- January 19, 2024

- Posted by: Shane Daly

- Categories: Trading Article, Trading Tutorials

Vertical spreads are popular options trading strategies that involve the simultaneous buying and selling of options on the same underlying stock. Vertical spreads offer traders the opportunity to profit from both upward and downward price movements, depending on the type of spread used.

There are two main types of vertical spreads: vertical call spreads and vertical put spreads.

- A vertical call spread is a bullish strategy that involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price.

- Vertical put spread is a bearish strategy that involves buying a put option with a higher strike price and simultaneously selling a put option with a lower strike price.

One of the key advantages of vertical spreads is that they limit both the potential profit and loss. The maximum loss in a vertical spread is the net premium paid, which is the difference between the premium received from selling the option and the premium paid for buying the option. The maximum profit is the value of the spread minus the premium paid.

Quick Take: Vertical spreads are options trading strategies that involve buying and selling options on the same underlying stock. They offer the opportunity to profit from both upward and downward price movements, depending on the type of spread used.

Using Vertical Spreads For Trading

Vertical spreads offer a unique ability to control risk and reward by allowing us to determine our maximum gain, maximum loss, break-even price, maximum return on capital, and even the odds of having a winning trade, all at the time we open the position!

Basics of vertical spreads

Remember that a single call option allows the buyer to control 100 shares of an underlying stock by giving the buyer the right to buy 100 shares of the stock at the option strike price up through the expiration day of the contract.

A single put option allows the buyer to sell 100 shares of stock at the option strike price up through the expiration day of the contract.

On the opposite side of the trade, the seller of a call option must sell 100 shares, and the seller of the put option has the obligation to buy 100 shares, of stock at the option strike price at any time through the expiration day of the contract, should the contract be exercised by the buyer.

The current price of a stock option is known as the option premium and is quoted as the dollar amount per share.

Stock option premiums have two components.

- Intrinsic value is the amount by which the option is in-the-money: stock price minus strike price for a call option, and strike price minus stock price for a put option.

- Extrinsic value which represents the value represented by the time remaining until expiration. The extrinsic value decays to zero by expiration, where only the intrinsic value remains.

Vertical spreads represent an option strategy using either call options or put options, and are created by buying one option and selling another option on the same underlying stock, of the same type (call or put) and expiration date, but at different strike prices.

This can be done for either a net debit or a net credit, depending on which option has the higher price.

For vertical call spreads, the call option with the lower strike price has a higher premium, and for vertical put spreads, the put option with the higher strike price has a higher premium.

Vertical Call Spread

A vertical call spread is constructed using two call options. If we are moderately bullish on an underlying stock, we can construct a call spread by purchasing a call option with a strike price near the stock price, typically at-the-money or one strike out-of-the-money, and sell one out-of-the-money call option with a higher strike price, typically and one or two strikes higher than the long call option.

This creates what is known as a bull call spread.

The position is bullish because the value of the position goes up as the price of the underlying goes up. This type of spread is also known as a debit spread because the premium of the long call is higher than the premium of the short call, and our account is debited by this difference.

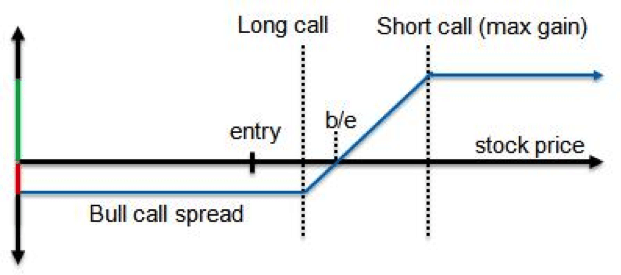

Figure 1 shows the profit/loss graph of this position at option expiration. This is also known as a parity graph.

With a bull call spread, the most a trader can lose is the net premium paid. However, to be profitable, the price of the underlying needs to move up.

The position is not profitable until the stock price reaches the point where it is equal to the strike price of the long call plus the premium paid. At this point, the intrinsic value of the long call is equal to the price paid for the spread.

As the stock price continues to move higher, the value of the spread increases until it reaches its maximum value at the strike price of the short call. At this point, the maximum value of the spread is the difference between the two strike prices, and the maximum profit is the value of the spread minus the premium paid.

Vertical Put Spread

If we are moderately bearish on an underlying stock, we can construct a put spread by purchasing a put option with a strike price near the stock price, again typically at-the-money or one strike out-of-the money; and sell one put option with a lower strike price, typically one or two strikes lower than the long put option.

Since the premium of the long put is higher than the premium collected for the short put, this creates a debit spread.

This is considered a long put spread, but since the position is bearish (the value of the position goes up as the price of the underlying goes down), this creates what is known as a bear put spread.

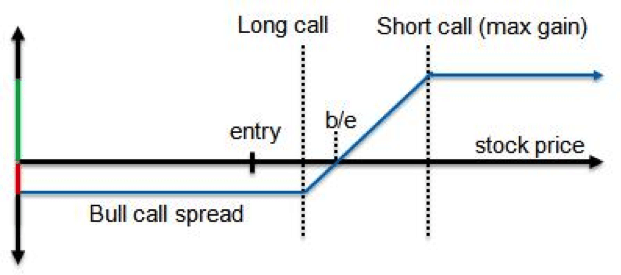

Figure 2 shows a parity graph of this position.

With a bear put spread, the most a trader can lose is the net premium paid, and just like the bull call spread, the position is not profitable until the stock price moves in the desired direction, which is lower.

Break-even is reached when the stock price drops to the strike price of the long put minus the premium paid.

As the stock price moves lower, the value of the spread increases until it reaches the strike price of the short put, at which point the value of the position reaches its maximum value, which is the difference between the two strike prices, and maximum profit is achieved, which is the value of the spread minus the premium paid.

With these first two positions, we were either moderately bullish or moderately bearish, and the stock price was required to move in the correct direction to make a profit.

If we are willing to accept less profit and a little more risk, we can use options to construct vertical spreads that profit even if the stock price does not move in our direction.

These spreads can be profitable even if the stock moves a little against us.

For instance, if we are only somewhat bullish to neutral on an underlying stock, we can construct a put spread by selling a put option one strike out-of-the money; and buy one put option with a lower strike price, typically one or two strikes lower than the short put option.

This creates what is known as a bull put spread.

Since the premium collected on the short option is larger than the premium paid for the long option, our account is credited with this difference, and the spread is known as a credit spread. We are short the spread, but this position is considered bullish because a profit is realized if the underlying stock goes up in value.

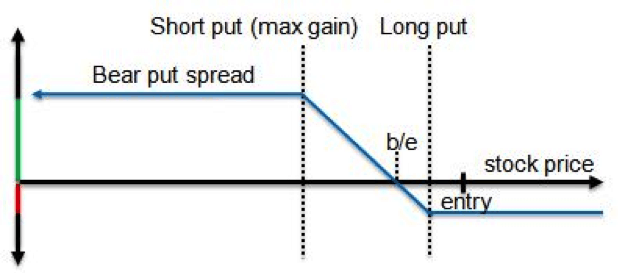

Figure 3 shows the parity graph of a bull put spread at option expiration.

With a bull put spread, the maximum profit achievable is the initial credit collected at order entry.

The position remains profitable as long as the stock price does not drop below the break-even price which is determined by subtracting the credit received from the short put strike price. If the price continues to drop, losses increase until a maximum loss is reached at the long option strike price.

At this point, the maximum value of the spread is reached, which is the difference between the two strike prices, and the maximum loss is the spread minus the initial credit collected. This spread has a greater probability of being profitable (because the stock price can go up, stay the same, or even go down a little), but the profit is smaller than a bull call spread, and the losses can be greater.

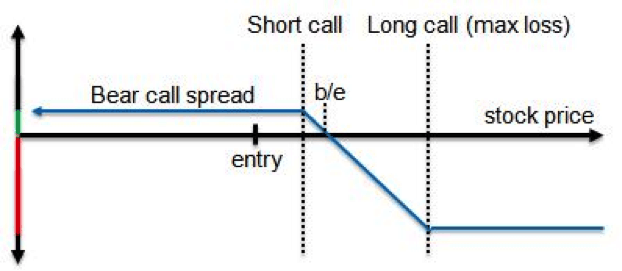

Finally, if we are somewhat bearish to neutral on an underlying stock, we can construct a vertical call credit spread by selling a call option one strike out-of-the money; and buy one call option one or two strikes higher than the short call option.

This creates what is known as a bear call spread. Again, since the premium collected on the short option is larger than the premium paid for the long option, our account is credited with this difference.

We are short the spread, and this position is considered bearish because a profit is realized if the underlying stock goes down in value.

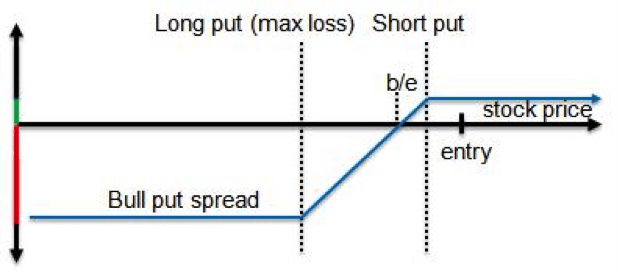

Figure 4 shows the parity graph of the bear call spread at option expiration.

Just like the bull put spread, with a bear call spread, the maximum profit achievable is the initial credit collected at order entry.

The position remains profitable as long as the stock price does not move higher than the break-even price, which is determined by adding the credit received to the short-call strike price.

If the price continues to rise, losses increase until a maximum loss is reached at the long option strike price.

At this point, the maximum value of the spread is reached, and the maximum loss is this spread minus the initial credit collected. This spread also has a greater probability of being profitable (because the stock price can go down, stay the same, or even go up a little), but the profit is smaller than a bear put spread, and the losses can be greater.

Benefits of Vertical Spreads

Understanding the potential risks and benefits of vertical spreads is essential if wanting to use them in your options trading. When considering the benefits of vertical spreads, recognize their role as effective hedging strategies and their potential to optimize returns.

| Benefits | Description |

|---|---|

| Risk Limitation | Allows for predefined maximum loss, providing a hedge against adverse market movements. |

| Profit Potential | Offers the opportunity for controlled and potentially high returns. |

| Flexibility | Provides flexibility in choosing strike prices to tailor risk and reward. |

| Probability Calculation | Enables traders to calculate probabilities of success for informed decision-making. |

| Portfolio Diversification | Facilitates diversification within an options trading portfolio. |

Risks Associated With Vertical Spreads

Risk management plays a role in ensuring that potential losses are minimized. Understanding the maximum loss, maximum profit, and break-even points is essential for effective risk management when using vertical spreads. The inverse relationship between maximum profit and the probability of achieving that profit shows the importance of carefully assessing and managing risks associated with vertical spreads.

Case Study

The following real example demonstrates how these metrics are calculated, using Autodesk (ADSK), trading at $32.40 twenty-three days before the expiration of the October 2012 front month. (Commissions are not included for simplicity.)

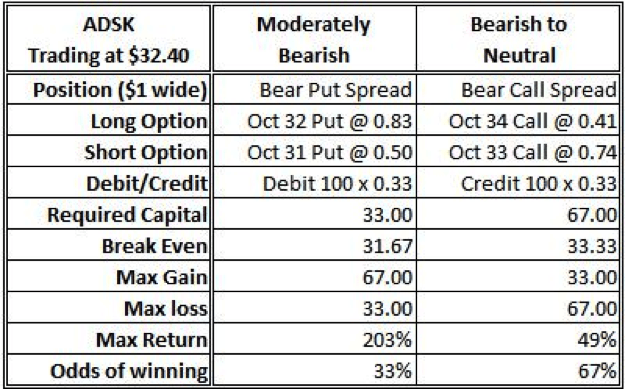

Table 1 below shows the two possible bearish vertical spread strategies using spreads that are 1 strike wide.

The first column is a debit spread where a bear put spread is purchased. In this example, the net debit is $0.33 per share, which means that each spread purchased will cost $33.00, which is the capital required to make this trade. The stock price must move down below the long strike by $0.33 to $31.67 just to break even.

The maximum gain is reached once the stock price drops below the short option strike price of $31.00, and is equal to the difference in the strikes minus the debit paid, 100 x (1.00-0.33) = $67. The maximum loss is the debit paid, and the maximum return on capital is 67/33 = 203%.

The odds of this being a winning trade is (max loss)/(width of strikes) = 33%.

The next column shows the results for selling a bear call spread.

In this example, a credit of $33 is collected, which means that as long as the stock price does not go higher than the short strike plus the credit (33.00 + 0.33), then this trade is profitable. Maximum loss occurs if the stock price is above $34 at expiration and is equal to $67, which is the capital required to make this trade.

The maximum return on capital is 33/67 = 49%, however, the odds of winning, 67%, are greater because the trade has a lower potential return.

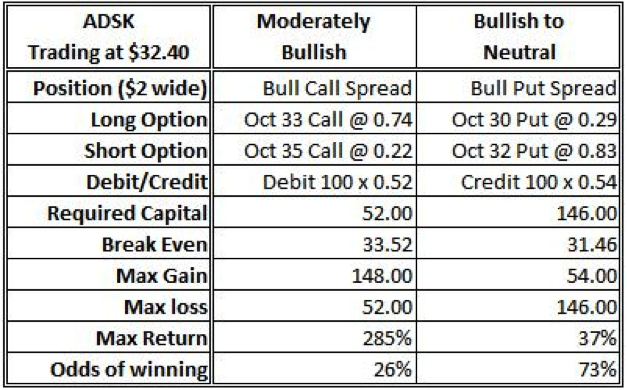

Table 2 shows the metrics for placing bullish trades on ADSK using $2-wide vertical spreads.

Using the formulas defined above, the table shows the impact that the larger spreads have on all the calculations.

The first column is a debit spread where a bull call spread is purchased. Since the net debit is $0.52, each spread purchased will cost $52.00, and the stock must move up to $33.52 to break even. The maximum gain is reached once the stock price reaches $35, and is equal to the difference in the strikes minus the debit paid, 100 x (2.00-0.52) = $148.

The maximum return on capital is 148/52 = 285%, however, the odds of this being a winning trade is only 52/200 = 26%.

The next column shows the results for selling a bull put spread for 0.54 per share. In this example, a credit of $54 is collected, which means that as long as the stock price does not go lower than the short strike minus the credit (32.00 – 0.54) = 31.46, then this trade is profitable. Maximum loss occurs if the stock price is below $30 at expiration, and is equal to $146, which is the capital required to make this trade.

The maximum return on capital is 54/146 = 37%, and the odds of winning are 73%, which is fairly high because of the lower potential return.

For these bullish trades, $2 wide strikes were chosen to demonstrate the impact of selecting wider strikes.

For the debit spread, because the width between the strikes is larger, more capital is required (less premium is collected on the short option), the break-even price is pushed farther away from the long option strike price, the maximum gain and loss is larger, and the maximum return on capital is larger, however, the odds of a winning trade have been reduced.

For the bull put spread, the impact of the wider spread means that the initial credit is larger, the required capital is larger, and the maximum return on capital is smaller, but the odds of winning have increased.

Vertical Spreads Offer Flexibility

If you are extremely bullish or bearish, you can simply buy a single call or put, but greater capital is required for this position, and the stock has to move more in the required direction to be profitable.

By creating a debit spread, the short option reduces the expense of the position, and the stock does not need to move as far to break even. There is a greater chance for a winning trade, but the trade-off is that the maximum profit is reduced.

With credit spreads, there is an even greater probability of a winning trade, but with the trade-off of greater capital requirements and greater potential loss. The advantage of selecting a vertical spread strategy is that you have a lot of flexibility in selecting the width of the spreads and the option strike prices.

The spread width, along with the debit paid or credit collected, provides all the information needed at order entry to determine capital requirements, break-even stock price, maximum gain, maximum loss, maximum return on capital, and the market odds of having a winning trade.

This allows the trader to select the appropriate vertical spread strategy that is appropriate for the trade indicated by the trade plan, depending on the level of bullishness or bearishness, price target, expected time in the position, and the maximum acceptable level of risk.

Conclusion

By understanding option premiums, intrinsic and extrinsic values, and the construction of vertical call and put spreads, traders can make better decisions that align with their financial goals. Whether using bullish or bearish strategies, evaluating trade probabilities, or assessing profit potential, the key to unlocking profit potential lies in analyzing these factors and applying them to vertical spreads.

1 Comment

Comments are closed.

thanks for this article, it nice to see something that has alot of number crunching.