- June 22, 2023

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

Using pending orders can help limit risk, maximize profits, and semi-automate your day trading efforts by pre-entering your price levels. Traders can use stop-loss orders to limit potential losses and take-profit orders to lock in profits.

By using pending orders, traders can also avoid emotional trading decisions and stay disciplined in their approach.

As a day trader, you know that risk management is important to your success but how can you limit risk while maximizing profits?

One tool in your arsenal should be the use of pending orders.

In this article, we’ll explore how to effectively use pending orders as part of your overall day trading strategy to help achieve more consistent profits with less stress.

Understanding Pending Orders In Day Trading

Understanding pending orders in day trading is important to help limit risk and maximize profit.

But what are pending orders?

Pending orders are orders set in their online trading platforms in advance to buy or sell a security at a specific price level, different from the current market price.

These orders will remain active and open until executed or canceled (some brokers offer time limits), making them useful for traders who cannot constantly monitor their positions.

Several types of pending orders include limit orders, stop-loss orders, and take-profit orders.

Limit order is an instruction to execute a trade only at the specified price level or better.

Stop-loss order is for you to minimize losses by automatically selling a security once it reaches a price you set to protect your position.

Take-profit order takes profits when prices reach your set levels.

Compared with market orders that involve buying/selling immediately at the best available price in the market, pending orders offer more control over trades’ execution prices.

It is not foolproof as it does come with risks such as slippage and rejection due to insufficient liquidity.

Introduction To Pending Orders

One of the main advantages of using pending orders in day trading is that they allow traders to set entry and exit points without having to sit by their screens throughout the trading day.

For example, if a stock is currently trading at $50 per share but you believe it will drop down to $45 per share before rebounding, you could place a buy limit order for $45.

This way, if the stock does indeed drop down to $45, your order will automatically be executed and you’ll have entered into the trade at a price your entry strategy called for.

4 Main Types Of Pending Orders In Day Trading

Pending orders are an essential tool for day traders that allow them to enter and exit trades based on predetermined criteria.

There are four main types of pending orders in day trading:

- Buy -Stop Order: This type of order is used to enter a long position when the market breaks through a specific price level. The buy stop order is placed above the current market price, and when the market reaches the specified price, the order is executed as a market order.

- Sell -Stop Order: This type of order is used to enter a short position when the market falls through a specific price level. The sell stop order is placed below the current market price, and when the market reaches the specified price, the order is executed as a market order.

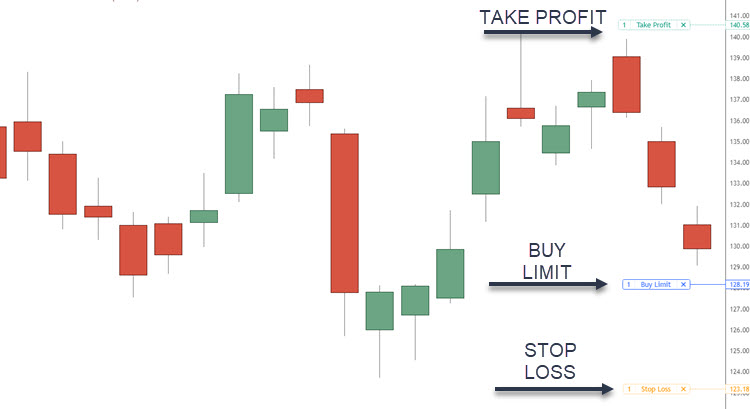

- Buy Limit Order: This type of order is used to enter a long position when the market retraces to a specific price level. The buy limit order is placed below the current market price, and when the market retraces to the specified price, the order is executed as a limit order.

- Sell Limit Order: This type of order is used to enter a short position when the market rallies to a specific price level. The sell limit order is placed above the current market price, and when the market rallies to the specified price, the order is executed as a limit order.

It’s important that you use pending orders wisely and with proper risk management to avoid unnecessary losses.

Pending Orders Vs. Market Orders: Key Differences

These two types of trades are the basic entries for any trader to use when entering and exiting a position.

Market orders allow traders to buy or sell a particular asset immediately at the best available price. This type of market order is great for those who want quick executions but may not be suitable for those looking to limit risk as slippage can occur.

On the other hand, pending orders give traders more control over their trades as they wait until specific conditions are met before being executed.

When using a pending trade or pending order, traders can set specific entry and exit points based on technical analysis.

For example, if you think that stock XYZ will increase in value once it reaches $100 per share, you can place a buy order with a limit price of $100. If the stock hits this price point, your trade will automatically execute.

This is a popular method of entering breakout trades.

By knowing which type of order best suits your trading strategy and goals, you’ll be able to make better decisions about when to enter or exit positions.

In the next section, we’ll explore practical ways of executing day trading strategies using pending orders so that you can start incorporating them into your trading routine today!

Practical Execution Of Day Trading With Pending Orders

After understanding the key differences between pending and market orders, how do you use pending orders in day trading?

| Step | Order Type | Description |

|---|---|---|

| 1 | Stop-loss | Set up as a pending order to automatically close your position if the trade moves against you. |

| 2 | Take-profit | Set as a pending order to exit the trade when it reaches your profit target. |

| 3 | Limit | Use as a pending order to enter into trades at specific price points. |

By utilizing these methods as your “standard operating procedure”, day traders can execute with very little emotions coming into play. It takes discipline and practice to master this consistently but once you do, it can be incredibly rewarding.

By setting up stop-loss, take-profit and limit orders as pending orders, traders can enter and exit trades without constant monitoring.

How To Trade With Pending Orders: Step-By-Step Guide

By setting predetermined entry points, day traders can avoid making emotional decisions in the moment and, hopefully, stick to their strategy.

To execute day trading with pending orders, start by

| Step | Description |

|---|---|

| 1 | Determine your desired entry point based on technical analysis or market trends. |

| 2 | Then, set a buy stop order above the current market price if you’re looking to go long or a sell stop order below the current market price if you’re looking to go short. |

| 3 | Once your pending order is set, monitor the market closely for any changes that may affect your trade. |

| 4 | If your order is triggered, ensure that you have an exit plan in place so that you don’t miss out on potential gains or let losses spiral out of control. |

By following this step-by-step guide to using pending orders in day trading, traders can minimize risk while still pursuing profitable opportunities in the markets.

In the next section, we’ll take a closer look at some of the pros and cons of using pending orders so that you can make informed decisions about how to incorporate them into your own trading strategy.

Pros And Cons Of Using Pending Orders In Day Trading

Using pending orders in day trading does has both positive and negatives.

| Pros | Cons |

|---|---|

| 1. Better price control | 1. Orders may not be executed if price isn’t met |

| 2. Reduces emotional decision-making | 2. Requires continuous monitoring of market |

| 3. Automates trade execution | 3. Partial fills can occur with limit orders |

| 4. Facilitates disciplined trading approach | 4. Stop orders may trigger during short-term spikes |

Best Practices For Using Pending Orders To Optimize Day Trading Strategies

As a day trader, you live and die with short term price movement but it’s not as simple as just placing an order and waiting for it to execute.

It’s important to understand the different types of pending orders available: buy limit, sell limit, buy stop, and even sell stop orders. Each has its own purpose and should be used in specific situations depending on your trading plan.

When setting up your pending orders, consider using technical analysis tools such as support and resistance levels or moving averages to help determine entry points. Instead of just buying or selling at random intervals based on emotions (FOMO), you have set locations in which you are interested in trading.

Remember that even with proper use of pending orders there are still risks involved in day trading. Risk management such as stop-losses to minimize potential losses and position sizing are important to protect your trading account.

Frequently Asked Questions

What is the process of trading with pending orders, and how can I execute this type of trade?

The process of trading with pending orders involves placing orders to buy or sell an asset at a predetermined price, which get executed when the market reaches that price. To execute this type of trade, you can set a limit or stop order on your trading platform, specifying your desired price and trade size

Which type of order is most suitable for day trading, and why?

The type of order most suitable for day trading is limit orders because they allow traders to buy or sell at a specific price, providing control over entry and exit points, and reducing slippage,

What are the benefits of using pending orders in trading?

The benefits of using pending orders includes better price control, reduced emotional decision-making, and automation of trade execution. They help traders by allowing them to set predefined entry and exit points, thus facilitating a disciplined trading approach.

Are market orders recommended for day trading, or are there better options available?

While market orders are commonly used in day trading, limit and stop orders can offer better control over entry and exit prices, reducing slippage and the impact of market volatility. These alternatives may be preferable for more precise and potentially profitable trades.

Can the use of pending orders in trading have an impact on the price of a stock

Pending orders can have an impact on stock prices, especially if a large amount of orders are sitting around specific price levels. This can create support or resistance levels in the market, but the overall impact depends on the stock’s liquidity and market conditions.

Conclusion

The power of pending orders in day trading cannot be underestimated. By using these tools, you can limit your risk and maximize your profits that may not be possible by sticking with market orders for all your trading.

Pending orders come with their own risks. It’s up to you to adjust your strategy when market conditions change.

Don’t forget the importance of patience – sometimes waiting for that perfect execution can mean the difference between a profitable trade and a costly mistake.

With careful planning and execution, they can help take your trading game to the next level.