- September 25, 2020

- Posted by: Shane Daly

- Category: Trading Article

Every trader should be trading with a plan that highlights important things such as:

- What is the trade setup (your trading strategy)

- How to enter a trade (trade trigger)

- Where the stop loss is placed (manage your risk)

There are many ways to define a trading setup but regardless of what you use, you need a way to enter the trade.

We don’t want to just hit the buy or sell buttons. We want to ensure there is something telling us that your setup was successful. Having a proper way to determine an entry point in the market, will determine how well you do with trading opportunities when they present themselves.

What Is Your Setup For Forex Trading?

This is not an article on trading setups but we need to use one to demonstrate how to enter a trade. We could use a pullback to a moving average, breakouts, or trading support and resistance. Let’s use a simple support and resistance trade setup looking for rejection of those levels in the direction of the trend.

While I am using Forex market for this example, you can use any liquid instrument.

Using price action determination of trend direction (lower highs and lower lows), our trend is down. We will be looking for selling opportunities when price finds resistance levels.

To keep it simple, just look for areas that are obvious and when you see the trend price pattern stall, start looking for a trading range.

Once price meets a resistance level, do we just use that as an entry point?

No.

Price can and does slice right through these levels so we need to add another step before we have a trade entry.

How To Use A Trade Trigger To Enter The Market

In using support and resistance for trading in a trending market, we are essentially using a pullback trading strategy. Instead of using a moving average as a target for the pullback, we are using price levels that formed a potential turning point in the market.

Our job is to see if there is a higher probability of the level holding instead of breaking.

How do we do that?

- Technical indicators

- Price action

- Price pattern breaks

What is important is that whatever you use shows up in a trading plan that you’ve designed and tested. Nothing can kill progress like lack of consistency can so ensure you follow a plan.

Technical Indicators For Trade Entry

There are as many methods as there is trading indicators so let’s keep it to a few simple ideas:

- Zero line crosses

- Slow and fast line crosses

- Leaving an oversold or overbought condition

You also have the option of using multiple time frames: your trading time frame and your trade entry time frame.

Here are the trading indicators I will use in this example:

- Stochastic Oscillator is for the two line cross

- RSI is for oversold or overbought

- CCI is a zero line crossover

On both of these setups, the two line cross beat the CCI by at least 5 bars (hours) and the RSI never reached overbought on this time frame.

Looking at the 15 minute chart for our trade entry:

The Stochastic Oscillator 2 line cross is still the winner here but there is a trade off: you may see your stop loss hit depending on how you determine where to place your stop.

When using lower time frames, we start to see peaks and valleys that we don’t see on the higher time frame charts. Needing the trading indicator signal plus a break of a previous swing high or low, may be something to consider.

You do have the option of using a stop order (pending order) to enter the market at the break of lows of the candlestick that turned the indicator to give a trigger. This will trigger you in when price moves in your direction which shows, at least temporarily, momentum in your direction.

Price Action As A Trade Entry Point

Using price action as an entry signal requires a trader to see when the balance of power is shifting from buyers to sellers (or reverse) just through the use of price.

This is what is known as a pin bar. Price breaks below this support level and lower prices are quickly rejected. I use the term “spring” when talking about this formation.

Traders would enter either on the close of the candle or when price breaks the high of the reversal bar. Stop loss location is generally below the low of the reversal.

Your profit target will depend on the trader however looking at previous highs, in the case of a buy, is a good place to monitor the evolution of price.

Traders can also look at engulfing candlesticks as a means of trade entry. Both bullish engulfing and bearish engulfing for shorts show a decided change in market state especially at important swing points.

Two and Three Bar Reversals

These are trade entries I find more reliable than a single bar reversal and the first one is a 2 bar reversal.

This is a resistance zone in the stock of Starbucks and I have labelled two candlesticks. Here is what we are looking for:

- This is our trigger setup candlestick. We need to see the next candlestick break the high of this candlestick and close below the close of this candle

- Price clears the high of candle #1 and in the same 15 minute candle, price closes below the close of the #1 candlestick

You can enter at the close or break of the low of candlestick #2.

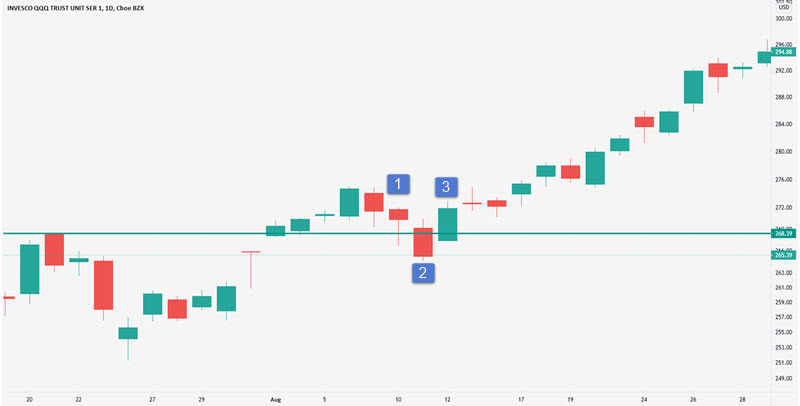

Three Bar Reversal

In this example, price has pulled back into a support zone and we look for our entry trigger.

The main difference between this and the two candlestick is where price closes.

- Trigger setup candle

- Price washes out the low of #1 and if price closes above the close of #1, we’d have the 2 bar reversal. Price closes lower.

- This is our trigger candlestick once it close above the close of the first candlestick.

This entry will not be valid if we need another candlestick in the sequence. If the #3 candle does not close higher than the #1 close, you need a different entry to trade.

Using Price Patterns For Trade Triggers

When using price patterns, I generally use a lower time frame than the setup time frame. This is dependant on what price does at the support and resistance zones of course but it is a standard part of the plan.

The most utilized pattern for a trade entry would be a breakout of a lower time frame range to enter a higher time frame pullback. Don’t confuse it with a breakout trade strategy. It’s an entry trigger and you would use the higher time frame pattern for stop loss location.

The daily chart shows a pullback into a support zone. Dropping to a four hour chart, we actually have two entries.

The one on the left is our 3 bar entry.

On the right, we see price form a trading range. Traders can set a buy stop order with the entry level being just above the resistance line. A stop loss can go either below the range or the low on the left. It depends on your risk reward ratio and position sizing.

The stop loss location fits the higher time frame chart as the lows are the same. When setting both your stop and take profit order, use the setup chart time frame for those prices.

Trade Entry Wrap Up

While this is not an exhaustive list of entering a trade, it does give you something to start investigating. Using a trading log to write down your results with different tactics for entry, can help you zero on something you can use.

When looking at an order type, limit orders will not work on these trade entries as we are looking for price to move in our direction before we enter the trade. A pending order in the form of a stop order, will work.

A successful trade requires more than just an entry but having a set criteria for when your trading setup occurs, can assist you in profitable trades. While not every trade is a winner, put the odds in your favour with a disciplined approach to putting risk on in the market.