- November 21, 2022

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

We’ve covered a lot of Options trading material over the last few months and it’s not by accident. The truth is that at Netpicks, options trading is something we are very good at, and have a huge customer base to show for it.

Many traders want to go it alone, and that is fine. Many may have a strategy that works well for them and you don’t need a lot of the heavy lifting done for you.

In the next few articles, I am going to give you our exact playbook on how we take different types of trades in Options. While this is not a substitute for the services we offer, for some of you, it could be very valuable.

Our Long Call And Long Put Options Approach

Yes, these are the most basic trades you can take but, they are also some of the most powerful. These trades have the most profit potential, as in unlimited, just as if you were buying the shares of stock.

Even better, unlike stocks that can go to zero, your risk in buying calls and buying puts is limited to whatever you paid in premium.

Playbook 1 – Long Calls/Long Puts

We use this approach when bullish on the underlying stock or ETF. Our actual trading strategy has given us a signal that the next move is probably up and we want to take advantage of it.

Outlook: Bullish

Duration of trade: 1 day to 3 weeks

Max profit: Unlimited

Max loss: Our cost to put on the trade (premium paid)

These are short-term options trades and typically, we are out within a 5-day period which depends on how the trade is unfolding.

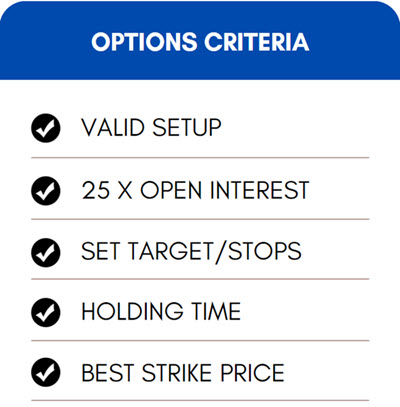

Criteria For The Trade

Whether trading long calls or puts, the following are the exact criteria for both positions.

Valid Setup

Valid Setup

While we use a propriety system for trading, the bottom line is we need a trading strategy. Trading with emotions is one of the biggest killers for a trader and we highly recommend you have a system that gives a setup. Our system gives us an entry point, the profit targets, and the stop loss point that we need to get out to avoid losing all of our risk in the trade.

Open Interest That Matters

We want to see at least 25x the number of contracts we want to trade, in open interest. For example, if I want to trade 5 contracts, I want to see at least 125 contracts of open interest. The higher the open interest and volume (they are different), the more confident I am about getting my order filled quickly at a good price.

Targets and Stops

If I have no clue where to get out of the trade, it makes no sense to get into the trade. I place these orders the moment I set up the trade on my platform. A simple rule of thumb is to target 100% of what it cost me to open the trade for profit. My stop loss is 50% of what it took to open the trade.

As an example: if it costs me $1.80 to open a position, I want to target $3.60 for my profit and I will want to exit if the option price hits $0.90.

As mentioned, these orders are set the moment I open the trade. Do you want a less stressful way of trading? If so, copying that format is something to consider.

Consider Your Holding Time

Since options have time decay, I need to have a rough idea of how long it will take for my predicted move to occur. While we like to average 3-5 days, the closer the expiration date is, the faster time decay occurs and cheapens our position.

Having a basket of instruments you routinely trade is the best way to get this number. Keeping great journals and trade logs can assist you in determining your average hold time on the underlying instrument. With thousands of instruments available, narrowing it down to a consistent list can bring consistent trading results.

Consider At Least 2X the Expected Holding Time

Although we generally look for contract expiration dates 20-40 days out, there is another way. If you are expecting a holding time of 5 days, ensure the expiration date is at least 10 days away. Keep in mind that premiums for closer expiration dates are generally cheaper. While “cheapness” should not be your main criteria, it’s something to keep in mind.

However, while 2X is a good start, we routinely look for 20-40 day expirations.

Best Strike Price

There are always many strikes to consider so you should have some rules for your selection. There are two ways we will consider with the first one being our priority:

1-2 strikes in the money. When we use these, our trades automatically have intrinsic value (have worth) and extrinsic (time is still on our side) the moment we set the trade up. Taking an in-the-money position can help offset the effects of time decay in our position.

Delta. Remember that delta is how much the option will increase or decrease with a $1.00 move in the underlying asset. We look for .60 – .65 for Delta in positions expected to last 1-3 weeks.

Manage The Trade

We may have different criteria for managing trades depending on the strategy. For many new traders, a simple approach is to set your orders and let the position play out. Micro-managing a trade can lead to losses or, at the very least, less profit.

Simple Trade Example

Imagine Netflix was one of my watchlist tickers and I was bullish on the trade due to my trading strategy. This would lead me to open a call option on the ticker.

Imagine, for this example, my entry price on the chart is $289.00 – the price my trade would trigger.

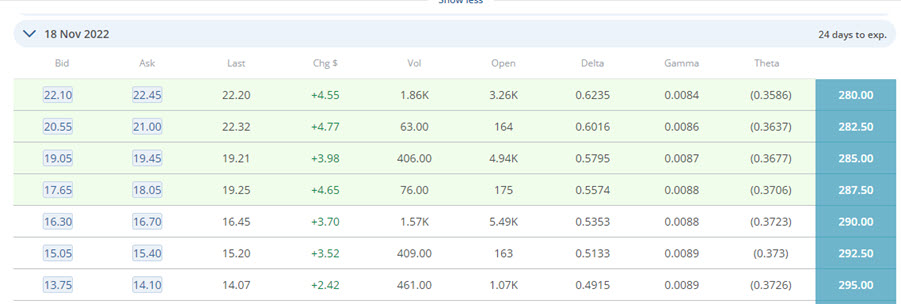

Using the criteria mentioned above, I’d look for a contract in the 20-40 days expiration zone. I settle on the 28 days to expiration with 1-2 strikes in the money from my entry point.

Since my entry point into the trade is $289.00, I would look at either the $287.50 or $285.00 strike price.

There is a huge difference in open interest between those two strikes and selecting the one that’s more liquid, I opt for the $285.00 strike.

I’d look to enter this trade at the midpoint of the bid/ask price or $19.25. If filled, I’d be looking at a profit of $19.25 x 2 (100%) or $38.50. For my stop loss, I’d want to be out of the trade if the price of the option hits $19.25/2 = $9.62.

In a perfect world, I am holding this trade for a short time as time decay accelerates the closer we get to the expiration date.

Create The Options Order

All option trading platforms are a little different but the last step is to enter your trade. Make sure you have all the numbers inputted correctly and hit the buy button.

You’ve set the entry price and both your targets. The last thing to do is let the trade play out. This process, once you’ve got your entry order for the trade, takes about one minute to set up.

Five Quick Points

Long Call and Long Put options are a great way to trade with defined risk and unlimited profit potential

Consider at least 2x the expected holding time when choosing an expiration date.

Look for 1-2 strikes in the money to help offset time decay.

Using the Delta criteria to choose the best strike price is another way to decide which one to use.

Manage the trade by setting your targets and stop loss.

1 Comment

Comments are closed.

It’s my first trade today; I hope I don’t blow the sell tomorrow. Your explanations are short and understandable, thank you.