- April 12, 2024

- Posted by: Shane Daly

- Categories: Basic Trading Strategies, Trading Article, Trading Indicators

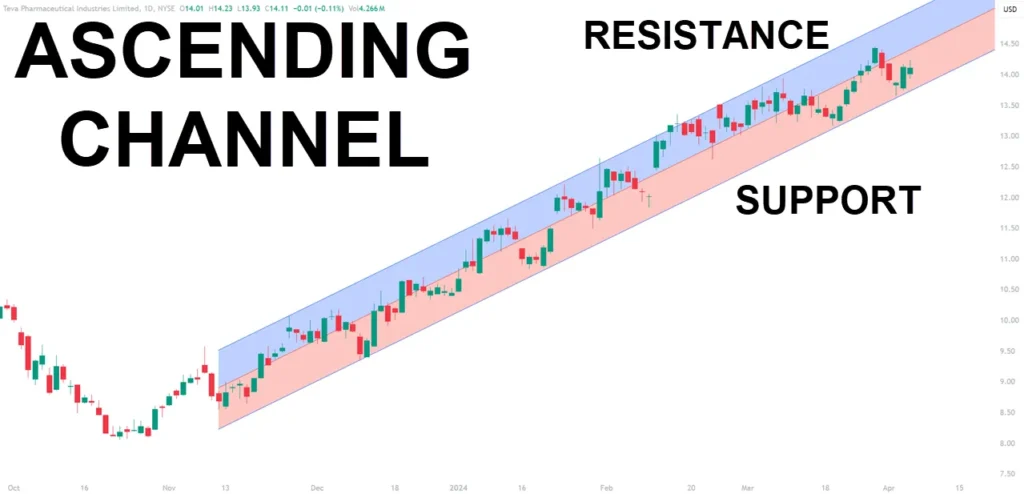

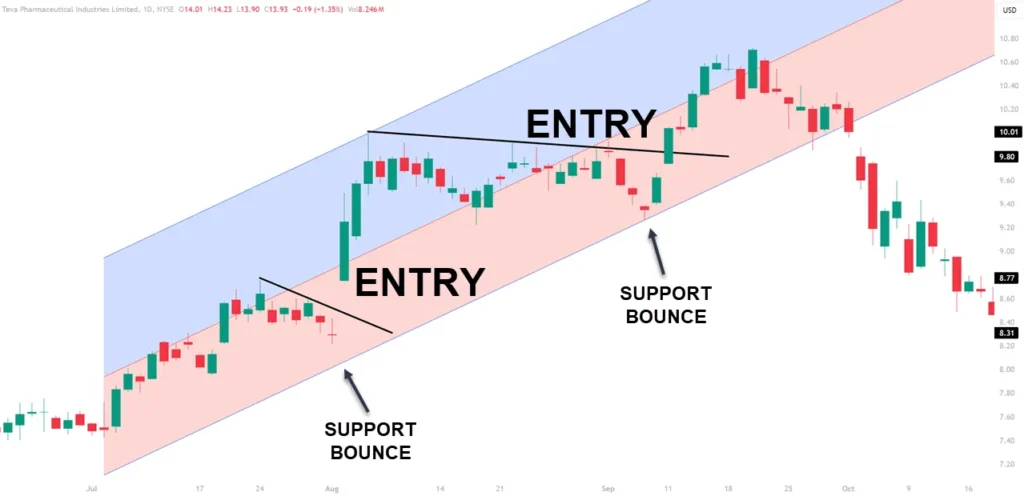

To trade a channel effectively, you need to find support and resistance levels within parallel trendlines. Buy at support and sell at resistance in an ascending channel. Short sell at resistance and cover at support in a descending channel.

Look for price movements outside the channel lines for breakout trades. Use stop-loss orders, indicators, and smart entry/exit points. Consider analyzing multiple timeframes for better accuracy.

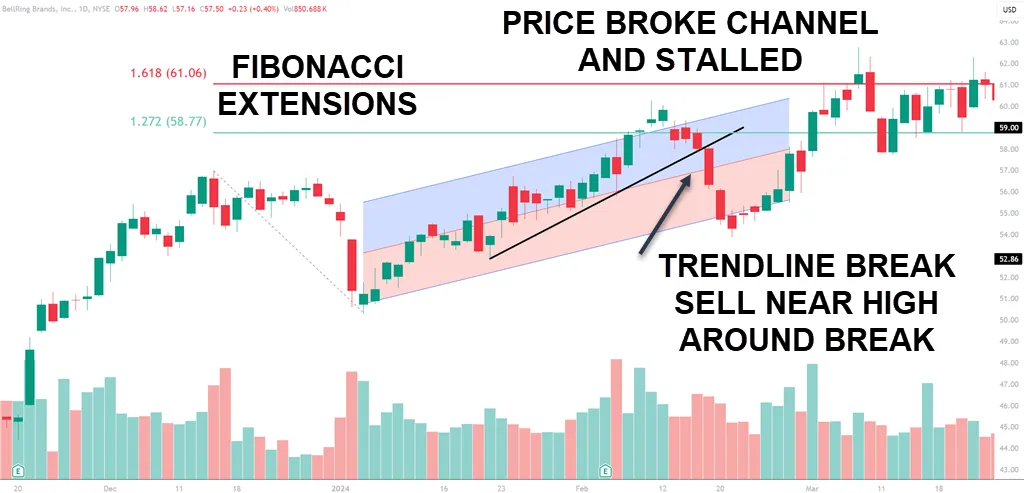

Avoid relying too much on channels and adjust your strategies based on market news. Advanced tools like Fibonacci levels and moving averages can improve your trading precision.

Different markets, such as stocks, forex, crypto, and commodities, offer various channel trading opportunities. Mastering these techniques can help you succeed in trading.

Understanding Channel Patterns

Channel patterns, made by price movement between two parallel trendlines on a chart, are important in identifying support and resistance levels within a set range. These patterns guide traders, showing where prices might bounce off or breakthrough. Support levels act as floors, stopping prices from dropping further, while resistance levels act as ceilings, limiting price movements.

By knowing these levels, traders can decide when to enter and exit trades, optimizing their chances for profit. Trendlines inside channels also give insights into market volatility, helping traders understand the strength of price movements and possible trading opportunities. Understanding these channel patterns is important for handling the market effectively and being able to jump into trades that fit your trading strategy.

With a clear understanding of support, resistance, trendlines, and market volatility, traders can improve their trading strategy and make informed decisions to reach their financial goals.

Trading Strategies for Different Channel Patterns

When analyzing different channel patterns, one can use specific trading strategies tailored to each pattern’s characteristics for better market navigation. Here are some strategies for trading different channel patterns:

- Ascending Channel: In uptrends, think about buying at support levels and selling at resistance for potential profits.

- Descending Channel: Focus on short selling at resistance levels in downtrends and covering positions at support levels.

- Horizontal Channel: Trade within the established range by buying at support and selling at resistance levels.

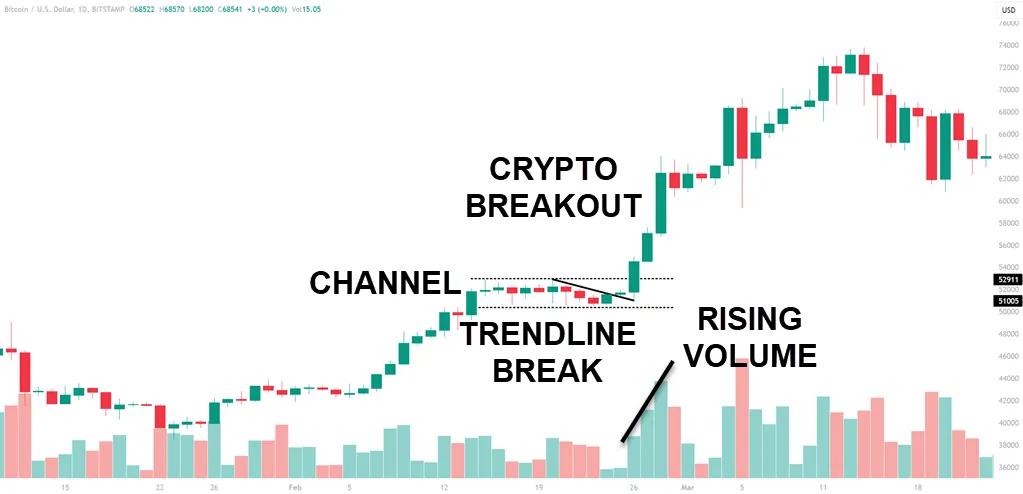

- Breakout Trading: Take advantage of price movements outside the channel boundaries with confirmation and increased volume for validity.

Using these strategies can help you handle various channel patterns effectively. Also, think about using a Bollinger band trading strategy and see if they can enhance entry and exit points within the channel based on price action.

Multi-Timeframe Analysis in Channel Trading

Analyzing different channel patterns can be better by using multi-timeframe analysis in trading to confirm trends and identify trading opportunities across varying timeframes.

In channel trading, studying price action on different timeframes like daily, 4-hour, and 1-hour charts is important to get a full view of the market you are trading. By analyzing various timeframes, you can find key support and resistance levels within the channel, match short-term trading decisions with the trend direction seen on higher timeframes, and improve the accuracy of channel trading signals while reducing the risk of false breakout trades.

This method helps in making good trading decisions and getting into profitable trading opportunities within the channels. Including multi-timeframe analysis adds depth to channel trading strategies, giving a more comprehensive view and increasing the chances of successful trades based on a good understanding of price movements across different timeframes.

The Risks of Over-Reliance on Channel Trading

You must be careful not to rely too much on channel trading to reduce the risks linked to potential missed opportunities in fast-moving markets. When trading within channels, you need to understand the risks of over-reliance:

- Missed Opportunities: Depending too much on past channel patterns might make traders miss out on new chances due to changing market conditions.

- Inaccurate Predictions: Only relying on channels may not always predict future market movements correctly, which could lead to losses.

- External Influences: Unexpected news or sudden market shifts can disrupt established channels, making trading signals less trustworthy.

- Market Adaptability: Market conditions are always changing, affecting how effective channel trading can be. This highlights the importance of being adaptable and flexible in trading strategies.

To manage these risks effectively, it’s advisable to blend channel trading with other strategies, keep updated on external influences, and be flexible in response to market changes.

Impact of News and Events on Channel Trading

Being informed about news and events is a good idea for channel traders as these factors affect price movements and trading channels’ stability. News events can bring more volatility within trading channels, causing significant price fluctuations.

Unexpected announcements, earnings reports, or economic data releases can lead to breakouts or breakdowns of established trading channels. Traders need to keep updated on scheduled news events to be prepared for potential market reactions and to adjust their strategies accordingly.

Major news events like economic reports, central bank decisions, or geopolitical developments can disrupt the stability of trading channels, requiring traders to adapt quickly. Understanding how news and events influence trading channels is important for a well-rounded approach to managing risk and optimizing trading strategies.

Technical and Practical Tips

If channel trading, you need to be precise in identifying levels and entry points to maximize profitability. Here are some tips to improve your trading channels:

- Utilize stop-loss orders: Protect your capital by using stop-loss orders to manage risk and limit potential losses while trading within the channel.

- Use indicators for confirmation: Consider adding indicators like moving averages or MACD to validate trading signals and improve decision-making within the channel.

- Focus on entry and exit points: Try to buy near the lower trendline in an ascending channel and sell near the upper trendline for the best entry and exit points.

- Monitor volume and price action: Keep an eye on volume and price action at critical levels within the channel to assess market sentiment and identify potential breakout opportunities.

Advanced Strategies: Beyond Basic Channel Trading

Moving past basic channel trading opens up new ways to improve trading performance. Using Fibonacci retracement levels in the channel can help find potential reversal points based on important support and resistance levels.

Adding a moving average crossover strategy confirms trend changes and gives signals for entering or exiting trades in the channel.

Volume analysis helps confirm price movements and assess trend strength to make better trading choices.

Harmonic patterns like ABCD or Gartley patterns within the channel can help spot potential entry and exit points with higher chance setups.

Also, looking into options strategies like straddles or strangles can help take advantage of expected volatility breakouts in the channel, offering opportunities for both bullish and bearish trades.

Channel Trading in Different Markets

Channel trading techniques can be applied in various markets to analyze price movements and execute trades based on identified support and resistance levels. Different markets offer unique opportunities and challenges for channel trading:

Channel trading techniques can be applied in various markets to analyze price movements and execute trades based on identified support and resistance levels. Different markets offer unique opportunities and challenges for channel trading:

- Stock Market: Traders use price channels to decide when to buy or sell based on support and resistance levels, improving their entry and exit points.

- Forex Market: Traders profit from price movements within channels by entering and exiting positions strategically, using support and resistance levels.

- Cryptocurrency Market: Channel trading helps navigate volatile price movements and spot potential trend reversals, which are crucial for making well-informed trading choices.

- Commodities Market: By analyzing price behavior and making decisions based on channel boundaries, traders can effectively navigate the market and leverage channel patterns for profitability.

Frequently Asked Questions

How Do I Manage Risk When Trading Within a Channel?

When trading in a channel, managing risk is vital. To do this effectively, you can focus on position sizing. By adjusting the size of your positions based on the channel’s width and your risk tolerance, you can limit potential losses. This strategy allows you to maintain control over your risk exposure while still taking advantage of trading opportunities within the channel.

What Timeframes Are Best for Channel Trading?

When deciding on the best timeframes for channel trading, consider the channel boundaries and your trading psychology. Shorter timeframes like 1-hour charts are good for quick trades within narrow channels, while longer timeframes such as daily charts suit broader channels. Adapt to market conditions by being flexible in your timeframe selection.

Should I Adjust My Strategy for Volatile Channels?

When dealing with volatile channels, adjusting your strategy is essential for effective trading. Volatility management becomes key in these situations. Consider tightening your stop-loss orders to protect your positions from sudden price swings.

Is It Necessary to Use Multiple Indicators for Channel Trading?

When choosing indicators for channel trading, focus on quality over quantity. Opt for a few reliable indicators that complement each other. This streamlined approach avoids analysis paralysis. The goal isn’t to overwhelm yourself with numerous indicators but to use them effectively. Additionally, prioritize risk management by setting stop-loss orders and defining your risk tolerance.

How Do I Handle False Breakouts While Trading Channels?

When handling false breakouts in channel trading, focus on avoiding whipsaw signals by waiting for confirmation of a genuine trend reversal. Look for multiple indicators aligning before entering a trade to increase accuracy. Keep an eye on volume to confirm price movements. Utilize stop-loss orders to manage risk and protect your capital.

Summary

Mastering channel trading needs a good grasp of channel patterns, effective trading strategies, and analyzing various timeframes.

While channel trading can be a profitable strategy, you need to be aware of the risks of over-reliance and how news events can impact market behavior.

By staying informed, using technical tips, and exploring advanced strategies, you can confidently handle different markets and improve your trading success.