- December 6, 2016

- Posted by: Shane Daly

- Category: Trading Article

We are forever extolling the virtues of Options trading and for good reason. You are able to make a play in a stock without every having to own the actual stock. Consider the stock price of Google today: $$778.22.

If I wanted to take advantage of a move in this stock with 100 contracts, it would cost $77822. Using Options (as you will see below) it would cost me a fraction to take part in the move.

Limited Risk With Options

The amount of leverage is a big plus but for many traders, there is a bigger bonus at play: risk is tightly controlled. I can never lose more than the price I paid for the Options contract. Contrast that with Futures trading where not only do I have to put up higher margin for longer term plays, I can lose more than I wanted to risk due to slippage.

Any trader whose been around the block a few times knows that limiting your risk is the key to overall success in the market. Options trading is an outstanding way to trade for those that are serious about protecting their downside.

Many Ways To Profit

With Options, I don’t have to be chained to deciding on market direction. There are plays you can make where the overall direction of the market is not something that has to be decided. If you are trading other markets, you must pick a direction. Many people, perhaps you, have stayed away from trading Options because they seem confusing.

The great news is that you can get your feet wet by focusing on bullish and bearish strategies and work in the more flexible strategies as you improve.

Too Many Options To Choose From

It certainly can be mind boggling when faced with the amount of stock options that are available. While opportunity is great, it’s really meaningless if you can’t get past the “barrier of confusion”. We absolutely understand how difficult it can be and that is why we have put together a list of the Options that we prefer to trade.

These are time tested stock options that are routinely used by us and the many traders that have been introduced to Options trading through Netpicks. Many of these chosen names have seen 50-150% gains that our members have profited from.

It’s appropriately titled the “Options Hotlist”.

So impressed with the opportunity that Options trading offers, not only do we want you have the Hotlist for free but we also want you to have 3 weeks access to our highly acclaimed Options Reversal Strategy.

You can download it for free here and you will receive further information for the strategy.

5 Recent Options Trades

I wanted to show you five outstanding Options trades that we recently had and you may agree that they highlight that Options trading is quite the opportunity.

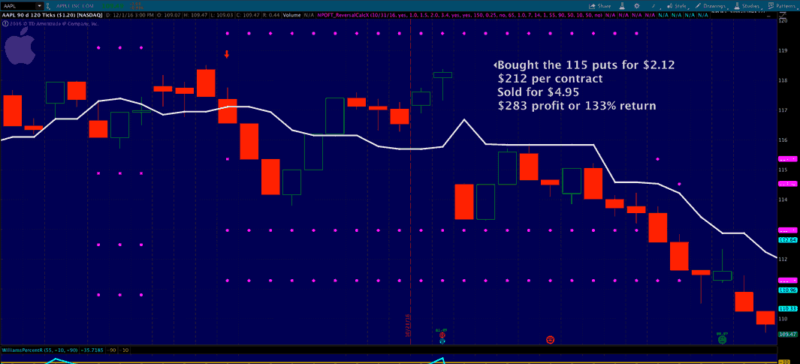

Apple – 133% return

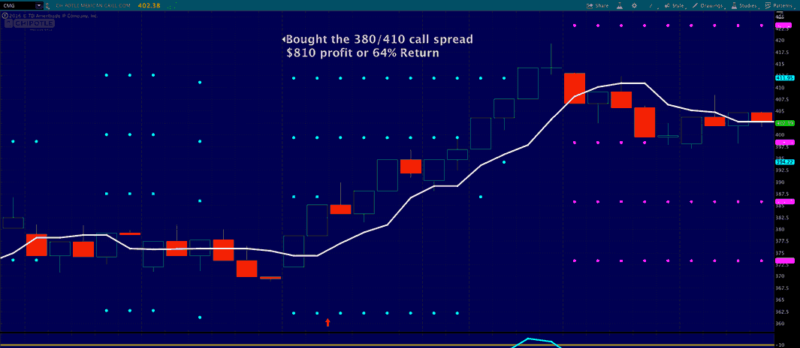

Chipotle Call Spread – $810 Profit

Facebook – $339 Profit

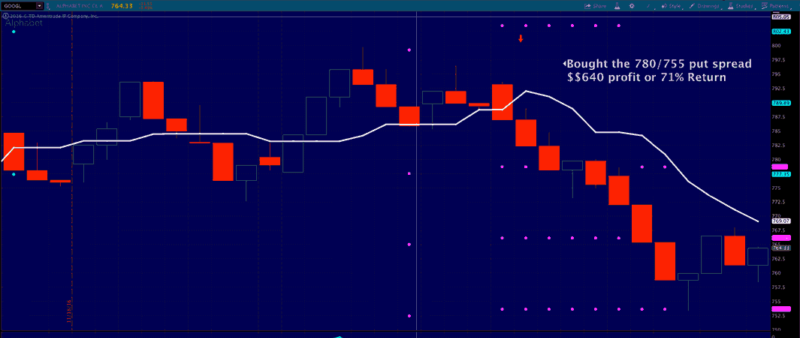

Google Put Spread – 71% Return or $640 Profit

Barclays – 108% Return

It’s not just us!

Here is what Mitch had to say about the Options Reversal System from Netpicks. (remember, you get 3 free weeks just for grabbing the Hot List)

Just thought I’d send a note about how my first trade went with the Options Fast Track Reversal System.

I saw a signal setting up last Thursday on GOOGL for a short. The Option was a little pricey I thought, so I went with a Vertical Put Spread when it hit 725 . Today, I saw that it was nearing my low of 705, so I closed it out for a profit of $437 on one contract. WOW, first profit I’ve made in a long time trading options.

I am interested in learning more about how to trade options for replacement income I have been reading about trading but I have never done any trades thanks

Hi David. Mike here at Netpicks is the guy to talk to if you have any interest in Options. You can email him directly at mike@netpicks.com