- May 5, 2021

- Posted by: CoachMike

- Category: Trading Article

New all time highs week after week has been the story for months now as markets have pushed higher relentlessly. However, over the last week we have seen signs of very tired conditions.

The rally higher has been fueled by never ending stimulus from central banks worldwide.

The Fed continues to use emergency measures to prop up the economy as a result of the pandemic.

The trouble is now that trillions of dollars have been printed out of thin air and poured into the markets, we are now seeing warning signals of inflation ready to zoom higher.

Is Tapering In The Cards?

We are starting to hear talk of the Fed being backed into a corner where they will need to start thinking about tapering. Sure, many Fed speakers are denying that there is any problem but the numbers tell a different story.

- Buying groceries

- Buying a new house or car

- Trying to find every day supplies

All of these will lead to sticker shock for consumers these days. Whether the Fed wants to admit it or not, inflation is picking up in a big way.

Why is this important to us as traders?

If the Fed begins to pullback on the stimulus it could mean less bond purchases and higher interest rates. Neither of these will be good for equity markets. As a result, we are seeing a more nervous trading environment this week.

Markets haven’t had any extreme moves as of yet, but we have seen more selling over the last week than we have seen in months. Should the selling pick up going into the end of this week, we could very well see a much better environment for us as active traders.

Key SPY Levels

We have seen the S&P 500 (Symbol: SPY) test key support levels for the last 5 days.

It started last week with the 8 EMA on the daily chart being tested 3 days in a row at $416.86. The bulls defended that level until the gap lower on Tuesday where we saw nasty selling in the tech sector lead the market lower early in the session before bouncing higher before the close.

Yesterday SPY found support on top of the 20 SMA at $414.59. That level held yesterday and again today as support with the bulls trying their hardest to defend against a bigger selloff.

If that level breaks on the downside we would see a bigger move lower down to the 50 EMA at $403.69.

While we aren’t expecting a market crash anytime soon, we are looking for more active two way price action in the near future. Conditions should provide for much better trading as opposed to the slow one way price action higher that we have seen for months now.

The end of this week has the potential to give us some fireworks.

We will be watching the support levels mentioned earlier very closely to see if we finally get the much needed pullback that we have been waiting for.

Volume, ATR, and the VIX

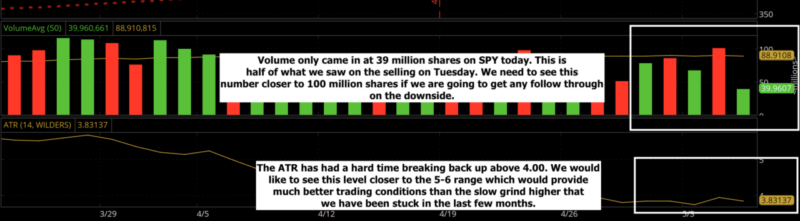

Volume was extremely light on SPY again today which has been par for the course on the moves higher of late. We only saw 39 million shares trade on SPY today. That is less than half the volume we saw on the selling on Tuesday.

We would like to see the volume back up towards 100 million shares but for that to happen we will need to see some selling in equities.

The Average True Range (ATR) on SPY has been struggling to get back above 4.00. We would like to see this number closer to the 5-6 range in the weeks to come. The only way that will happen is if the selling picks up.

Should that happen, our options playbook will open up more for us.

The VIX has traded up above 19 for most of this week but we continue to have a hard time getting above the 20 level. We will be looking for that 20 level to break on the upside. Higher volatility gives options traders more flexibility to use a bigger range of strategies.

This is another reason why we continue to look for a move lower in equites. Should stocks selloff, we will see the VIX pop higher.

Midweek Recap Video – Stocks To Watch

In this week’s Midweek Recap webinar we take a look at some of our options trades that we have closed out this week. Tuesday we closed out of 8 winning trades across our different services. We also take a look at a wide range of stocks and ETF’s that are setting up for us the rest of the week and also take a look at what we are expecting market wide going into the second half of the week.

You will find the webinar recording below for review. Take a look and let us know if you have any questions that we can help with. We will be back on Friday for our next Weekly Options Recap. Hope to see you there. Mike@netpicks.com