- March 24, 2020

- Posted by: CoachMike

- Categories: Day Trading, Futures Trading, Options Trading, Stock Trading, Swing Trading, Trading Article

The main work space that I look at throughout the day to get a feel for market strength or weakness is what I call my Market Internals work space.

In this article, I am going to discuss that market internals I use on a daily basis and how they influence my trading.

My 20 Minutes Per Day Trading Plan

One of the biggest transitions a trader can make is to go from a day trading approach to becoming a longer term swing trader. This is an issue that I have had to deal with over the years in my own trading.

When you are actively trading the markets from opening to closing bell taking multiple day trades it’s not difficult to have a pulse on the market. When you stretch things out to a swing trading approach, it becomes more difficult to get a feel for how strong or weak the market is.

When I swing trade, I typically come in to check the charts 2-3 times per day for a total of about 20 minutes per day. While this is great for me as I can get onto other things throughout the day and still stay active in the markets, it can be tricky to have a good feel for how strong the market is.

I use a market snapshot approach using a few simple tools.

When logging into my trading computer I have a few different work spaces loaded up. The first is the work-space that has all of the names on my current watch list of products that I trade on a regular basis. These charts include all the indicators telling me where to get in and out of trades.

The second work-space is what I call my Market Internals work-space.

If you have been trading the markets for any length of time, you know that it is not enough to just look at the values of the big index products to see if the market is up or down. Often times there is more going on under the hood than those numbers indicate.

To further gauge the strength of the market, I use 5 tools that can be found in most charting platforms. You will find a link to a pre loaded shared Thinkorswim platform below that you can click on and take a look at these tools.

Before I get into the details of these tools, I will point out that I do not place or manage trades based on these tools. They are simply there for me to stay up to speed with what is going on in the overall market without being glued to the computer screen all day long.

My 5 Market Internal Trading Tools

$UVOL-$DVOL

The first tool that I use is a volume trading indicator – a chart that plots the amount of volume going into stocks that are positive on the day versus the amount of volume going into stocks that are negative on the day. This gives me a ratio that helps me gauge how strong the move is for that day.

For a strong positive trending day I want to see this ratio at a value of at least 2:1 positive.

This means we have 2x the amount of volume going into names moving higher on the session when compared to volume going into names moving lower.

The opposite is true for a weak session moving lower. In that case, I want to see at least a -2:1 volume ratio meaning 2x the amount of volume is going into stocks moving lower on the session versus volume going into stocks moving higher.

This ratio helps lay the groundwork for me to see how strong the move higher or lower has been that day.

Typically if we see a volume ratio of +/- 2:1 that means we are in a strong trending day where it’s going to be difficult to get a big reversal.

Advanced – Decline line

In Thinkorswim this can be looked at by using symbol $ADVN-$DECN. This chart shows me how many names are moving higher and lower on the session on the NYSE.

This value is shown on a price chart and is constantly updated throughout the day.

When this number is +/- 1000 that means the market is in a strong trend for the day and is going to be difficult to get a reversal in the market.

For example, if I come in for my lunch time update and see the S&P 500 down 15 that immediately has me thinking the market is getting beat up that day.

Is that really the case?

By taking a quick look at the Advance – Decline line I can get a better view of how strong the selling is. If that value is at -1500 that means there is strong selling across the board. If that value was only -500 then that tells me the market is lower but it’s been more of a mixed market at that current time.

If the value is only +/- 500 then it’s not going to take much to get the market to reverse in the other direction.

NYSE Tick

In Thinkorswim this can be looked at by using symbol $TICK. This is a tool that tells me at the current moment in time how many stocks are trading on an uptick versus how many stocks are trading on a downtick.

I track this on a 15 minute chart throughout the day. This can be a very short term indicator that is handy for day traders, but it can also be a powerful tool for someone like myself who is trying to quickly see if we have hit any extremes or not throughout the day.

What makes an extreme on the NYSE Tick chart?

I have a few price levels market on the chart to easily read where we have been that day. I mark the 0, +400, +800, +1000 levels on the upside and -400, -800, -1000 on the downside.

- If we reach +1000 on the upside, that means 1000 stocks on the NYSE are trading on an uptick at that moment.

- A -1000 reading tells us 1000 stocks are trading on a downtick at that moment.

- When +/- 1000 is hit that indicates a near term market extreme.

When we hit these overbought or oversold extremes we will often times see the market pause or pullback slightly.

When you get multiple extremes of +/- 1000 that indicates a very active market. On a day when we are stuck between +/- 400 that indicates a very slow indecisive market.

SPY 5 Minute Chart

I load up a very basic pivot point indicator that can be found in most charting platforms. There is no custom settings being used for the pivot points.

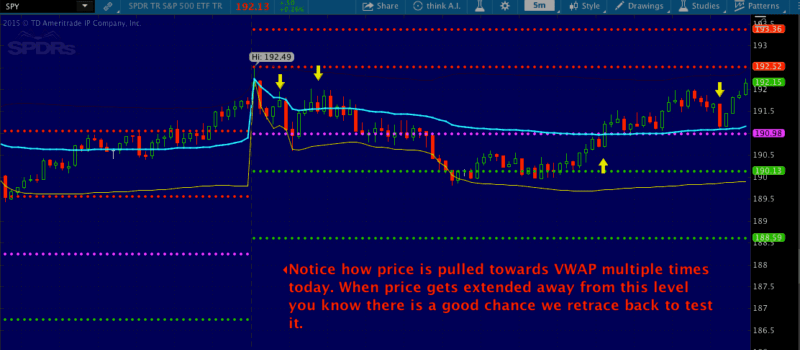

I also load up what is called the VWAP. This looks very much like a regular moving average but it’s much more than that.

The VWAP is the Volume Weighted Average Price. It is calculated by dividing the dollar value of transactions by the average volume.

The VWAP can often times act like a magnet attracting price towards it. When we get extended away from this level, often times we will see a retracement back towards it. On a slow moving day you will often times see price action hug this level throughout the day.

The pivot points and VWAP level give me an idea of support and resistance levels that might influence things going forward. You will see a snapshot of today’s VWAP (Oct 1, 2015) on the SPY 5 min chart. Notice how it draws price to it in both directions throughout the day.

This can be a very powerful tool when trying to figure out where the market is headed next.

VIX As Market Volatility Gauge

We look at volatility quite a bit as options traders because we want to know if options are cheap or expensive.

- A VIX in the 11-13 range is an extreme on the downside, meaning there is very little fear in the market and as a result the options are very cheap. In this case, we will be buyers of options premium.

- A VIX reading in the 20-25 range is an extreme on the upside, meaning there is a lot of uncertainty in the market and as a result options are more expensive. In this case, we will be sellers of options premium. The VIX just helps me form an opinion on how long I expect to be in trades for.

- A high VIX will typically mean very short term trades of 1-3 days.

- A low VIX reading will in many cases lead to longer term trades of 2-3 weeks.

These tools used together help me quickly take a look at the overall strength or weakness in the market.

It might seem like a lot to look at but when loaded up as a workspace I can take a look at these charts and in 60 seconds have a feel for what I have missed that day by being busy with other things.

Like I mentioned earlier I am not looking to trade based off and values or trends off of these charts. They are strictly used for me to get a quick pulse on the markets. They help free up my schedule so I don’t feel pressured to be in front of the screen all day.

Swing trading is hugely beneficial for me because I’m in and out in 20 minutes a day but I also have to realize that I’m going up against traders that are looking at the markets all day. So it’s important for me to use tools like the Market Internals workspace to dig in and see what’s really going on in the markets instead of just looking at the overall Index values.

If you are a Thinkorswim user I have included a copy of my

fully setup Market Internals workspace here.

Start using these simple tools in your own trading and I think you will be surprised how much better your understanding of market strength will be.

If you have any questions on this feel free to send me an email. Mike@netpicks.com.