- June 16, 2021

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article, Trading Tutorials

Trading support and resistance levels is a common approach to trading.

Whether it’s a viable strategy is another question and much of that will depend on the trader.

One of the biggest issues with support and resistance is defining price levels that actually mean something.

Quick Facts:

Support levels are where price is expected to cease declining and then resume moving upwards.

Resistance levels are where price is expected to stop climbing and then reverse downwards.

Support and resistance levels are estimates and not necessarily exact prices.

Better Than Random Lines?

If you were to turn off all the bars on your screen, toss up some horizontal lines and then turn the bars back on, you would see that price has miraculously bounced from the line you have drawn.

- A market does not have to instantly bounce from a level

- A market can breach a level only to turn around and reverse back where it came from.

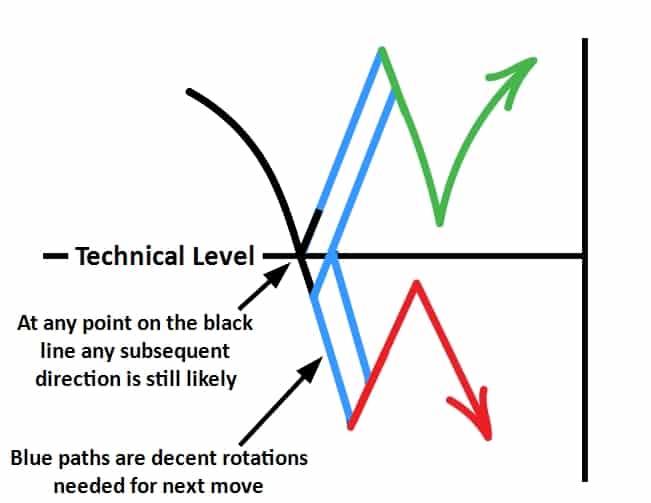

A technical level of support and resistance is merely a reference point for subsequent activity and this must be at the forefront of a trader’s mind when looking for clues to take their next trade.

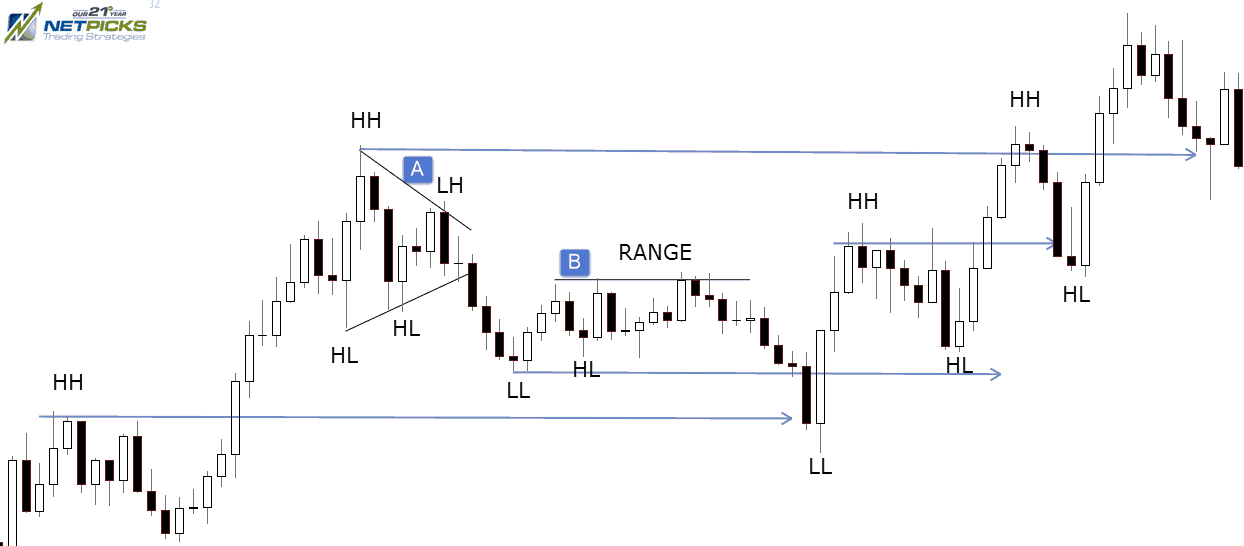

I’m not going to cover how to identify what levels to use but using the structure of price is a great start as you can see in this example.

What Is Rotation And Does It Matter?

Before we get onto how a market can respond to a level, it’s crucial to cover rotations. A rotation is simply a definable leg within the market movement.

It doesn’t have to be a big directional swing – think of it in terms of breathing.

A market must, just as a living creature, breath in and out.

In a bigger directional move, there are still counter rotations to the move. You can think of these in terms of breathing out – the expulsion of stale air or market energy in readying for the next intake of breath to fuel the next rotation in the direction of the bigger move.

The key point is that it’s always happening and by identifying the size of the last swing, you can get a better feel for whether enough energy has been expended in order to encourage the other side to push the market in the opposite direction – at least by enough for what you consider to be a small rotation.

Trading Pullback Tip

The rotation concept is important when you think of trading pullbacks. The markets “breath in” should result in a gentle exhale.

The breath in should show that another breath in (another impulse move) is deserved as long as the expulsion of air (the pullback) is not severe.

What we don’t want to see is the breathing in, the correction being full of momentum. That is a good rule to have when choosing pullbacks to trade.

What You Are Trading Matters

The size and distribution of rotations is highly dependent on the product and the time frame that you are looking at.

What you’ll end up with is a distribution and what has been the most common sized rotation over the period of analysis.

By tailoring the time frame you trade and the general scale out size to take the market’s rotation profile into account, you can get to a point where your trades have a much greater probability of becoming “safe” even if they don’t end up being big winners.

Put another way, understanding the rhythm of the instrument you are trading, can help you get in sync with the market flow so you don’t enter a trade just when the market is tipping its hand that a pause is coming.

Price Doesn’t Always Bounce From Support/Resistance – 3 Paths

We have some basics about rotations as a foundation now let’s look at the ways the market can react to levels of support and resistance.

1. Price can bounce from or a tick or two before the level itself. Some would call this a “strong level”.

Like in all cases, a market can bounce with a counter rotation of sufficient size.

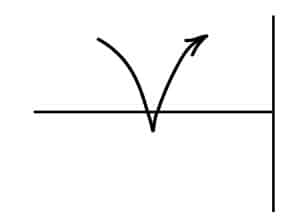

However, before the counter rotation is sufficient in size, it is going to look something like this:

From here, the market can continue up and form a reasonable bounce or it can continue to move lower but at the same time be moving back and forth by a handful of ticks each time it does. That certainly can make trading very difficult as price churns.

At this point, it’s a little bit premature to make assumptions based on the information the market is giving you. Too much can happen from here.

Once the market has moved a full rotation however, the chances of it pulling back to the level and then at least attempting a secondary push in the same direction, are much higher.

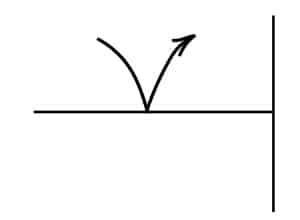

2. Price can slice through the level as it if isn’t there.

Again, for a greater chance of the break to at least have a secondary push after pulling back to or somewhere towards the level, the simple requirement is that the break is by a number of ticks that by studying the market, has been identified as a common size for a rotation.

Also keep in mind that if price does slice through a level, it could keep on going.

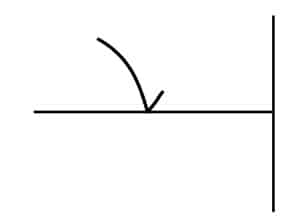

3. Price breaks the level and then bounce back in the original direction.

The textbook version of trading support and resistance is not accurate. It is very common for price to slice right through the area without invalidating the level of interest. If you think about traders who play the small bounce shown earlier, where do they place their stop loss?

Right below the swing low for longs!

The market seeks order flow, takes out the stops and then continues in the intended direction. Ensure you set your stop that allows for some degree of “randomness” of price.

Now there are of course many different combinations that the markets can conjure up to throw us off course. But we’re not expecting certainty are we. All we’re after is a decent probability to lean on.

Timing Is Vital For Trading Support Resistance Levels

A market can look like it has already reacted to a level in a certain way?

- It might look like it’s bounced for example, only to run through the level on a retest.

- It might look like it’s broken the level but really it’s trapping sellers (in the examples I’ve used).

The key thing here is to get your timing right and to do this you can leverage your understanding of rotations.

If a market bounces from or breaks through a level by a decent number of ticks, what it’s telling you is that it had enough energy on that side to gain that reaction and at least an additional secondary test in that direction is therefore likely after any pullback.

It might continue to reverse or power on lower. In fact it might never give you a decent pullback at all once you’ve spotted how it’s initially behaving.

But until you see how the market reacts, it’s extremely difficult to judge the nature of other traders and what they want to do at the level.

2 Steps To Trade Price Levels: Identify And Consider

I will always believe in the importance of identifying key technical levels of support and resistance.

Identifying them is not enough. You need to consider how the market may react when it gets there.

You must accept that price may not break support levels or break above resistance levels:

- Either bouncing after pulling back from the level by just a handful of ticks

- Making a big move on a breakout just because the price is traded through by a tick or two.

Understanding rotations and market energy is another part of unlocking the power of levels.

Get it right and you’ll potentially improve your timing of trades significantly.