- September 26, 2022

- Posted by: Shane Daly

- Categories: Options Outlook, Trading Article

If you want to trade stock options, you must know how to read an options pricing table. This is the table that shows all of the available options for a given stock, as well as their corresponding prices. Whatever broker you are using, what’s involved in the options chain is pretty standard.

In this post, we’ll take a look at what all of the different elements in an options pricing table mean so that you can make more informed decisions when trading options and putting risk on in the market. As long as you know what to look for, it is fairly simple to read.

Online Sources For Option Chain Data

Before we jump in, a quick note on where you can find options chain data.

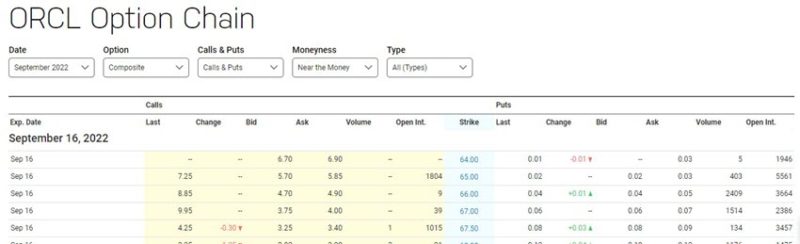

The majority of online brokers will provide some form of options analysis tools directly on their websites. This is the options chain for ORCL from inside the Interactive Broker package.

In most cases, you can just go to your broker’s website and find the options chain data there. However, there are other choices including this same ORCL chain as found on the NASDAQ website.

Not all will look the same and it can be a little intimidating for someone new to trading options. We are going to cover the basics of the chain so you will find it very easy to follow.

Going forward, I will be using the Options Chain I use at Questtrade.

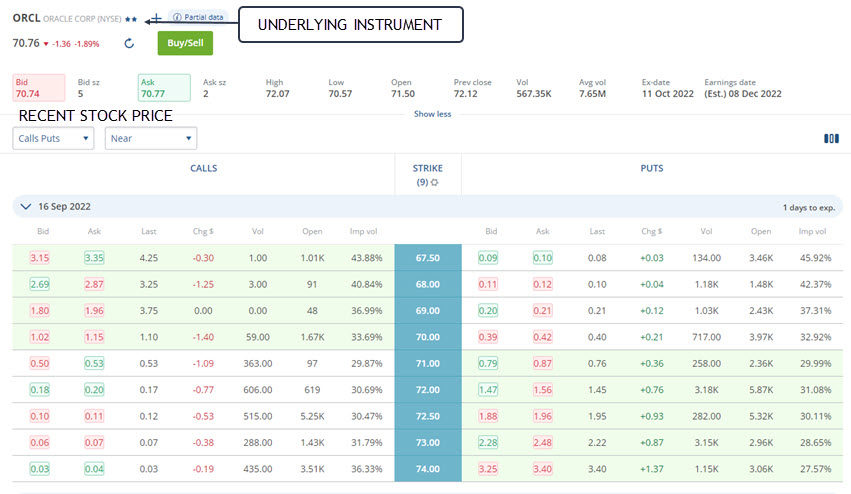

Underlying Instrument

The most important thing is to ensure that you are looking at the correct underlying instrument on the options chain. This example shows we are looking at the proper chain for ORCL as well as the current bid/ask price for the stock when this image was taken.

Under the underlying information data, is where you will find the important information you will need to place an options trade for ORCL.

Reading The Options Chain

The first thing you’ll notice when looking at an options pricing table are the various dates available.

Expiration Dates

These dates represent when the options contract you buy/sell, expires. I have set this to show contracts that are set to expire in the near term. Your options strategy and expectations for the trade will determine how far out in time you will go for the date.

Calls, Puts, Strike

The three columns to pay attention to are the calls, puts, and strike columns.

If you are looking to purchase a call option because you expect the stock to rise in value, you would use the calls column.

The strike price is the price you have the right, not the obligation, to buy or sell the underlying asset at.

The put option column is for those looking for a stock to decline in value and you will buy a put option to take advantage of that.

Options Chain – Digging Deeper

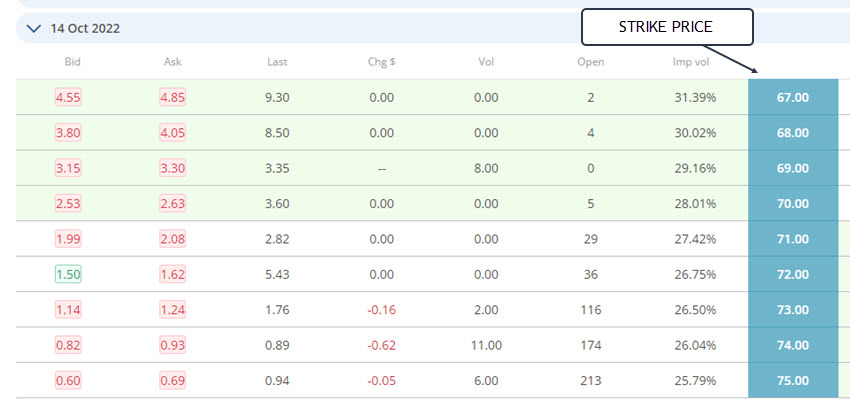

You’ve confirmed you are looking at the right underlying asset, ORCL, and decided you will be looking for an options contract that has an expiration date of about 30 days from today.

Your strategy has indicated the ORCL may rise shortly and you choose to buy a call option. To get the information you need to place an order for the option you want, you will look at the options chain and find an options contract with the strike price that works for your strategy.

The price of the stock at this time was slightly above $70.00. You will notice that there is a portion of the chain that is colored green. This means that all those strike prices are in the money, meaning they already have value.

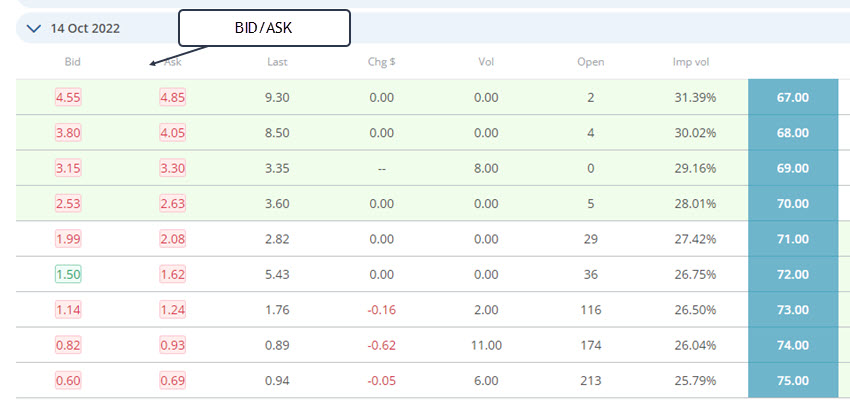

On the left, we see two columns called the bid and ask.

The bid price is the highest price that someone is willing to pay for your option. The ask price is the lowest price that someone is willing to sell their option for. When buying your call option, you would be looking at the ask column as well as the column titled “last”. Last is the last price the options were traded at.

The volume column shows how many contracts were traded today. You can see that the $69.00 strike price had 8 contracts traded. The open column (open interest) shows how many contracts, at this time, are still open.

Notice at the $69 strike, it has a 0 listed in the open column. This could mean that the 8 in volume were closing orders. However, the open interest is lagging by one day so the 8 could be new orders but you will not know this until the next trading day.

After considering the above information and deciding it does not suit the trade, many will decide they are going to go out in time a little further in expiration.

Notice by going out a little further to 36 days for expiration, there is a lot more liquidity in this particular option. The bid/ask spread is five cents and the last traded is closer to the current ask price. The last price traded is a good reference to know for how much you should offer to purchase the contract. We want to ensure we offer enough to get filled but not pay more than what is required to get the contract.

The volume traded is 252 on this day as well as over 2000 active contracts as of yesterday. This is good news for an options trader.

Placing The Order – Call Option Example

Your strategy is bullish on ORCL and you expect a jump in the stock long before Oct 21. You want to buy an in-the-money call option with a strike price of $70.00. As long as the stock stays above this price you are in profit.

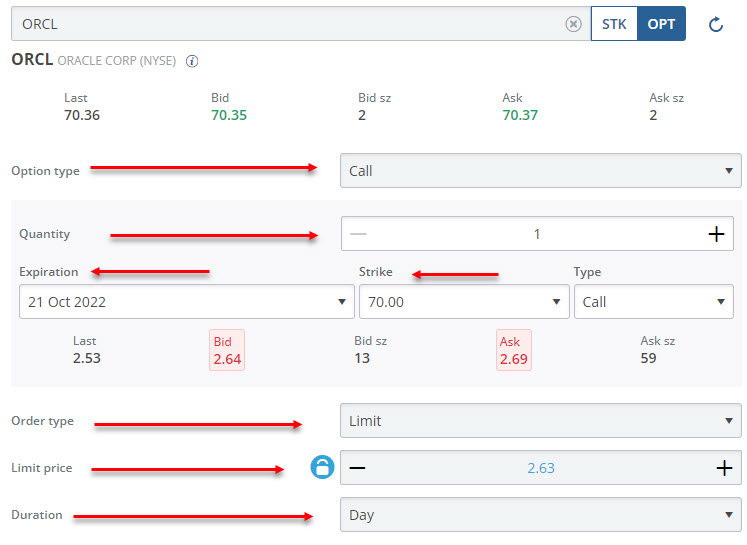

If I am happy with my selection, I would bring up the order entry window for ORCL and there are some important things to ensure are correct.

Option Type: Being bullish on the stock, ensure this is set to a call option (put is bearish)

Quantity: This is the number of option contracts I will purchase (1 contract is 100 shares)

Expiration: The expiration date of this contract and I need the stock to move up within this time

Strike Price: This is the number I have the right but not the obligation to purchase the stock at

Order Type: I use limit orders which means I limit my price to this amount. If I am not getting filled as the bid/ask increases, I can adjust this until I do.

Limit Price: The actual price I am willing to pay for this contract. If it is too much less than the ASK, I may not get filled. Remember, this is $2.63 per share or $263.00 for the contract. This is the premium I would pay for this contract.

Duration: This is set to “day” which means if not filled by end of day, the order is canceled. There are other options such as GTC which means the order stays live until canceled.

Put Options Example

What we discussed for calls is the same for put options except we are looking for the stock to move down in price.

This is the options chain for the put side of the same example as earlier.

Notice the green prices are all above the current price of $70.00. This gives the options trader that bought puts the right and not the obligation to sell ORCL at $80.00, for example. At the current price of $70.00, these traders would be sitting on $10/share profit.

Traders in this type of scenario would generally close their position and the difference between what they paid for the option and what they sell it at, is their profit.

If this trader bought their puts at $5.00/share or $500.00, and using the last price at the 80 strike price, they could sell it for $10.15/share or $1015 for a profit of $515.00.

Conclusion

The options chain is a powerful tool for any trader. However, it can be difficult to understand if you don’t know the basics.

In this post, I walked you through the different parts of the options chain and what they mean as you look to enter your options trade.

The moment you enter a call or put option, time starts to work against you. What’s important is that you choose the right option for your trading strategy and understand your time horizon in terms of when you expect your stock to move.

Do you want to learn how to trade options and make a killing in the markets?

Our 8 minute success formula is designed to help you learn everything you need to know about options trading in record time. You’ll be able to start trading like a pro in no time!

1 Comment

Comments are closed.

Thanks for the brief lesson. It’s very helpful. I will keep it as reference until it becomes habit.