- April 8, 2024

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

Selecting the appropriate options contract involves understanding the basics, setting clear trading goals, and evaluating strike prices and expiration dates aligned with your financial objectives.

Essential to this process is differentiating between call and put options, including variations such as American and European, to match your risk tolerance and investment goals.

Essential to this process is differentiating between call and put options, including variations such as American and European, to match your risk tolerance and investment goals.

Advanced techniques use technical analysis and fundamental information, integrating tools like options scanners for efficient selection of contracts.

Risk management strategies are important for success, incorporating protective measures against market volatility.

Professional advice can further improve your decision-making and strategy design.

Understanding Options Basics

To find any success in options trading, it’s important to have a strong understanding of the basics. This includes the mechanics of options contracts and their key components like strike prices and expiration dates.

The strike price determines the cost of the transaction for the underlying stock, while the expiration date establishes the timeframe for executing the transaction. These components impact the risk and potential return on investment, making them key considerations for traders looking to leverage the power of stock options.

Identifying Your Trading Goals

Identifying your trading goals is the initial step in developing a successful options trading strategy. Whether your goal is income generation, speculation, or hedging against potential losses, understanding your primary aim will guide your decisions in stock picks and options strategies.

Each goal requires a unique approach to the options market that line up with your financial objectives.

Each goal requires a unique approach to the options market that line up with your financial objectives.

- For individuals focused on income generation, selecting option strategies that provide consistent returns is key.

- Speculators might prioritize stock picks with high volatility to capitalize on market movements.

- Those interested in hedging need to identify options that offer protection against adverse price changes in their portfolio holdings.

This differentiation in goals shows the importance of smart selection of stocks and options contracts. It ensures that your trading activities are not only aligned with your financial goals but are also structured to minimize risks while maximizing potential returns.

Evaluating Strike Prices

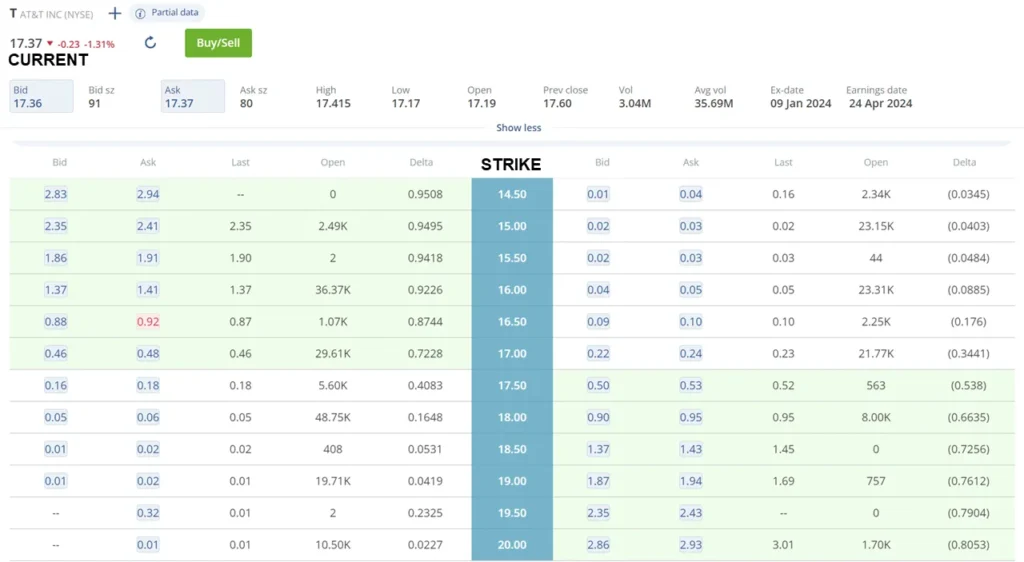

After defining your trading goals, the next step involves an assessment of strike prices to line up your strategies with market dynamics and expectations. Strike prices within options contracts play a pivotal role, indicating the predetermined price at which the underlying asset is either purchased or sold. This decision impacts both the initial cost of entering an options contract and the potential profitability upon its expiration.

When assessing strike prices, consider the following factors:

- Current Market Price vs. Strike Price: Evaluate how the selected strike price contrasts with the current market price of the underlying asset. This comparison is crucial for predicting whether the asset is likely to move in a manner that favors the option of being in-the-money or out-of-the-money.

- Predicting Price Movements: Using historical price data, study volatility levels, and take trends into account to forecast future price movements. This analysis aids in choosing strike prices that align with your market outlook.

- In-the-Money vs. Out-of-the-Money: In-the-money options, are more costly and offer a higher probability of profitability, as opposed to out-of-the-money options, which are less expensive but require a more significant price shift to yield a profit.

At Netpicks, in most cases, we are going to be using the options that are 1-2 strikes In the Money. We can also use Delta to identify the best option to take the trade with. We’re ideally looking for the option with a Delta between 0.6 and 0.65.

Selecting the appropriate strike prices is important for aligning options contracts with your trading objectives and market expectations, and optimizing the potential for successful outcomes.

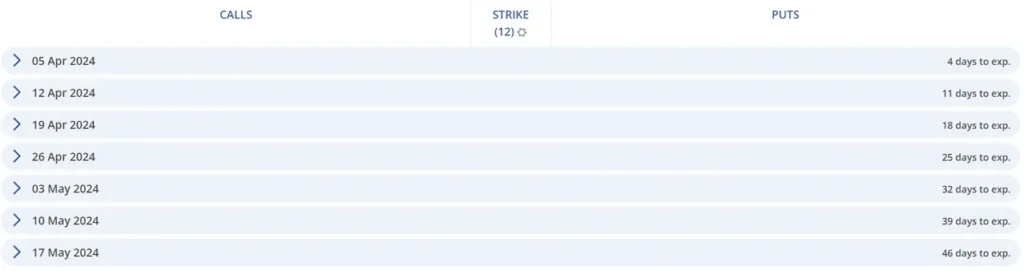

Analyzing Expiration Dates

Expiration dates are a fundamental aspect of any options trading strategy, directly influencing the pricing and potential profitability of the contracts. Selecting the right expiration date requires a balance between market expectations and the timeframe for the anticipated price movement of the underlying asset.

| Expiration Length | Considerations |

|---|---|

| Short-term | Faster time decay |

| Medium-term | Balances risk and potential for profit. |

| Long-term | Higher premiums, more time for movement. |

| Very Short-term | High risk, high potential for rapid gains. |

| Custom Expirations | Tailored to specific trading strategies and market expectations. |

Options with longer expiration dates might provide more time for the asset to move in the desired direction, aligning with a more patient, long-term trading strategy.

Shorter expiration dates may be suitable for traders looking for quicker gains, albeit with higher risk due to the need for rapid price movements.

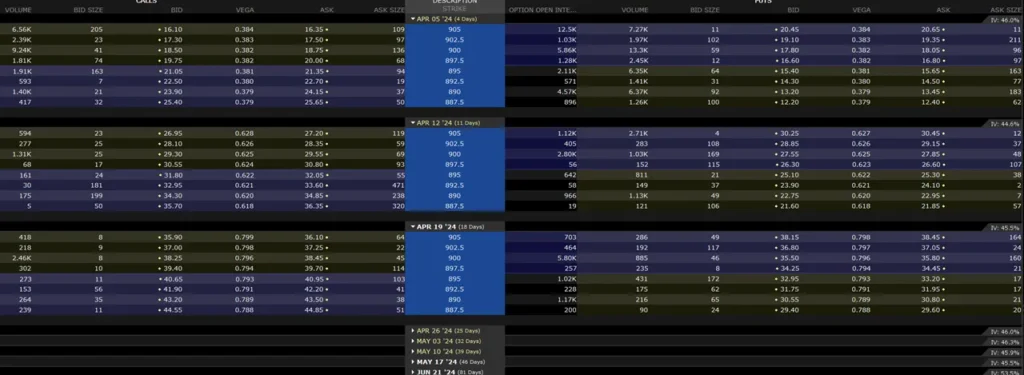

At Netpicks, we use various lengths depending on the strategy being used and the VIX reading.

- OFT Trades: 20-40 days. VIX +15 also look at shorter-term weekly options with 7-20 days remaining.

- SPT Trades: 35-60 days. VIX +15 also look at shorter-term options with 20-35 days remaining.

Ultimately, the selection of expiration dates in options contracts should consider both the trading strategy and market expectations, impacting the pricing and potential returns.

Exploring Contract Types

Exploring the various types of options contracts is essential for traders seeking to customize their strategies to match their specific risk tolerance and investment goals. Understanding the differences between the available options and contract types is a critical step in aligning trading activities with individual trading objectives.

Here’s a closer look at some of the key contract types:

- Call Options: These include the standard plays and American, and European options. Each type offers unique characteristics and features, catering to various speculative or hedging strategies in options trading.

- Put Options: Similar to call options, put options also come in basic plays, American, and European forms. These options provide traders with different ways to hedge against potential price movements in the market, allowing for protection against downturns.

- Specialized Options: This category comprises strategies like covered call options, where traders hold a long position in the underlying assets while selling call options, and protective put options, which involve buying put options to safeguard against potential losses. These strategies are tailored for income generation, protection, and risk management, directly reflecting the diverse trading objectives of investors in the options market.

Risk Management Strategies

Having examined the variety of options contracts, it’s important to focus on strategies for managing the risks associated with options trading. In options, where the stock price can fluctuate markedly due to market volatility, using effective risk management strategies is vital to your long-term success.

| Strategy | Description |

|---|---|

| Stop-Loss Orders | Set a predetermined price level at which an option will be sold automatically to limit losses. |

| Diversification | Spread investments across different options to mitigate risk against market volatility. |

| Position Sizing | Allocate only a portion of the portfolio to options to manage overall risk exposure. |

| Protective Puts | Purchase puts to act as insurance against a significant drop in the stock price. |

These strategies help safeguard investments from the unpredictable nature of the market, especially as the expiration date of options contracts draws near.

Seeking Professional Advice

By seeking professional advice, individuals can access a wealth of knowledge and experience that can improve their understanding of options contracts and strategies. This guidance is especially valuable when aligning investment choices with personal risk tolerance and financial goals.

Here are three key benefits of seeking professional advice in options trading:

- Expertise in Selecting Appropriate Options Contracts: Professionals can provide insights into selecting the right options contracts that match an investor’s financial goals and risk tolerance, ensuring more informed and strategic decision-making.

- Guidance on Complex Strategies: Options trading encompasses a range of strategies that can seem challenging. Advisors can help you understand these strategies, offering personalized recommendations that can lead to better outcomes.

- Enhanced Decision-Making Processes: With professional advice, investors can better understand the nuances of options contract selection techniques, leading to more effective and profitable trading strategies.

Advanced Selection Techniques

Advanced selection techniques in options trading are important for investors looking to optimize their portfolio’s performance. These methods involve a thorough exploration of both technical and fundamental analysis.

Technical analysis, utilizing indicators like Bollinger Bands, RSI, and MACD, serves to identify potential entry and exit points by analyzing historical price trends and implied volatility. This approach is critical in timing the market, a vital aspect of successful options trading.

Fundamental analysis of the underlying asset, including earnings reports and industry news, guides the selection of options contracts based on the company’s performance. This analysis ensures that the investor’s decisions are rooted in the financial health and prospects of the underlying asset, rather than solely on market sentiment.

Using advanced screening tools and options scanners simplifies the process of identifying potential opportunities, allowing for a well-rounded contract selection process.

Using sophisticated risk management strategies, such as delta hedging or portfolio diversification, is a common play. These strategies align the investment with individual risk tolerance and financial objectives, enhancing the overall effectiveness of options trading and contract selection.

Summary

The process of options contract selection is important for success in options trading. By combining a solid understanding of options basics with a clear identification of trading goals, traders can effectively evaluate strike prices and expiration dates.

Further exploration of contract types and the application of risk management strategies, along with professional advice, empower traders to utilize advanced selection techniques. This systematic approach encourages prudent decision-making, optimizing trading outcomes in the options marketplace.

FAQ

What are the basics of options contracts?

Options contracts give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. They are key in financial strategies for speculating on stock price movements or hedging against losses.

How do I identify my trading goals in options trading?

Identify whether your goal is income generation, speculation, or hedging against losses. This guides your stock picks and strategies, with each goal requiring a unique approach to maximize returns and minimize risks.

What factors should I consider when evaluating strike prices in options contracts?

Consider the current market price versus the strike price, forecast future price movements using historical data and trends, and understand the difference between in-the-money (higher cost, higher profit probability) and out-of-the-money options (lower cost, higher price shift needed for profit).

How important are expiration dates in options trading?

Expiration dates are important as they influence the pricing and potential profitability of options contracts. Selecting the right date involves balancing market expectations with the timeframe for the asset’s anticipated price movement.

What are some effective risk management strategies in options trading?

Effective strategies include setting stop-loss orders to limit losses, diversifying investments across different options, sizing positions appropriately to manage overall risk, and using protective puts as insurance against significant stock price drops.