- September 25, 2015

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

How do you know which stocks/ETF’s should be on your watch list?

How many names should be on your watch list?

These are common questions asked by traders looking to swing trade.

With literally thousands of stocks available to trade, it can be overwhelming trying to figure out which ones you should look at.

There are many traders and systems available in the marketplace that scan thousands of names on a daily or weekly basis looking for the best setups. In my opinion, this is way overboard and can lead to inconsistent results.

12 Years Of Trading Lessons

Over the past dozen years, I have learned many lessons the hard way. One of those lessons was to focus on a smaller watch list of products. A bigger watch list does not necessarily mean bigger profits.

Let’s walk through how you should create the best list that fits your trading style, account size, and available hours to trade each day.

It always makes me shake my head when I work with new NetPicks students and see them looking at dozens of products. The fear of missing out on the next big move is a big culprit for looking at such a large watch list.

An eye opening experience for me early in my career was when I got to interact with professional traders in Chicago. I got to see how they approached the markets and saw just how different their approach was to most retail traders, including myself.

Instead of scanning hundreds of names each evening, they focused on a small watch list of products.

That watch list could be anywhere from 10-50 names depending on the trader. When I asked why they took this approach, they said it allowed them to master that list of names. They got to be familiar with things like what a typical move looks like, average volume, and a normal range for volatility.

Instead of trading a random name found off a scan looking at certain price patterns, they were able to place trades based on levels of volatility and price movement specific to that product. While this doesn’t seem like an earth shattering idea, it has probably been one of the bigger breakthroughs for me as a trader.

Keys To Building A Trading Watchlist

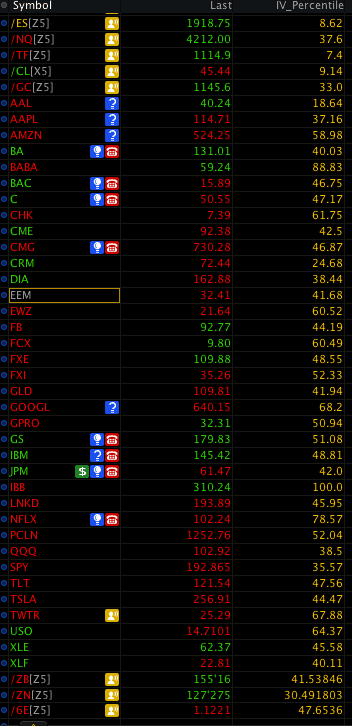

So what should you consider when building your personal watch list? Let’s take a look at some topics that I factored in when creating my own personal watch list (which you will also see below)…

- How big is your account size?

If you have a small account size ($5000-$25000) then focus on a smaller list of products.

What you don’t want to run into is looking at a list of 25 names but only being able to take 3-4 trades at a time. In this case you are left cherry picking trades.

You want to be able to focus on a list of names where you can be properly diversified.

In my opinion the sweet spot initially is to look at between 10-25 names. A list this size will allow you to cover a good mix of both individual stocks and ETF’s across many different sectors (financials, technology, index, volatility, retail, energy, commodities, metals). This way you aren’t over exposed to one area which will help with your consistency over time.

- How much time do you have to trade each day?

This was a big issue for me early on and remains a huge part of how I create my watch list to this day.

If you don’t have all day to track the markets, then don’t look at 50 names. Focus on a smaller list of products so that you can easily come in a few times each day to check on your trades.

With my list of names (see below),I like to be able to come in and check them all in about 5-10 minutes (I do this ONLY 3 times per day). The development of mobile platforms that most brokers now offer has been very helpful.

I can still quickly check on things even when away from my trade desk through the use of a phone, ipad, or laptop.

If you haven’t already, I would encourage you to consider looking into the use of a mobile platform. Check with your broker to see what they offer.

- Are you able to trade options?

If you are able to trade options, then the types of trades that you can take on each stock/ETF on your list really expands. You aren’t limited to looking at just buying/selling shares of stock.

You can look at options trades like long calls/puts or many different types of spreads. There are options strategies out there for any type of market condition, which means you can be more active with the names that you trade.

With this in mind, even with a bigger account size you don’t have to look at a large list of names.

In the example of my own personal watch list, I might only have 20 names on that list but I could have multiple different trades on for each product.

For example, if I am trading AAPL I could have a long call spread, short put spread, and an iron condor on all at the same time. This allows me to diversify and smoothen out my equity curve over time.

- Focus on mastering the names on your list.

Don’t misunderstand this statement. The goal here isn’t to wait for the perfect time to start trading in an attempt to be perfect and catch all winners.

The goal is to learn the different characteristics of each name.

This means you are tracking things like how long a typical trade takes. This is very important when deciding what type of options trade to put on.

It’s also important to track levels of volatility for each name. We teach some easy ways of doing this as part of the Options Mastery program. This will also help in deciding what types of trades to put on.

Finally, track volume closely for each name on your list. This is especially true if you are trading options. We want to focus on very liquid names to make sure we can easily get in and out of trades without chasing price too much.

Once you start tracking this type of information, I think you will be surprised how much your confidence will start to improve when trading each name on your list.

Pick And Stick To Your Chosen Names

Don’t feel pressured into trading a large watch list of products. If you can focus in on between 10 and 25 names you will be plenty active enough.

The key is to put aside the feelings of potentially missing out on the next big move.

You aren’t going to catch every move in the markets. That doesn’t even bother me anymore because I know in order to catch every new hot stock/ETF it would take way more time than I have available to trade and also cause bigger swings in my equity curve.

My number one goal with my trading is to see consistent growth in my account over time. If I am able to find that by looking at 25 names then I ignore all other names out there.

Reducing the number of names on your watch list is a quick way to simplify your trading while at the same time increasing your overall profitability. In today’s volatile markets this is more important than ever.