- December 28, 2022

- Posted by: Shane Daly

- Category: Trading Article

An options trader using the Short Strangle Options Strategy is looking to profit from minimal or no changes in the price of the underlying stock. By simultaneously selling both calls and put options with different strike prices, traders can maximize their chances of making a return even when there is little movement in the price of their asset.

With this strategy, traders must understand that their upside in the trade is capped. On the other hand, the losses on these trades can be large especially if a trader is lazy with their exit strategies.

The key to success with a Short Strangle Options Strategy is selecting the right strike prices and having an understanding of how the stock price could move.

How Does A Short Strangle Work

A short strangle involves selling one call option with a higher strike price and one put option with a lower strike. Both options have the same underlying asset and the same expiration date, but they differ in their strike prices.

This trade is established for a net credit, meaning that profits can be made if the price of the underlying stock remains in a narrow range between the break-even points. The most you can make on the trade is limited to the total premiums received, minus commissions.

On the other hand, potential losses are unlimited if the stock price increases and substantial if it decreases. A stock can always go to zero but the upside is always unknown.

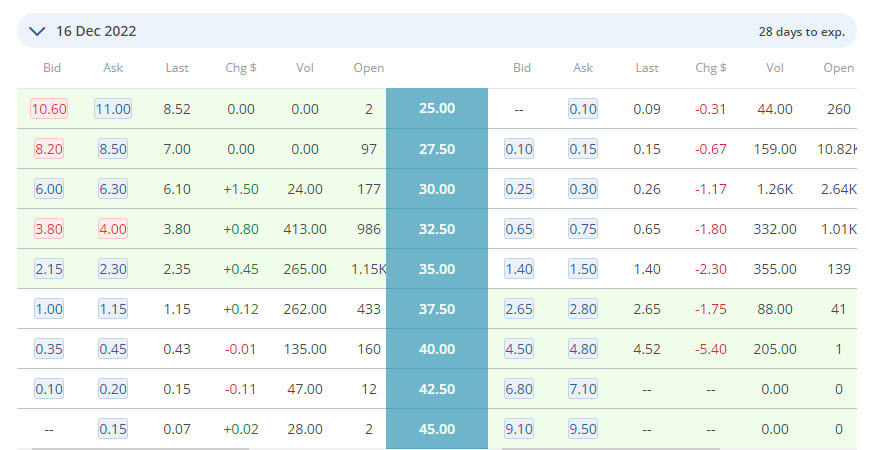

Let’s use an example of Footlocker (FL) which at the time of this article, was trading at $35.38. We will choose one strike OTM for both the call and the put. For illustration, we will use the “last” transacted price.

Sell 1 FL call at $37.50 for $1.15

Sell 1 FL call at $37.50 for $1.15

Sell 1 FL put at $32.50 for $0.65

Because we are selling, we receive the premium which is $1.80 or $180.00 per options contract.

Short Strangle Profit

The profit potential is limited to the total premiums received minus commissions paid to open the trade. The maximum profit is earned if the short strangle is held to expiration, the stock price closes at or between the strike prices, and both options will expire worthless. Keep in mind that only around 7% of options contracts are ever exercised. Most traders will close the position before the expiration date.

Using the FL example, the most we can make trading 1 contract would be the premium we received by selling the calls and puts, or $180.00.

Many options traders will be happy to keep a percentage of the premium received, such as 60-80%.

Maximum risk

The potential loss is unlimited on the upside because the stock price can rise indefinitely. On the downside, the potential loss could be substantial, but because the stock price can only fall to zero, the downside may not be as drastic.

Having a strategy to exit your options trades is vital especially if the trade has turned against you.

One approach for risk control to the downside is closing the trade when have lost a percentage of the premium received.

Where Do We Find Breakeven Prices?

The breakeven points of a short strangle are the strike prices added to/subtracted from the net credit received. In our example with FL, the upper and lower break-even point would be:

Upper Breakeven Point = $37.50 + 1.80 = $39.30

Lower Breakeven Point = $32.50 – 1.80 = $30.70

Using the breakeven points as your line in the sand is one way you could manage these positions.

When To Use A Short Strangle Options Strategy

When you use a short strangle options strategy, it means that you’re predicting that the price of something won’t change much in the near future. This way, if the price stays between your set points, then you can make money from it.

Just remember that the prices of calls and puts depend on what other traders think will happen. For a strangle to work, market participants must feel that the current value of the underlying stock is acceptable. What we don’t want to happen is a change in bias which will send the stock drastically in either direction.

Is A Short Strangle Good To Use?

Terms like good and best are subjective and short strangles do have pros and cons.

Unlike a straddle, the short strangle breakeven prices are further away from the underlying price at trade setup. This means that a strangle can absorb more price movement in the underlying than the short straddle can.

Because the prices are further away and the underlying must make a large move for the possibility of the options being exercised, a trader has the potential to keep the majority of the credit received.

Using OTM strike prices is cheaper for the buyer so the premium you receive, and your maximum profit, are less than they could be if using another strategy. Simply compare the “last” prices at the strikes we used to the “Last” prices at the $35.00 strike.

Short Strangle Quick Hits

Q: What is a short strangle options strategy?

A: A short strangle options strategy involves selling both call and put options at different strike prices with the same expiration date. This strategy allows you to make money if the underlying stock stays within a certain range.

Q: How much can I make when trading a short strangle?

A: The maximum profit is earned if the short strangle is held to expiration, the stock price closes at or between the strike prices, and both options will expire worthless. Generally speaking, you can make up to the amount of premium that you receive when opening the trade.

Q: What are the breakeven points for a short strangle?

A: The breakeven points for a short strangle are the strike prices added to/subtracted from the net credit received.

Q: When is it best to use a short strangle?

A: A short strangle is best used when you think the stock price won’t move much in the near future. If it stays within your set points, then you will make money from this strategy.

No matter what strategy you use to trade options, it’s important to have risk management parameters and techniques in place. Using a short strangle allows you to use the upper and lower break-even points as your line in the sand. This way, if the price of the underlying moves too far in either direction, you can close out the trade and still have a profit.

With proper risk management, trading options can be a great way to make money in any market climate.