- June 9, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

An options premium refers to the current price of the option that would need to be paid by the buyer to the seller. When looking at the prices quoted in your broker platform, you will notice they are quoted per share.

Each contract however represents 100 shares of stock.

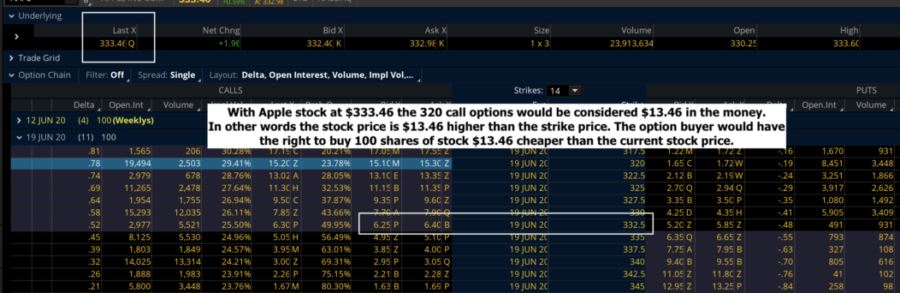

For example, looking at the Apple (Symbol: AAPL) options below you will see the 332.5 call options trading for $6.40.

- This $6.40 is the current premium in the 332.5 call option

- Each option contract represents 100 shares of stock

- It would take $640 to buy the 332.5 calls from the seller.

Regardless of whether you are looking to buy or sell, it’s important to understand what are the factors affecting option premiums of an option. There are 4 inputs that impact the premium of an option most.

4 Factors That Affect The Options Premium

They are stock price, intrinsic value, implied volatility, and time value. As the price of the underlying security changes, the option premium changes

Stock Price

Most traders start trading options with the understanding that buying a call option is bullish looking for a stock move higher and buying a put option is bearish looking for a stock move lower.

As the stock value increases, the premium of the call options will increase while the put options decrease.

As the stock value decreases, the premium of the put options will increase while the call options decrease.

While this is an important piece to trading directional options, the other factors below can have just as big of an impact on your profitability.

Intrinsic Value

How far away the stock price is from the strike price of the option is referred to as the” moneyness” of the option.

The intrinsic value of the option represents how far in the money the option is.

- A call option is considered in the money when the stock price is higher than the strike price of the option.

- An in the money call option is worth more money to the option buyer.

For example, if you own the Apple (Symbol: AAPL) 320 calls with AAPL stock trading at $333.46 the 320 calls would be $13.46 in the money.

This is calculated by taking the difference between the $333 stock price and the 320 strike of the call option. In other words, the 320 call options would have $13.46 of intrinsic value.

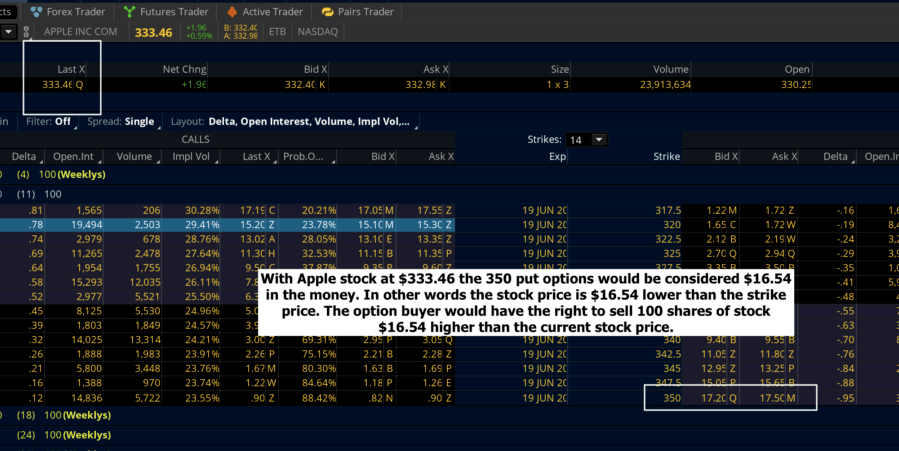

A put option is considered in the money when the stock price is lower than the strike price of the option.

An in the money put option is worth more money to the option buyer.

For example, if you own the Apple (Symbol: AAPL) 350 puts with AAPL stock trading at $333.46 the 350 puts would be $16.54 in the money.

This is calculated by taking the difference between the $333.46 stock price and the 350 strike of the put option. In other words, the 350 put options would have $16.54 of intrinsic value in this case.

As an option goes further in the money, the option will typically increase in value (not taking into account the time value or implied volatility). This makes the in the money options more expensive for the option buyer.

A call option is considered out of the money when the stock price is lower than the strike price of the option. A put option is considered out of the money when the stock price is higher than the strike price of the option.

Out of the money options have no intrinsic value.

Implied Volatility

In simplest terms, the implied volatility is a prediction of future stock volatility. It is the value that is being used in the option pricing model to generate the current option premium.

Implied volatility is the option pricing factor that is most overlooked by traders. It has a huge impact on the performance of your options trades.

High levels of implied volatility will predict bigger moves back and forth in the stock price. This uncertainty will be priced into the options leading to more expensive prices.

Low levels of implied volatility will predict smaller moves back and forth in the stock price. The lack of uncertainty will be priced into the options leading to cheaper prices.

- As implied volatility increases the values of the options increase faster.

- If implied volatility decreases it will cause the options premium to get cheaper.

As an options buyer you ideally want the volatility to either stay steady or increase during the lifespan of the trade.

- If it increases you will see bigger profit potential.

- If it decreases while you are holding the trade it will lower the option premium which can cause you to lose money or not make as much profit as expected on the trade

As an options seller, you ideally want the volatility to decrease from the moment you put the trade on. As the volatility decreases, the options premium gets cheaper which will allow you to buy your options back at a cheaper price.

The cheaper the premium gets the more money you make on the trade.

Time Value

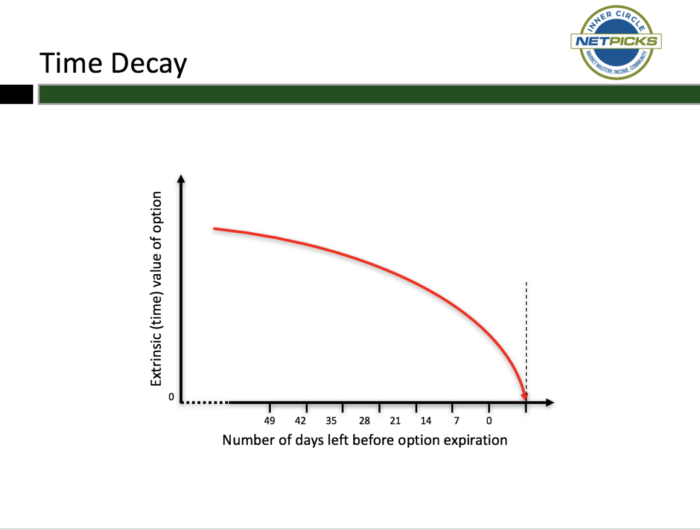

Options are decaying assets meaning every day that passes the options premiums get cheaper.

There is more time value in the options premium the farther out in time that you go from expiration. You will pay more for the option the farther out in time that you go due to the options giving you control of the position for a longer period of time.

However, options will lose value at an increasing rate the closer they get to expiration. This is known as decreasing in a non-linear fashion.

While paying a cheaper option premium on an option that has less time to expiration can seem attractive, it also means the time decay becomes more significant with every passing day the closer you get to expiration.

Time value is the enemy of an options buyer and a friend to the options seller. As a buyer you want the stock price to move in your favor as quickly as possible to avoid the time decay taking some of your profit potential.

As a seller you want the option premium to get as cheap as possible. Every day that passes is your friend when selling options to open a position.

Bottom Line About Premiums Of An Option

Trading options doesn’t have to be overly complex. However, understanding the factors that impact the options premiums can help you select the best strategy to maximize your profits based on your outlook for the stock.

Paying attention to stock price, intrinsic value, implied volatility, and time value will lead to bigger profits from your trading.

2 Comments

Comments are closed.

Love the site

Thanks Edward!