- April 17, 2024

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

If you’re thinking about getting into day trading with limited funds, there are some important things to consider before you start. Understanding the unique challenges of trading with little money and having the right mindset is important for you to find success.

By learning how to maximize growth with a small account and staying disciplined during market changes, you’ll see that starting day trading with little money is not just about the cash you have but also about your approach and strategies.

Understanding the Challenges of Day Trading with Little Money

Day trading with limited funds can present challenges such as the Pattern Day Trader Rule and account minimums, which may limit your trading options. It’s important to be aware of how commissions and fees can eat into your profits, especially when you’re working with small amounts of capital.

Managing the ups and downs of trading with limited funds can be tough emotionally, but there are strategies to help you tackle these challenges. One approach is to focus on high-probability trades and set clear stop-loss levels to protect your capital.

High Probability Trades

A high-probability trade is a trading opportunity that has a greater likelihood of being profitable. Some key characteristics of high-probability trades include:

| Key Aspect | Description |

|---|---|

| Confluence of Factors | High-probability trades often have several technical and fundamental factors aligning in their favor, such as a stock breaking out of a consolidation pattern while also having strong institutional buying support. |

| Favorable Risk-Reward Ratio | These trades usually offer a larger potential profit compared to the risk being taken. The stop loss is placed close to the entry while the profit target is a multiple of the risk. 1R targets have a greater likelihood of being hit |

| Trading with the Trend | High-probability setups look to enter trades in the direction of the prevailing trend, not against it. Going with the path of least resistance improves the odds of success. |

| Patience and Selectivity | Traders wait for the most favorable setups to materialize and avoid overtrading or forcing trades when conditions are not optimal. Only the highest conviction ideas are acted upon. |

| Robust Backtesting | Strategies that produce high-probability trades have usually been extensively backtested on historical data to validate their edge and profitability over a large sample size. |

Another strategy is to consider trading in markets with lower capital requirements or exploring alternative trading instruments like options or futures. By diversifying your trading approach, you can potentially reduce the impact of limited funds on your overall trading performance.

Pattern Day Trader Rule and Account Minimums

When starting day trading with limited funds, you’ll find you will face challenges like the Pattern Day Trader Rule and account minimums. To handle these issues, focus on three key aspects: risk management, account growth, and market selection.

- Pattern Day Trader Rule: Know the rules to avoid penalties for being classified as a pattern day trader.

- Account Minimums: Look for brokerage firms with low or no minimum deposit accounts to get started.

- Risk Management Strategies: Use stop-loss orders and position-sizing techniques to safeguard your capital.

- Market Selection: Pick markets that suit your trading style and offer enough liquidity for your trades.

Understanding these points will help you handle day trading with limited funds more effectively.

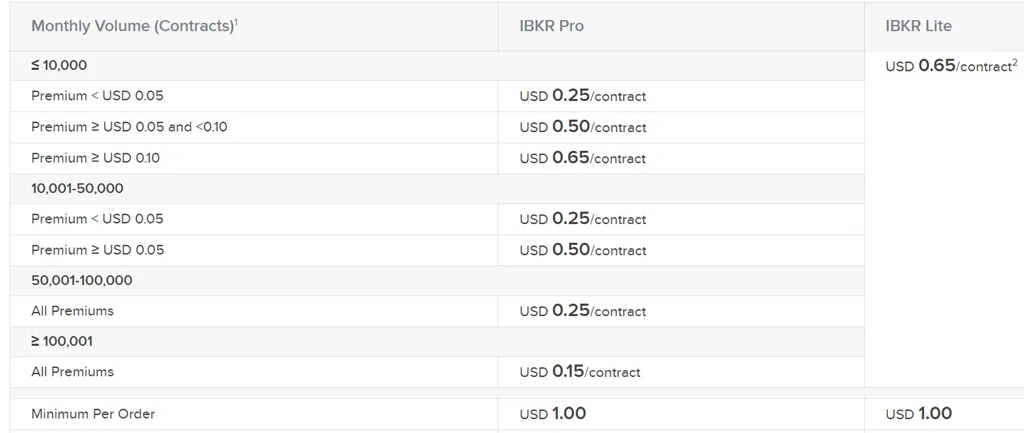

Impact of Commissions and Fees on Profitability

When you’re day trading with limited funds, consider how commissions and fees can impact your profitability. To make the most of your trades, comparing fees is the first step to maximizing your profit margin.

Different brokers have varying fee structures, so it’s important to research and select a broker wisely. Even small fees can significantly affect your profits when you have limited capital. Choosing brokers with lower commission rates can help you make your funds go further instead of being drained in fees. Before making any trades, analyze how these fees will play into your overall profitability.

Emotional Challenges of Trading with Limited Capital

Day trading with limited capital can be tough. Handling the emotional side is important to your success and here are some common challenges traders face:

- Stress spikes due to money constraints.

- Fear of losing what little funds you have.

- The temptation to take big risks for quick gains (the “can’t lose” mentality).

- Staying disciplined and patient in volatile markets.

Developing the Right Mindset

When you’re starting day trading with limited funds, it’s important to have realistic expectations. Success in day trading doesn’t happen overnight. Focus on the trading process rather than just chasing profits.

Developing discipline and patience are needed for handling the highs and lows of day trading with restricted capital.

Importance of Realistic Expectations

Having a realistic mindset is important when trading. It’s important to set expectations, manage emotions, and establish achievable goals to succeed over the long term.

- Acknowledge the Risks: Day trading involves significant risks, and experiencing losses is part of the process.

- Practice Patience: Success in day trading takes time. Stay patient and committed to your trading strategy.

- Keep Learning: Stay up-to-date on market trends, trading strategies, and economic indicators to make informed decisions.

- Be Flexible: Markets can be unpredictable, so be ready to adapt and adjust your strategies when needed.

Focusing on the Process, Not Just Profits

To succeed in day trading with limited funds, focus on mastering the process instead of just chasing profits. By practicing mindful trading, you can make decisions based on market analysis and risk management – not hope.

It’s important to have a long-term growth mindset, seeing setbacks as opportunities to learn and staying dedicated to your trading strategy.

Day trading is an ongoing learning experience, with each trade offering insights to improve your skills. Value the learning and improvement process more than just the outcomes.

Cultivating Discipline and Patience

To succeed in day trading, you need to work on discipline and patience. Here’s how you can improve your skills:

- Stick to your trading plan and have faith in your strategies to boost confidence and maintain a consistent approach.

- Control your emotions to avoid making hasty decisions, and minimize distractions to stay focused on your trades.

- Learn from your losses, adjust to market shifts, and persist through challenges to evolve as a trader.

- Establish realistic goals, track your progress, and make necessary changes to enhance your performance over time.

Choosing the Best Markets for Small Accounts

When you’re starting with limited funds in day trading, it’s important to look into cost-effective options beyond stocks.

Comparing Forex, futures, and options can give you more opportunities with smaller account sizes.

By examining factors like market liquidity, volatility, and accessibility, you can make choices on where to focus your trading efforts in line with your capital.

Exploring Low-Cost Alternatives to Stocks

If you have limited capital in your account, it’s smart to look at low-cost options beyond stocks. Here are some markets that suit small accounts:

- Cryptocurrency trading: It’s a volatile market that runs 24/7, offering potential rewards but you need to handle volatility.

- Penny stocks: These low-priced stocks can be highly volatile, and ideal for traders with small accounts.

- Leveraged ETFs: These funds aim to boost returns but come with higher risks.

- Micro E-mini Futures: Futures contracts with lower margin requirements, making them accessible for traders with limited funds.

- Options Trading: For a fraction of the cost and with defined risks, you can trade your favorite stocks with limited capital with options

Exploring these alternatives can help you diversify and potentially grow your account, even with limited funds.

Comparing Forex, Futures, and Options

When comparing Forex, Futures, and Options, traders with small accounts must choose the right market that aligns with their investment strategies and risk tolerance.

In Forex trading, you trade currency pairs like EUR/USD, each with its unique behavior and level of volatility.

Futures trading involves standardized contract sizes, which may require higher margins but offer the potential for significant profits. You also have micro E-Mini futures which may be suitable for you and your account

Options trading provides flexibility by granting the right to buy or sell assets at predetermined strike prices, offering limited risk compared to futures.

To decide which market is best for you, consider factors like your risk appetite, initial capital, and preferred trading style. Understanding currency pairs in Forex, contract sizes in Futures, and strike prices in Options is key to making decisions for your day trading activities with a small account.

Analyzing Market Liquidity, Volatility, and Accessibility

When day trading with limited funds, consider market liquidity, and volatility. Here are key factors to keep in mind for small-day trading accounts:

| Factor | Description |

|---|---|

| Market Analysis and Profit Potential | Evaluate the market trends and potential profits before making any trades. |

| Risk Assessment and Trade Execution | Manage risks by carefully assessing each trade and executing them effectively. |

| Capital Preservation and Growth Strategies | Focus on preserving your capital while implementing strategies to help it grow. |

| Accessibility and Ease of Entry | Choose markets that are easy to access and enter to avoid unnecessary complications. |

Understanding these factors will help you make better decisions, capitalize on opportunities, and handle risks. By selecting markets with the right mix of liquidity and volatility you can improve your chances of success while protecting your capital.

Strategies for Maximizing Small Account Growth

If you want to grow your small day trading account effectively, you need to follow strict risk management rules. This means focusing on trades with a high probability of success to boost your chances in the market.

To maximize your gains, consider using strategies like scalping to take advantage of “less time in the market. By sticking to these methods, you can increase your account’s growth potential steadily over time.

Implementing Strict Risk Management Rules

To grow your small trading account effectively, follow strict risk management rules. These techniques will protect your capital and help you in achieving success in day trading. Consider these strategies to make the most of your account:

- Decide on the maximum percentage of your account to risk on a single trade.

- Utilize stop-loss orders to cap potential losses.

- Spread the risk by diversifying your trades across various assets.

- Maintain a consistent position sizing method to manage the capital at risk effectively.

I take my risk capital a little further. Depending on the setup, I may allocate a 25% position of the overall capital (EX: 25% of $100000 = $25000). From that amount, the risk will be between 1-3% for swing trades. An example would be a $25000 position size with a risk of 2% or $500.00.

Focusing on High-Probability Setups

To grow a small trading account effectively, focus on high-probability setups. Use technical analysis to pinpoint the best times to enter and exit trades based on past price movements and patterns. This analytical approach that uses a confluence of factors, boosts decision-making accuracy and boosts the chances of trade success.

You need to implement strong risk management tactics. Protect your account by setting stop-loss orders and sticking to prudent position sizes. Keep in mind the psychological aspect of trading too. Emotions like fear and greed can influence your choices, so maintain a logical mindset for sustained success.

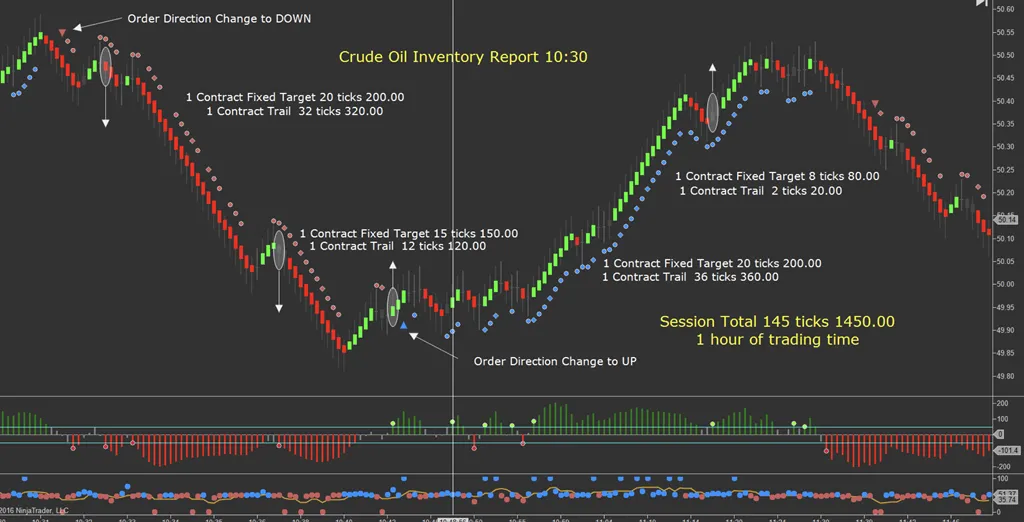

Considering Scalping and Other Low-Risk Strategies

Low-risk strategies like scalping can be a smart approach for growing a small trading account efficiently. Scalping involves making frequent small trades to benefit from slight price movements. When working with limited funds, these strategies can help you manage risk and steadily increase your account size. Here are some key tips to consider:

- Manage Risk: Protect your capital by setting stop-loss orders and following a risk-reward ratio.

- Act Quickly: Scalping requires prompt decision-making and execution to capitalize on short-term price changes.

- Use Technical Analysis: Leverage charts and indicators to pinpoint entry and exit points accurately.

- Stay Updated: Stay in the loop with market news and events that could influence your trades.

While the rule of thumb is a risk/reward ratio of 1:3, keep in mind you will hit 1:1 a lot more times than the 1:3 rule of thumb.

Funding Your Account Responsibly

When you’re adding funds to your day trading account, it’s essential to figure out how much risk capital you can afford to use. This helps prevent potential financial troubles down the road. Avoiding excessive risks and over-leveraging.

You can also consider exploring different financing options to manage your account smartly and with flexibility. By being smart with your funding and still being able to sustain your lifestyle, you can set yourself up for more sustainable trading practices.

Determining Your Risk Capital

Determining your risk capital is an important step when funding your day trading account responsibly. To manage your capital effectively, consider these key steps:

- Calculate potential losses: Decide the maximum amount you can afford to lose on a single trade.

- Use risk management strategies: Apply stop-loss orders and diversify your trades to lower potential losses.

- Calculate position size: Determine the right position size based on your risk tolerance and market volatility.

- Set aside emergency funds: Keep a portion of your capital ready for unexpected market changes or emergencies.

Avoiding Over-Leveraging and Excessive Risk

Funding your day trading account responsibly requires caution to steer clear of over-leveraging and excessive risk. In day trading, effective risk management is key. Controlling the size of your positions is an important step to limit the capital you expose to each trade, reducing potential losses.

Adhering to position sizing rules aligned with your risk tolerance and trading strategy helps cushion the impact of losing trades. Keeping a check on leverage is essential to avoid amplifying losses. It’s wise to maintain conservative leverage levels to shield your account from major downturns.

Exploring Creative Financing Options

When you’re starting day trading with limited funds, it’s essential to find smart ways to finance your account. Here are some practical options to consider:

- Crowdfunding: Some use the collective power of individuals to raise capital for their trading activities.

- Microloans: Secure small amounts of funds to kick off your day trading journey without taking on excessive debt.

- Peer-to-peer lending: Connect with individual lenders who are willing to invest in your trading venture.

- Angel investors: Look for individuals interested in backing your day trading goals in exchange for potential returns.

Exploring these alternative financing avenues can help you responsibly fund your day trading account and kickstart your trading journey without breaking the bank. However, these may also require you to show some success in trading before they front any of your trading business.

Scaling Up Your Trading Strategically

As you advance in day trading, it’s essential to expand your trading efforts. Consistently reinvesting your profits, gradually increasing your position sizes, and diversifying your portfolio over time are steps to consider.

Reinvesting Profits Consistently

To grow your day trading business smartly, an important step is to consistently reinvest your profits. This practice can boost the potential for your trading to expand while ensuring its long-term success.

Let’s say you start day trading with a $30,000 account. You risk 1% of your account per trade ($300). After a month of profitable trading, your account grows to $33,000. To reinvest profits, increase your position size in proportion to your account growth, while still risking 1% per trade.

So now risk $330 per trade (1% of $33,000).

If you continue to trade profitably, and your account value rises to $40,000, you would then risk $400 per trade. By increasing your position size as your account grows, you compound your gains. Only increase your risk in proportion to your account size. Avoid the temptation to risk a larger percentage as you make money. Stick to your strategy and risk parameters

Here are some practical tips to make this happen:

- Grow Your Gains: Reinvesting profits can snowball into significant growth over time. Do not spend your gains. Compound them.

- Spread Your Positions: Diversify your account to balance risks and increase potential returns. This could also include day trading with swing trading.

- Stay Realistic: Set achievable goals for reinvesting profits to influence your trading choices.

- Track Progress: Regularly assess how reinvesting profits impact your overall trading strategy. Larger position sizes can move smaller instruments.

Increasing Position Sizes Gradually

Gradually increasing your position sizes is a smart way to grow your day trading operations. It helps you control risk by managing the amount of money you put into each trade.

By adjusting your position sizes as your account grows, you can protect your profits and reduce potential losses. It’s important to think about your risk management plan when you increase position sizes to ensure you’re comfortable with the level of risk.

As you slowly expand your positions, you give yourself more room to make higher profits. Position sizing is key to keeping a balanced portfolio and improving your day trading performance in the long run.

Diversifying Your Portfolio Over Time

When expanding your day trading portfolio, it’s smart to diversify your positions gradually. Diversification is key for long-term success. To manage risks and protect your capital, invest in different types of assets. Analyze markets thoroughly to make well-informed decisions. By choosing a mix of assets and staying updated on market conditions, you can build a stronger trading strategy.

Remember, a diversified portfolio helps you handle market changes and enhance your trading performance.

- Spread investments across various asset classes

- Stay updated on market trends

- Adjust your portfolio based on market changes

- Use both short-term and long-term trading strategies

Staying Motivated and Focused

In day trading, it’s important to stay motivated and focused. One way to do this is by celebrating small wins and milestones. Recognizing your achievements helps you stay positive, and driven, and helps you avoid knee-jerk reaction trading. Everyone loses but not everyone wins so enjoy those small victories.

Learn from your losses and mistakes. This is how you can grow and improve your trading strategies. By analyzing what went wrong, you can make adjustments for better outcomes in the future.

Celebrating Small Wins and Milestones

Recognize and appreciate each small victory and milestone on your day-trading journey to stay motivated and focused. Celebrating these achievements is key to boosting confidence and drive. Set specific milestones and track your progress to see gradual growth.

Here are some ways to mark your wins and milestones:

- Reward yourself with a small treat or indulgence.

- Share your success with a trading buddy or mentor for extra support.

- Reflect on the progress you’ve made since you started.

- Update your trading journal or vision board to visually monitor your journey.

Learning from Losses and Mistakes

Learning from your losses and mistakes is essential for your day trading journey. It’s these challenges that help you build resilience, adjust your strategies, and gain experience.

When you encounter a loss, take time to analyze what went wrong. Was it due to market conditions, emotions, or flawed strategies? Was it simply a losing trade? By pinpointing the mistake’s root cause, you can tweak your approach to prevent similar errors in the future.

Conclusion

In starting day trading with limited funds, you need a smart strategy. Focus on making high-probability trades, managing risks tightly, and exploring different trading options.

Set clear stop-loss levels, mix up your trading methods, and use low-risk strategies to grow your small account efficiently.

To succeed in day trading with little money, cultivate the right mindset. Be disciplined, patient, and always ready to learn more.

FAQ

What is the minimum amount of money required to start day trading?

The minimum amount required to start day trading varies by broker and market. Some forex brokers allow trading with as little as $50, while many stock brokers require a minimum of $500 to $1,000. However, a larger account balance of at least $5,000 to $10,000 is recommended to have sufficient capital to manage risk effectively.

Which brokers offer the best terms for day traders with small accounts?

Brokers that cater to day traders with small accounts include:

- TradeZero: Offers commission-free trading and low minimum deposits

- Interactive Brokers: Provides a wide range of markets and competitive fees

- Robinhood: Offers commission-free stock and options trading with no minimum deposit

- NinjaTrader: Provides low-cost futures and forex trading with a $400 minimum deposit

What are the best markets or securities to day trade with a small account?

Markets and securities suitable for day trading with a small account include:

- Forex: Offers high liquidity, low capital requirements, and 24/5 trading

- Micro futures: Provide exposure to various markets with reduced contract sizes and lower margin requirements

- Low-priced stocks: Shares trading under $5 can be accessible for small accounts, but be aware of potential risks and volatility

How can I manage risk when day trading with a small account?

Risk management strategies for day trading with a small account include:

- Use proper position sizing: Risk no more than 1-2% of your account on a single trade

- Set stop-losses: Determine your exit points in advance to limit potential losses

- Diversify: Spread your risk across multiple markets or securities

- Avoid overtrading: Be selective and focus on high-quality setups

What tools, resources, and education are essential for successful day trading?

Essential tools, resources, and education for successful day trading include:

- Reliable trading platform: Choose a platform with low latency, real-time data, and advanced charting capabilities

- Market data and analysis: Access real-time news, economic calendars, and market insights

- Educational materials: Utilize books, online courses, webinars, and mentors to continually improve your trading skills

- Trading journal: Keep a record of your trades, including rationale, emotions, and outcomes to review and learn from your experiences