Without question, trading options is our single top recommendation for every individual trader. There simply isn’t any other trading strategy where you can combine leverage, controlled risk, minimal time to track & trade, and unlimited future potential.

There are three key ways to profit from options. These are among our favorite choices.

If you would like to learn how theses done, and even better, have us do virtually all the work (you just take the trades and book the profits) then go here:

Free Training: Earn from 50% to 500% Trading Options

1. Long Call or Put

When buying a long call or put, we need to make sure we have a strong opinion on which way the stock or ETF is headed in the near term.

We have to keep in mind that whenever we buy an option the clock is ticking the second we decide to initiate the trade. The time decay will start to add up and potentially eat into the profit potential that we have. This means not only do we need to be right on market direction, but the move needs to happen in our favor quick enough.

To combat some of the negative features of buying an option, we like to be very picky with the criteria that we use when selecting the call or put option.

First, we don’t pick the option based on what we can afford like so many retail traders make the mistake of doing. In many cases, this will leave you with an out of the money option which has a very low probability of success. Instead, we like to trade the in the money options.

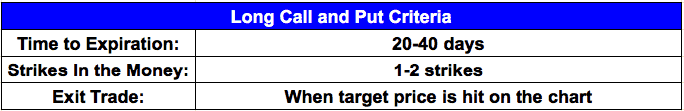

Our criteria has us going out 20-40 days until expiration and buying the call or put option that is 1-2 strikes in the money. This criteria is the same whether we are trading AAPL, BA, or C. By using the same criteria on all stocks and ETF’s, we are able to take much of the discretionary decisions out of the equation.

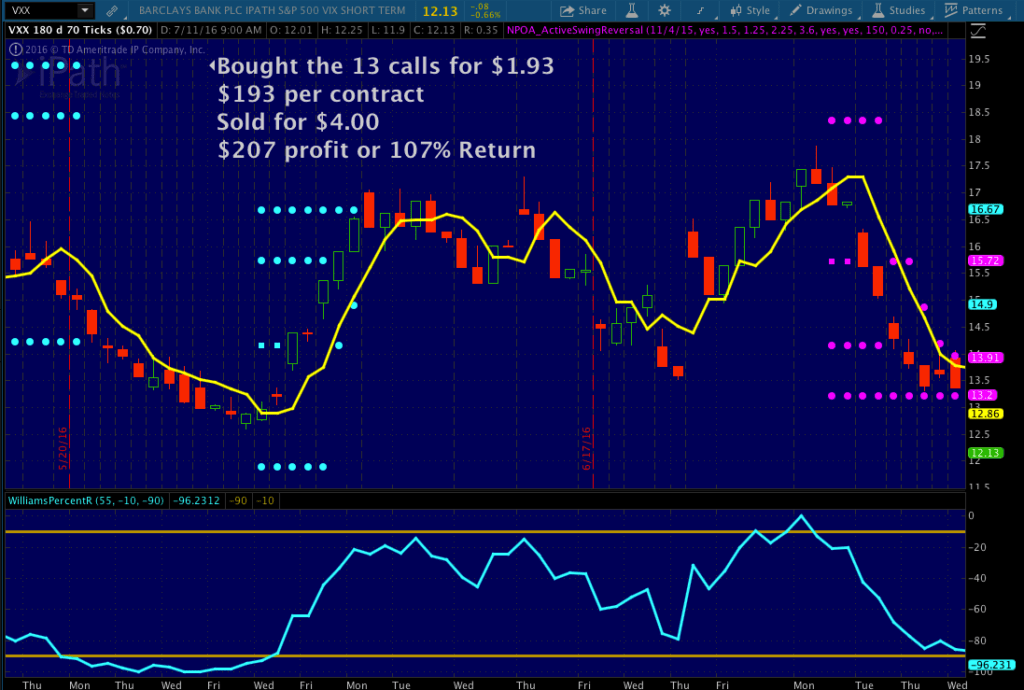

For example, our system gave us a long setup on one of the volatility ETF’s (Symbol: VXX). The entry point was at $14.15 on the chart. Instead of tying up the capital buying the shares of stock once the entry point was hit, we decided to buy the July 13 call options for $1.93 or $193 per contract.

Keep in mind, to buy just 100 shares would have cost $1,415 so you get in instead at a fraction of that cost.

The options had between 20-40 days left until expiration and the 13 calls were one strike in the money from the entry point.

For less than $200 we were controlling 100 shares of stock with the call option. This is a perfect example of the leverage that options offer us. Regardless of the account size you are working with, this is a trade that will leave you with very little capital at risk.

We were fortunate enough in this case that VXX did go up and hit our full target at $16.67. Once this level was hit, we sold out of the long call position for $4.00 per contract.

This gave us a profit of $207 per contract or a return of 107%.That’s a great profit that can give a quick boost to a small account.

Would you like us to do all the work and identify for you the top stocks & ETFs that you should be trading calls and puts with? We’ll give you the exact market, options, entry point and profit target. Just Go Here to learn more:

Free Training: Earn from 50% to 500% Trading Options

2. Long Vertical Spread

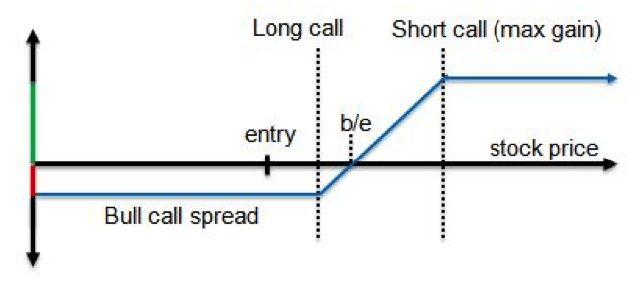

There are times when I want to make a directional bet but do so with a more conservative trade. This is where the long vertical spread comes in.

Out of all trade types, the Vertical Spread is my favorite as it is the most flexible strategy when it comes to trading options. When using a long vertical spread, we still need to have a strong opinion on which way the stock or ETF is heading in the near term.

While the time decay is still going to be there like with a long call or put, the long vertical spread is able to limit the effect of that time decay slightly.

We like to use the long vertical spread when we are less sure of market direction. We are able to do this because a long spread is constructed by both buying an option and selling an option with a different strike at the same time.

Vertical spreads offer a unique ability to control risk and reward by allowing us to determine our maximum gain, maximum loss, breakeven price, maximum return on capital, and the odds of having a winning trade, all at the time we open a position.

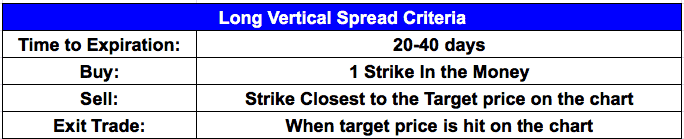

When setting up a long vertical spread we still like to trade the options that have between 20-40 days left until expiration. We structure the trade by always buying the option that is 1 strike in the money and then selling the strike that is closest to our target for that stock or ETF in the near term.

The nice part about using this simple criteria is that it is the same when using call or put options. The criteria is also the same regardless of the symbol of the stock we are trading.

Vertical Spreads are a must to add to your trading arsenal. How about we do the work and you take the trades?

Watch Our Free Training and Done For You Options Alerts Here

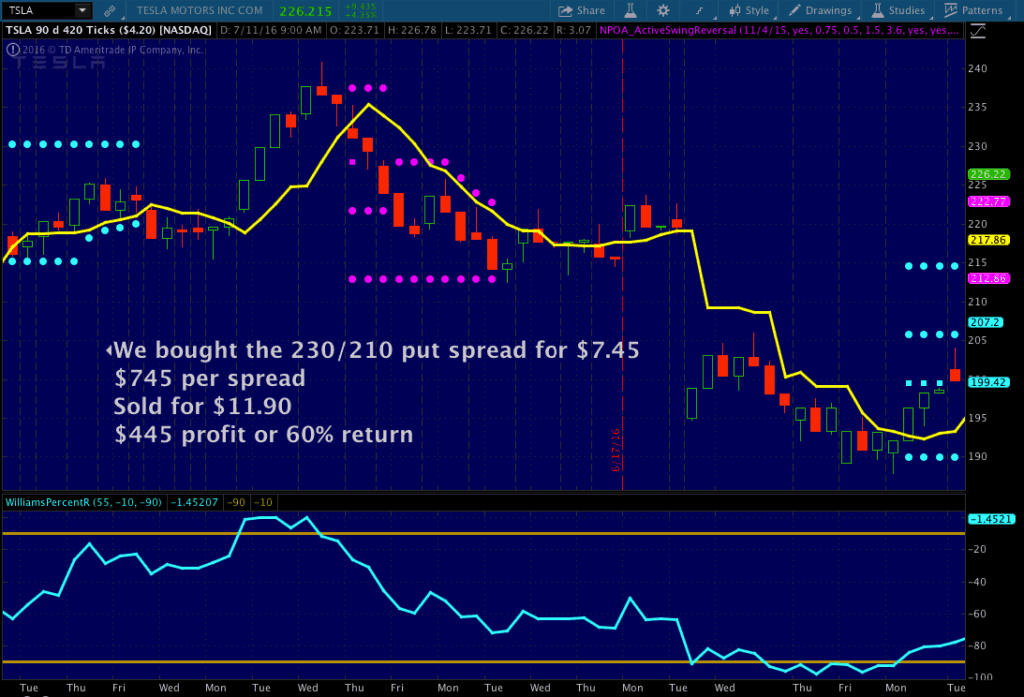

For example, our system giving us a short setup on Tesla (Symbol: TSLA) with an entry point at $227.98. Instead of going in and short selling the shares of stock, which could tie up tens of thousands of dollars, we decided to look at trading the options.

Buying a long put option is one way of playing the market when it is moving to the downside, but it would also tie up too much capital on the TSLA trade (over $2000 of capital per contract). So what else could we do?

We decided to look at buying the July 230/210 put spread for $7.45.

This trade had us buying the July 230 put and at the same time selling the 210 put. We paid $7.45 or $745 per spread. We still controlled 100 shares of TSLA stock on the downside but by using the put spread instead of buying the long put we were able to cut our cost by over 50%.

This is still a bearish trade so we make money if the stock moves lower. Our risk is limited to the price that we paid for the spread which was $745 per spread. The trade off here is we will be left with a smaller winner if the trade does hit the target on the chart.

In our example, the trade did go down and hit full target on the chart at $212.86. Once this level was hit, we closed the trade by selling the put spread for $11.90. This gave us a profit of $445 per spread or a 60% return.

Here is a great example of using options to open the door to some of the expensive tech stocks for a fraction of the price. Don’t feel like you are backed into a corner trading the cheap stocks because you have a small account size. Use the long vertical spread to go where the action is without tying up thousands of dollars of capital.

3. Short Vertical Spread

Trading long calls and puts or a long vertical spread give us great ways to put on an aggressive trade when we have a strong opinion on market direction in the near term.

What if we are a little less certain of market direction?

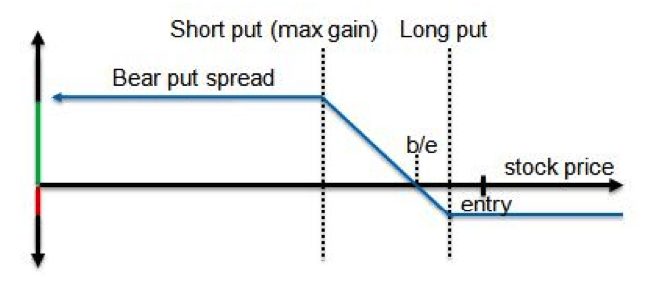

Selling vertical spreads to open a position can give us a way of scratching out a profit even in a period of choppy price action. We do this by selling an option that is closer to the current price of the stock and then going out and buying an option with a strike price that is farther out of the money.

By doing this, we are still able to be in a risk defined position but it also gives us multiple ways of being profitable. Let’s take a look at the criteria that we use when selling a vertical spread to open a position.

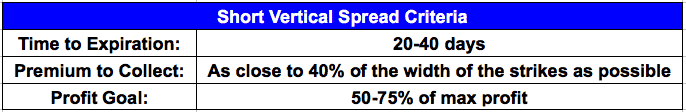

When selling vertical spreads to open a trade we still like to use options with between 20-40 days left until expiration. Why do we prefer to go out farther in time? In most cases the monthly options will have more volume and open interest when compared to the weekly options. This will make them easier to get in and out of trades at good prices.

Going out to the monthly options will also give us more time to be right just in case the market moves against us initially. This gives us time to recover while the weekly options don’t give us that flexibility.

When selling spreads, we like to collect as close to 40% of the width of the spread as possible.

For example, back in early June we saw that the Real Estate ETF (Symbol: IYR)was overbought and we felt it was due for a pullback. However, I was less sure on the timing of the move and didn’t want to be super aggressive by buying a put or put spread. Instead, I wanted a trade that would make money if IYR moved lower or got choppy.

We went out to the July monthly options and we sold the July 80.5/81.5 call spread to open the position.

This had us selling the 80.5 call and buying the 81.5 call at the same time to make it a risk defined trade. We collected $.38 or $38 per spread to put this trade on. This $38 was the most we could have made on the trade, while our risk was limited to $62 per spread (difference between the 81.5 and 80.5 strikes minus the $.38 collected to put the trade on).

Our break even point on this trade was at $80.88 (short 80.5 call plus the $.38 collected to put the trade on).

Why would we risk $60 to make $40?

That doesn’t sound like a very good risk to reward ratio. The reason we would like a trade like this is it would allow us to make money 5 different ways:

-

We make money if IYR moves slightly higher as long as price closes below $80.88

-

We make money if IYR moves lower as long as price closes below $80.88.

-

We make money if IYR moves sideways as long as price closes below $80.88.

-

We make money as the time decay adds up each day that we hold the trade.

-

We make money if the implied volatility contracts.

You could have put this trade on 10 times and still had less than $650 of capital at work.

It’s important to note that the criteria outlined above is the same for both short call spreads and put spreads. By having a rule set in place, it allows us to be more consistent and eliminate much of the discretionary decisions that so many retail trades get stuck on.

Selling vertical spreads to open positions is a very powerful approach that many retail traders miss out on. While short spreads are not the holy grail of trading, they give us the flexibility that we need to make money in any type of market condition that comes our way.

All of the above looks great right? But, maybe it appears a bit complicated? It certainly doesn’t have to be. Don’t let this hold you back. We’ve put together a detailed training, go into more specifics to make this simpler, AND also offer to do all the work for you!