- October 24, 2022

- Posted by: Shane Daly

- Category: Trading Article

Open interest is the total number of currently open contracts for a particular security and can be found on the option chain. It represents the total number of buyers and option sellers who have not yet closed their position.

For options traders, open interest is a valuable metric that can be used to gauge market activity and identify potential trading opportunities, especially which option strike price and expiration date to be involved in.

When open interest is rising, it typically indicates that new money is entering the market and that traders are bullish/bearish on the underlying security.

Conversely, when open interest is falling, it can signify that traders are losing confidence in the market and may be hesitant to open new positions. As such, open interest can be a helpful tool for options traders as they seek to navigate the markets and decide which asset to trade.

Read on to learn more about open interest and how much we at Netpicks like to see when we trade options.

Open Interest Is Not Daily Trading Volume

Many traders confused open interest with daily volume but they are two different things. Volume represents the total number of contracts traded during a particular period, while open interest represents the total number of outstanding contracts that have not been closed.

For example, let’s say that 100 calls are traded today and 50 of those calls are new positions being opened. The other 50 calls represent traders who are closing out their positions. In this case, the volume would be 100 contracts but the open interest would only be 50 contracts, the new positions.

For example, let’s say that 100 calls are traded today and 50 of those calls are new positions being opened. The other 50 calls represent traders who are closing out their positions. In this case, the volume would be 100 contracts but the open interest would only be 50 contracts, the new positions.

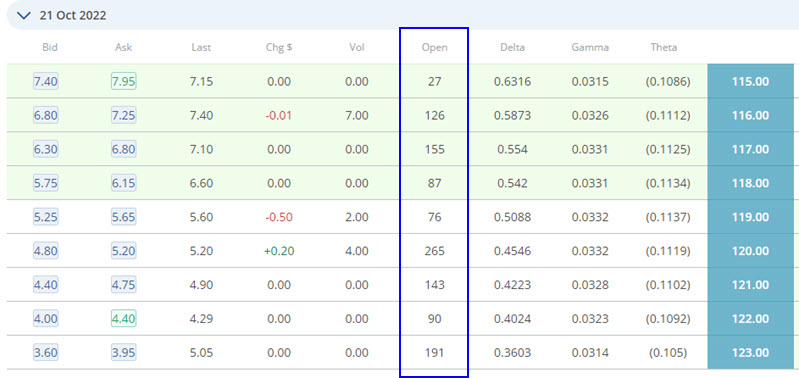

In the example, you can see that the out of the money strike price of $120.00 on the call side has the most open interest for the Oct 21 expiration date.

Option open interest will rise when traders establish brand-new contracts that did not previously exist. This implies that a new buyer must take a long position and a new seller must take a short position, which results in the formation of a new market contract.

How To Calculate Open Interest

Open interest is a simple concept: the number of outstanding contracts that have not yet been exercised or expired.

To calculate open interest, simply take the total number of contracts and subtract the number of closed contracts. For example, if there are 100 outstanding contracts and 10 expired contracts, the open interest would be 90.

Open interest can be a helpful indicator when making trading decisions, as it can provide insights into market liquidity and the strength of market trends.

Good thing is that you don’t have to calculate it.

Options Clearing Corporation

The Options Clearing Corporation (OCC) is the entity that manages and clears all options transactions in the market. The OCC is also in charge of keeping track of all open interest for options traded on registered exchanges.

On the website for OCC, it states: “We clear millions of financial contracts a day, which means we have a key role in the world’s largest economy. OCC is the buyer to every seller and the seller to every buyer in the U.S. listed-options markets – in fact, we are the only company that clears and settles every listed-options trade in the country.”

How To Use 0pen Interest Information When Trading 0ptions

Open interest is a good way to gauge how active a market is, and it can also give you some clues about future price movement.

If open interest is rising on the call side/put side, it means that more money is entering the market and that means more buying/selling pressure depending on the current trend direction. Declining open interest means that the market is liquidating and could mean that the prevailing trend is either set to reverse or pause.

Keep this in mind: every option contract has a buyer and a seller attached. One of them is on the wrong side of the market action.

While open interest isn’t the only factor you should consider when trading options, it can be a helpful tool in your decision-making process.

Why do most options traders prefer high open interest when trading? High open interest numbers usually relate to greater liquidity. This is vital to give you confidence that the price you want to enter and exit at, will generally be met. Trading an illiquid option market is not something we at Netpicks suggest.

Our rule of thumb is to look for 25 times the amount of open interest compared to the contracts we will trade. For example, if trading 1 options contract we want to see at least 25 in open interest. We could buy 10 contracts at the $120 strike price in the example above.

Limitation Of OI Data

While open interest data can be useful in gauging the level of activity in a given market, there is an important limitation to consider.

Open interest is only updated once per day and is not a reliable indicator of action if you are looking for up-to-the-minute updates. The OI number is only valid at the opening of that trading day. It will change throughout the session but that number will be posted the following day.

Open interest data can be affected by factors such as rollover activity or contract expiration. As a result, it is important to take these limitations into account when interpreting open interest data.

Closing Thoughts

Open interest is the number of active contracts of a particular security that exists at any given time. It is a measure of market activity and liquidity, as well as of investor sentiment. A high level of open interest could mean that there is strong support for the current direction, while a low level of open interest potentially means weak interest.

Open interest can be used to identify trends in the market and to confirm price movements. If there is high open interest on the call side at higher strike prices, traders are looking for the price to rise which is bullish.

Here is the stock chart of Bidu and note that the popular $120 strike price is, at this time, close to being met.

It can also be used to generate trading signals with some strategies. For example, a rising open interest in call options could be a bullish signal, while a falling open interest in put options might be interpreted as bearish and a trader may use that information as part of their strategy.

However, open interest should not be used in isolation; rather, it should be considered in conjunction with other market indicators.

Ultimately, open interest is just one tool that traders can use to gain insights into the market. When used properly, it can be a valuable addition to any trader’s toolkit.