in the sand and taking their stop, even the trailing stop, has protected them from devastating losses.

Even though trading the Crude Oil Inventory report can be a crazy time, using a proven trading plan and a trading strategy that has help “tame” the crude oil market so you can profit from it, is something we at Netpicks are very proud of.

We want you to be a part of it so please reach out to us at support@netpicks.com

1 Comment

Comments are closed.

This site is very informative and helpful to the beginners.