- September 8, 2022

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

Options present a great opportunity for traders to make a greater profit than would be possible if they were to trade the underlying asset, usually stocks, by amplifying potential upside gains. For example, instead of using $5,000 to buy 100 shares of a $50 stock, you could hypothetically spend $1,000 on a call options contract and have control of the same 100 shares.

Call and put options are a type of agreement when options trading that will give the trader the right, but not the obligation, to buy or sell an underlying asset at a predetermined price.

Call options give the holder the right to buy an asset, while put options give the holder the right to sell an asset. These options can be used in several different ways to help traders make profits while limiting their risks. Call and put options can be bought and sold on their own or as part of a more complex options trading strategy.

The key to success with call-and-put options is to choose the right strategy for the current market conditions.

What Happens When You Buy A Call Option

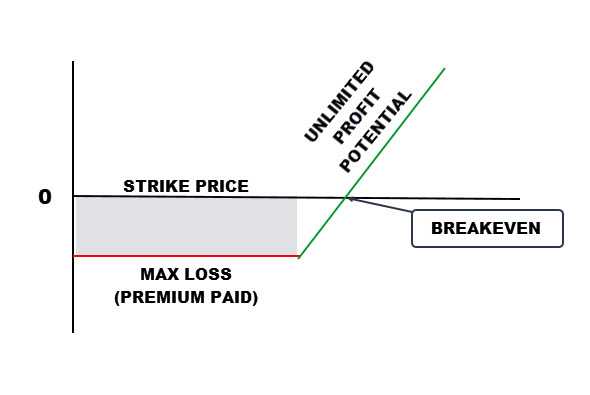

When you buy a call option, you are essentially betting that the underlying stock will increase in value. If the asset increases in value, you can then sell the option for a profit.

For example, let’s say you buy a call option for ABC stock with an options strike price of $50. This means you have the right, but not the obligation, to buy 100 shares of ABC stock at the specific price of $50 per share by a certain time (options expiration date).

To have this right, you would pay a premium to the seller of the option who must sell you the ABC stock at $50/share if you decide to buy it.

Imagine you are bullish on ABC stock and decide to buy a call option. The premium the contract is offered at is $3.00 per share ($300 per options contract). If you were to buy the stock at the current price of $50.00, you need to pay $5000.00.

Imagine you are bullish on ABC stock and decide to buy a call option. The premium the contract is offered at is $3.00 per share ($300 per options contract). If you were to buy the stock at the current price of $50.00, you need to pay $5000.00.

For your $300 option premium, you get to control $5000 worth of ABC stock. You also know your maximum loss is the premium you paid ($300) while your potential profit is unlimited.

If the market value of ABC stock price goes up to $60 per share, you can then exercise your option and buy the stock at $50 per share, and then sell it immediately at the current market price of $60 per share. This would give you a profit of $10 per share.

However, if ABC share price goes down to $40, you would not exercise your option because you could buy the stock for less than the strike price. However, if the asset does not increase in value, you will simply let the option expire and lose your initial investment (the premium paid to the seller of the call option).

Very rarely will an options trader exercise the option and buy the stocks involved. The common approach is to close the position by selling it back to the market. If you do exercise the option, you would do so to hold on to the shares as an investment to sell them later when the price has increased.

In our example, if a trader chooses to close the position and the current price for the contract is $5.00/share ($500.00/contract), this trader would profit $500-$300(premium paid)=$200.00.

What Happens When You Buy A Put Option Contract

When you buy a put option, you believe that the underlying asset will decline in value meaning you are bearish on the asset. If the asset does decline in value, you can then sell the option for a profit.

However, if the price of the underlying asset increases in value, the put option will decline in value and you may have to sell it at a loss.

For example, let’s say you buy a put option for ABC stock with a strike price of $50. This means you have the right, but not the obligation, to sell 100 shares of ABC stock at $50 per share by a certain time (options expiration date).

For example, let’s say you buy a put option for ABC stock with a strike price of $50. This means you have the right, but not the obligation, to sell 100 shares of ABC stock at $50 per share by a certain time (options expiration date).

To have this right, you would pay a premium to the seller of the option who must buy the ABC stock from you at $50/share if you decide to sell it.

If ABC stock goes down to $40 per share, you can then exercise your option and sell the stock at $50 per share, and then buy it immediately at the current market price of $40 per share. This would give you a profit of $10 per share.

However, if ABC stock goes up to $60 per share, you would not exercise your option because you could sell the stock for more than the strike price.

Just like with call options, most traders will not exercise their rights and will close the position if in profit.

Using Put Options As A Hedge

If you own shares in a stock as an investor, you are susceptible to downturns in the market.

Imagine you own shares of stock in ABC as an investment and want to protect some of the gains as the market is bearish. You can purchase a put option that will lock in a sales price for the stock which gives you the right to sell your shares of stock at a given price for a set amount of time.

Of course, if you are holding for a long-term investment, you’d not exercise the option and would simply close it (sell it back to the market) and book the profit.

Conclusion

So what does this mean for you as an investor or a trader?

if you think a stock is going to go up, you should buy call options instead of buying the actual shares. If you think a stock is going to go down, you should buy put options.

Of course, there are lots of factors to consider when making these decisions (like the current market conditions and your risk tolerance), but hopefully, this gives you a basic understanding of how call-and-put options work.

Trading options can be a great way to make more money.

You can potentially make a lot of money in a short period if you know what you’re doing. That’s where 8-Minute Options Cookbook guides come in. Click here to download your free Options Trading Guide.