- March 18, 2024

- Posted by: Shane Daly

- Categories: Options Trading, Trading Article

The VIX index, also known as the CBOE Volatility Index, is a key measure of market volatility and investor sentiment in the stock market. Understanding the dynamics of the VIX can provide insights into options trading and hedging strategies.

VIX options allow traders to speculate on or hedge against future market volatility. The VIX tends to spike during times of fear or uncertainty, giving VIX options unique properties compared to regular equity options. Mastering VIX trading requires an understanding of volatility dynamics and skill in trading options.

Trading the VIX can be rewarding but includes substantial risks, especially for novice traders. Success depends on gauging volatility expectations, determining optimal entry and exit points, and implementing advanced strategies like spreads and condors.

Benefits and Risks of VIX Options Trading

Benefits of VIX Options Trading

- Hedging against market volatility: VIX call-and-put options can help hedge portfolios against price swings during turbulent markets. Strategies like long VIX call positions can offset losses from increased volatility.

- Using technical analysis for informed decisions: Indicators like Bollinger Bands and moving averages are good tools for assessing overbought or oversold conditions and helping with entry/exit points.

- Managing risk effectively: Methods like position sizing, stop losses, and defined exit strategies are key for controlling your risk.

Risks of VIX Options Trading

- High risk, especially for inexperienced traders: The complex dynamics of volatility trading carry substantial capital loss risks requiring extensive expertise before engaging.

- Importance of having a clear exit strategy: Success depends on knowing when to exit positions, such as when positive vega turns negative. Disciplined exit planning is vital.

- No guarantees in trading; losses are possible: While strategies may appear profitable on paper, real-world trading results may be a lot different. Losses frequently occur even with sound strategies.

Understanding VIX Options

Call and Put Options

Like regular options, VIX options come in two varieties – calls and puts. VIX call options become more valuable when volatility rises, whereas put options profit from downward volatility.

- Call options are used to speculate on or protect against volatility spikes. But timing entries and exits are critical – buying too early could lead to losses from Vega turning negative.

- Put options face complications like volatility dragging and require expertise to trade profitably.

VIX Explained

The VIX looks to represent the market’s expectations for S&P 500 volatility over the next 30 days.

- VIX values above 30 generally signal high uncertainty – likely triggering volatility trading.

- Values below 15 indicate complacency, alluding to potential volatility expansion ahead.

The VIX is computed using S&P 500 options pricing models and tracks expected volatility rather than historical volatility. As volatility expectations shift, so does the VIX index. This complex relationship contains tradable opportunities for experienced VIX traders.

The Role of VIX Options in Portfolio Management

VIX options can play a pivotal role in portfolio hedging against market uncertainty. For example, during periods of low implied volatility, purchasing VIX calls can offset potential losses from volatility increasing.

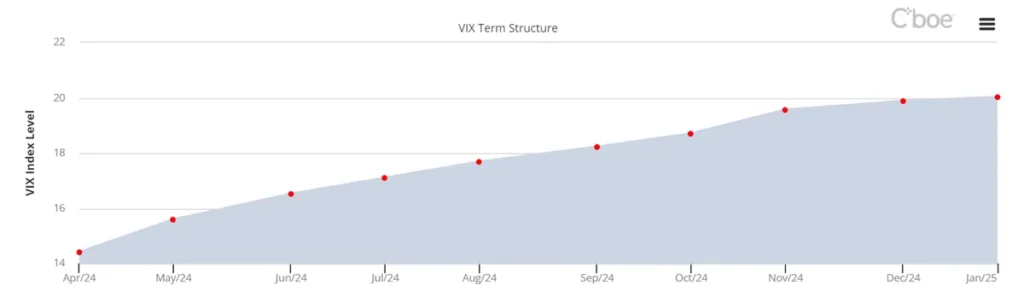

Portfolio managers monitor metrics like the slope of the VIX term structure to identify mispricings to capitalize on.

Rolling positions in VIX calls is a common technique for portfolio sensitivity reduction to volatility spikes over extended periods.

Specialized ETPs like the Barclays S&P 500 Dynamic VIX ETN can help portfolios realize gains from volatility jumps. Mastering these types of strategies is key for aligning investments with risk tolerances.

Advanced Strategies in VIX Options Trading

Beyond simple call-and-put positions, adept traders utilize advanced tactics like spreads trading, combination orders, and various volatility derivatives. For example, put spreads can offer defined, reduced risk profiles while profiting from volatility contractions.

Butterfly spreads combine both bear and bull spreads to profit within a range. Iron condor strategies use defined risk long and short positions to maximize profit potential from stable VIX levels. Expertise in these and many other advanced methods is requisite for success.

Research Studies

Research shows returns are significantly amplified during high VIX futures contango regimes with technical indicators demonstrating superior performance over buy-and-hold.

The studies emphasize that rather than trade levels, timing volatility cycles is key. Strategies based on volatility expectations, contango opportunities, and technical signals demonstrate consistent outperformance. But simple trading rules still fail to consistently beat the market, underscoring how complex volatility dynamics are.

Mastering Options Trading Terminology

There are endless terms to understand when trading VIX options – here are some key ones:

- Spot VIX – Current VIX index value

- VIX futures contracts – Derivatives for speculating on future VIX levels

- Implied volatility – Expected volatility priced into an option

- Volatility exposure – Sensitivity of a position to volatility fluctuations

- Vega – The rate of change of an option’s value based on volatility

Understanding nuances between historical volatility, implied volatility, and volatility expectations is needed to find profits when focusing on volatility. Mastering the options Greeks enables informed risk management when building positions.

Summary

Doing well with VIX options trading requires understanding volatility dynamics, risk management, and successfully implementing advanced strategies. You must align knowledge of indicators with probability theory, options mechanics, and the psychology of uncertainty when trading.

Adjusting trading approaches to current market conditions analysis and always assessing profit potential against risks is key to long-term success.

FAQ

What tactic provides the optimal approach for trading the VIX index?

The most effective VIX trading strategy involves using technical indicators to identify overbought or oversold conditions and employing options to speculate on upcoming volatility expansions or contractions.

What methods enable trading market volatility via the VIX?

Traders can use VIX options, futures contracts, and exchange-traded products to implement strategies that profit from increases or decreases in equity market volatility.

What VIX levels are best suited for trading volatility?

VIX readings above 30 typically signal high volatility conducive to trading, while values below 15 suggest lower volatility and potential opportunities to buy options in anticipation of volatility increasing.

How are options on the VIX index exercised?

As European-style options, VIX options do not require manual exercising and are automatically settled in cash upon expiration based on the settlement price.

Does high VIX benefit option buyers?

Yes, high VIX levels generally indicate elevated implied volatility, which increases the value of both calls and puts to benefit option buyers.

Which day provides optimal conditions for trading market volatility?

Mondays tend to exhibit the highest volatility and greatest opportunities for trading VIX instruments profitably.

Should traders buy or sell VIX products when volatility spikes?

When the VIX spikes to very high levels, volatility traders typically look to buy options or derivatives to benefit from an eventual reversion lower in volatility.