- October 18, 2022

- Posted by: Shane Daly

- Category: Trading Article

A covered call is an options trading strategy that involves holding a position in an underlying security, such as a stock, and simultaneously writing (selling) call options on that same underlying security.

The call option writer (seller) keeps the premium received from selling the call options, and if the price of the underlying security stays below the strike price of the call options through the expiration day, then the call options expire worthless and the call option writer’s profit is realized.

On the other hand, a covered put is an options trading strategy that involves holding a short position in an underlying security and writing (selling) put options on that same underlying security.

The put option writer receives a premium from selling the puts, and if the price of the underlying stays above the strike price of the put options through expiration day, then the put options expire worthless and the put option writer’s profit is realized.

The put option writer receives a premium from selling the puts, and if the price of the underlying stays above the strike price of the put options through expiration day, then the put options expire worthless and the put option writer’s profit is realized.

Just like with a covered call, if the price of the underlying moves against the put option writer, they may be assigned on their short position and will be obligated to buy the underlying at whatever the market price it is trading at that time.

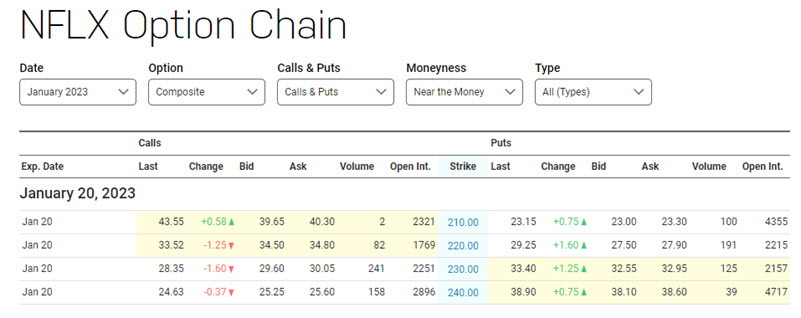

If you look at the bid, ask, last prices on this Netflix Option Chain, that is an example of the premiums you can receive per share. Example $230 strike price, a call buyer could, for example, buy the call for $30/share and the seller would make a premium of $30 x 100 = $3000.00. You can see the potential for a nice income trading this way.

Now that we know what covered calls and covered puts are, let’s discuss when it might make sense to employ one or both of these strategies.

When Would A Trader Sell A Covered Call?

Traders who are neutral to slightly bullish on a stock may write covered calls as a way to generate additional income from their position. One of the best times to be a covered call writer is when you become a holder of the underlying shares.

The seller of the covered call hopes that the stock will remain flat or experience a slight decline in value so that the options will expire worthless and they can keep the premium.

Another reason a trader may use a covered call is as a hedge against downside risk if the market begins to move against the position.

For the trade to be successful, it is important to select the strike price and expiration date of the option carefully. The strike price should be above the current market price of the underlying security OTM, to provide downside protection. A trader could also use an ATM (at the money) strike price while believing the stock won’t jump enough to become deep in the money (ITM)

The expiration date should be far enough out so that there is time for the trade to achieve its maximum potential, but not so far out that the underlying security is likely to experience significant price movement against you.

The best case scenario for a covered call seller is a slight increase in the stock price where your stock experiences gains but not high enough to trigger an exercise of the option. In addition, being able to keep most of the premium would also increase your bottom line.

When used correctly, covered calls can be an effective way to generate income and/or hedge against risk in a portfolio. Stocks don’t always experience a rapid rise in value and if you are holding long-term during flat periods, selling covered calls is a viable income opportunity.

Covered Call Example

Imagine you were bullish on stock AAA and you bought 100 shares and the share price is $50.00. This would cost you $5000.00.

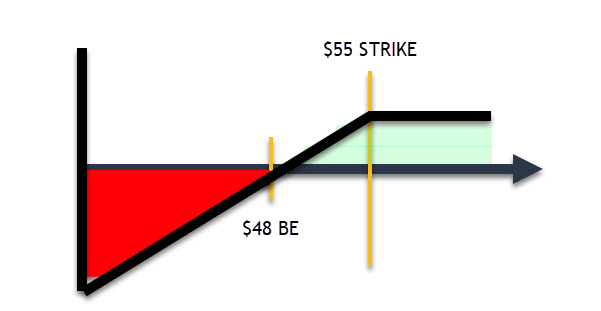

Since you believe that best is yet to come with this stock, you decide to make some income through premiums. You sell a covered call: Jun 17 Call with a strike price of $55.00 for $2.00/ share or $200 premium.

You just bought yourself some downside protection and the stock would have to drop below the price you paid per share – premium per share received = $48.00 for you to lose money.

Let’s examine some outcomes that could happen with this trade.

You were right and the stock barely moved during the time the options contract was live. On the day of expiration, the stock price was hovering around the $51.00 mark. The buyer of the call option has no benefit in exercising the option. It expires and you keep the stock and the $200.00 premium.

You were right and the stock barely moved during the time the options contract was live. On the day of expiration, the stock price was hovering around the $51.00 mark. The buyer of the call option has no benefit in exercising the option. It expires and you keep the stock and the $200.00 premium.

Good news happened in AAA and the stock value rose to $60.00. The buyer of the call exercises their right to buy the stock at the strike price of $55.00. You lose the stock (market value $6000), receive $5500, and keep the premium of $200.00. You’ve limited your upside gain to the strike price amount regardless of high the stock runs to the upside.

The stock took a hit on bad news and dropped to $40.00/share. Of course, the call option buyer doesn’t exercise their rights to buy the stock from you at the strike price but you took a $10 hit on your shares. You also have the premium so your loss is the $10 drop minus the $2.00 premium which is only a $8.00 loss.

When Would A Trader Use A Covered Put?

Covered puts function similarly to covered calls, with one exception: you’re selling an option on a stock you’ve borrowed and then sold on the open market.

What does borrowing the stock mean?

A stock “borrow” is when a trader borrows shares of stock from a brokerage to sell it short. The trader then buys additional shares at a lower price to return the borrowed stock. Of course, nothing is free and there will be interest and fees charged for the borrowing.

Writing covered puts against a short equity position creates an obligation for you to purchase the stock back at the put’s strike price if the contract is exercised.

If you have a flat to slightly bearish bias and you short the underlying, this would be the time to consider writing a covered put.

Covered Put Example

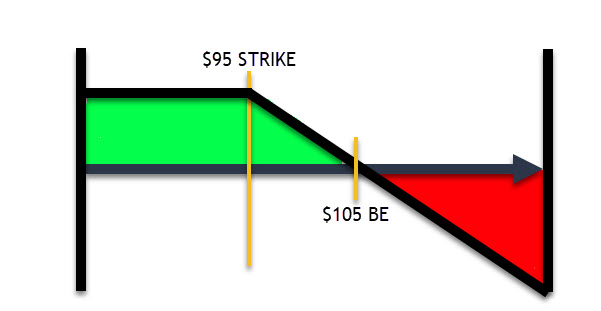

AAA is trading at $100.00 and the trader is bearish on the stock. This trader shorts 100 shares of AAA and costs the trader $100×100 = $10,000

The trader wants to make some premium income and writes a covered put at a strike price of $95.00 and the premium is $5.00 per share. The $95 is the price the trader does not expect the stock to fall past.

The trader wants to make some premium income and writes a covered put at a strike price of $95.00 and the premium is $5.00 per share. The $95 is the price the trader does not expect the stock to fall past.

With collecting the $5.00 premium, the breakeven price for this trader is $105.00. (Stock price $100 + $5.00 premium received from the put buyer).

The risk of loss for this trader could be large if the stock could rockets past its breakeven price, become in the money, is exercised, and the trader must buy the shares at the strike price.

If at expiration, the stock market price is below $95, the put writer makes money in a few ways: Trader shorted the stock at $100 and is now $95/per share or $500 per options contract. The trader also profited with the premium that was paid by the put contract buyer which was $5.00/share or another $500.

Profit totals $1000.00

What Are The Risks Of Covered Calls And Covered Puts?

There are risks inherent in any options trade but there are risks that are unique to these trades as well.

When talking about writing covered calls, if the underlying asset’s price increases above the strike price of the call option, the option could be exercised and the trader will be forced to sell the asset at the strike price. You also limit your profit potential by writing the call to the price of the premium.

Overall, selling a covered call can be a good way to generate income from an existing long position, but it is important to be aware of the potential risks involved.

Covered puts are riskier than covered calls and that’s reflected in the higher premiums. There’s always the potential for a big loss if the underlying stock price plummets and is trading far below the strike price at expiration. You’re obligated to purchase the shares at the strike price if assigned.

In Summary

Covered calls and covered puts are two types of options trades that function similarly but with one key exception: One uses stock you own and the other uses stocks you borrowed.

In a covered call, you are selling an option on a stock you own, while in a covered put you are selling an option on a stock you have borrowed

Covered calls are generally less risky than covered puts, as the latter entails more potential for loss.

Both strategies come with the risk that the underlying stock price could move in an unfavorable direction, limiting your potential profit, or resulting in a loss. Before entering into either type of trade, it is important to understand the substantial risks involved and make sure you are comfortable with them.

You don’t need to have tens of thousands of dollars to start trading options.

With One Day Options Trading Strategy, you can make money whether the stock market goes up, down, or even sideways.

Check out our free Options guide called 8 Minute Options Cookbook to learn more