- September 19, 2015

- Posted by: Shane Daly

- Category: Trading Article

It has been said that entries account for only a small part of finding success in trading. I would agree with this in part and that it is possible to create a strategy that has a positive expectancy using random entries.

However, unlike with random entries where you are bound to hit some good ones from time to time, a trader who consistently selects poor entries is likely to face a significant uphill struggle and therefore create a situation whereby entries become far more important than they might otherwise be.

So at the very least, trying to time your trade entries so that on average they are not poor, is critically important. The trouble is, many traders achieve just the opposite.

Wrong Before You’re Right

The way many people decide to take a trade is in anticipation of something happening. For example, if they think the market is going to go higher after already having moved up, they’ll buy it. If they think it’s going to reverse and look lower, they’ll sell it.

Makes sense right?

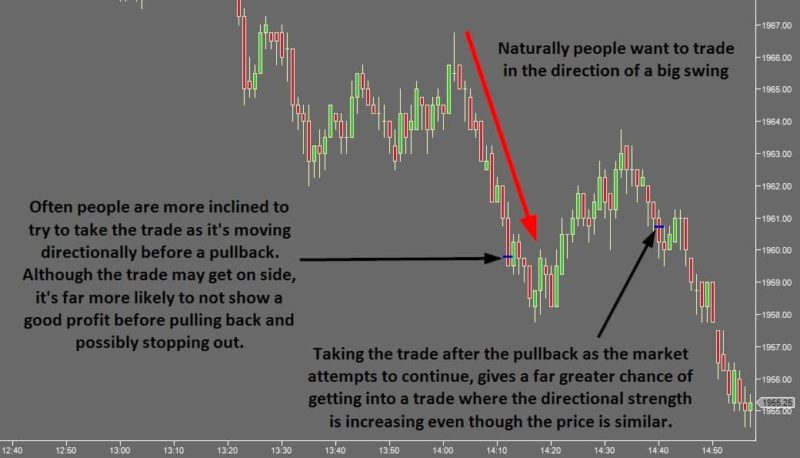

The issue is that rather than wait for other traders to start to show their hands, people take the trade as soon as they have the idea. So they won’t wait for a pullback in order to buy or they won’t wait for some kind of selling to enter the market before selling themselves.

Because of this, traders who trade in this manner often get stopped out before the market has a chance to move in their direction. Often they’ll either get long very close to the high of the current swing when taking a continuation trade or they’ll get stopped out on a short reversal trade in the same place.

They get forced out of the trade in the ebb and flow of the market instead rather than the actual direction itself.

Market Energy

Clearly, markets ebb and flow whether or not they are directional. Each swing is variable in size but depending on the chart time frame that you’re using, you can figure out what the standard size is and what constitutes a particularly large swing.

Also, it makes sense that generally there are more small legs than large ones. One way to think of this is that as a market moves in one direction, it expends buying or selling energy. To move a market higher, buyers have to buy and as price rises, there are probably going to be fewer participants willing to buy who aren’t already long within the same leg.

Of course, there are also times when a move higher is likely to bring in more buying – for example, when a market breaks an important price level.

As it turns out, before you know a swing is over, the statistical chances of the swing being over are not good. A swing which has already moved 10 ticks can end up being a 10 tick swing or a 10+ tick swing and there will be many more occurrences of 10+ tick swings than there are swings of exactly 10 ticks.

But then there are also plenty of occurrences where a swing pushes a little further and then has a decent swing in the opposite direction.

If you buy the top of the current leg for a continuation or stand in the way of the market with your sell order when anticipating a reversal, you’re taking a fair amount of risk that in fact, the swing may or may not be over. You can guess, but the truth is that you just don’t know. The point is that you don’t know how much energy the market has in the current leg – by taking a trade early, either buying the market in a current up swing or selling it as it moves up, you are taking 100% information risk in order to try to secure a good entry price.

Good Price Location

The thing is, whether a particular price is good or not can vary throughout a trading session. In theory, certain reference prices may end up being places where the market moves directionally from. It may be that beyond a certain level, a market just carries on in that direction or that once another price level is reached, it reverses and never looks back. But you can’t know whether this is going to happen before it does.

A good entry location isn’t the same thing as a good price level until a market shows its hand.

Time Your Trade Entries

The way to time your trade entries better in general is to look for how the market reacts around the area you are looking to enter at. One way to do this is to look to enter on a counter directional swing.

If you are looking to buy as the market is pushing higher, it’s often better to wait for a pullback and look for signs that buyers are starting to enter the market again. That way, you can enter as the swing is more likely to be gaining strength than losing it.

If you are looking to short a market that has been moving up, it’s often better to allow it to get to your possible entry location and see if it falters in that area. If it does, let it check higher again to see if buyers are re-entering once again and if not, try to sell as the balance of power shifts to sellers.

Timing in life can make all the difference. It can make the difference between whether you get that great job and who you marry. Timing in trading can also make all the difference. It can mean seeing an opportunity for what it truly is or taking it on blind faith. By giving a trade opportunity a small amount of extra time to develop, it’s far easier to identify whether it really qualifies as a good opportunity or not.