- October 3, 2020

- Posted by: CoachMike

- Categories: Options Trading, Trading Article

In the article about Call Credit Spreads, I wrote about how they can be a great way to put on a bearish position with defined risk and 5 ways of making money.

We are going to build on that article today by taking a look at selling a Put Credit Spread to put on a bullish position. The beauty of the Credit Spreads is you can utilize them in many types of market conditions. We can use them in bullish and bearish markets as well as in volatile markets and quiet markets

Long Calls/Puts Not The Only Game In Town

So many traders get caught up in trading long calls and long puts only that they miss out on other trade types like the vertical spread that can actually produce better probabilities of success and more consistent returns over time.

Let’s dive in and talk about how to use a Put Credit Spread which is our favorite strategy for putting on a bullish trade.

Definition

A Put Credit Spread is put on by selling an out of the money put option to open and at the same time buying a further out of the money put option to open at the same time.

When Do We Use

You want to sell a Put Credit Spread when you are looking for a neutral to bullish position with defined risk. If you are expecting a big move higher there are strategies like buying a long call that will give you a bigger profit potential.

Ideally you want to sell a credit spread when volatility is high. Doing so will allow you to take advantage of higher priced options.

While not required, trading credit spreads in higher volatility markets will produce better performance than trading them in lower volatility markets.

Do We Use Weekly Or Monthly Options

The Put Credit Spread can be used with short term weekly or monthly options. The key is to make sure you are trading options with good liquidity as your fill prices can make a huge difference in the P/L.

When starting out with this strategy we recommend using monthly options with between 20-40 days left to expiration. As you get more comfortable with the strategy you can then move into the weekly options.

The weekly options will react much faster to changes in stock price and are less forgiving than the monthly options.

How the Trade Is Constructed

Once we decide whether we are using the weekly or monthly options, then the next step is to determine which options to use.

- We like to start by selling the put option that has a 65% chance of closing out of the money.

- We will then buy a put option further out of the money that will allow us to put on the trade for between 30-40% of the width of the strikes.

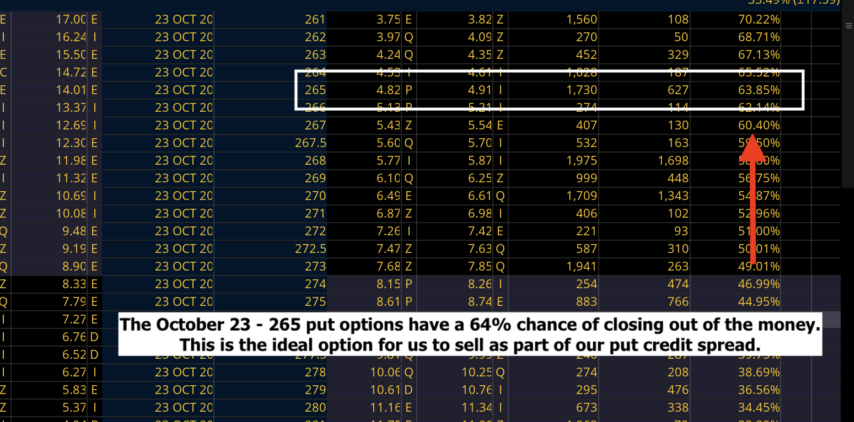

See screen shot below for an example

How Much Can We Make

Our max profit on the trade is whatever price we collect to put the trade on. For example, if we sell a Put Credit Spread for $.70 then our max profit is $70 per spread.

We make money on the trade as long as the stock or ETF price stays above the strike price of the option that we are selling to open the trade.

What Is the Risk

The nice part about a credit spread is they are fully risk defined trades. We know what our maximum loss is right up front before ever placing the trade. Our max risk is the difference between the strikes minus the credit received for placing the trade

If we sell a $2 wide Put Credit Spread for $.70 then our risk would be $1.30 or $130 per spread. Even if we are dead wrong on the trade the most we can lose is $130 per spread. While the credit spread might seem more advanced it’s actually a much safer trade than buying an outright call or put.

Why would we risk $130 to make $70 on the trade? Risking more to make less doesn’t sound that attractive. We are ok with this ratio as these trades have a high probability of success.

Having 5 ways of making money on these trades make them very forgiving. We are ok risking between 2 and 3 to make 1 as we can get the numbers to work for us over time. We are not ok risking 5 or 6 to make 1 as the numbers don’t back it up.

Making Money With A Put Credit Spread

With a credit spread we will have 5 ways of making money on the trade. When selling a Put Credit Spread, we make money if the stock moves up, down, or sideways as long as the stock stays above the price of the strike price of the option that we sold.

We also make money from time decay adding up. In other words, we make money from every day that passes as the options will get cheaper.

Finally, we also make money from volatility decreasing.

The goal is for the options to get as cheap as possible so we can buy the spread back to close the position at a cheaper price than we sold it for when opening the trade.

- We make money if the stock moves up, down, or sideways as long as the stock price stays above the strike price of the option that we are selling.

- We make money from time decay adding up on a daily basis.

- We make money from volatility decreasing.

Any combination of the factors above will allow us to make money with the credit spread.

Trade Management

The only way we can book the full profit on the trade is if we hold to expiration. We don’t like to hold all the way to expiration. We will typically close out of the trade early when we can keep 50-75% of the max profit on the trade.

If we collected $.70 to open the trade, then we will look to close the trade when we can buy it back for between $.17 and $.35 as that would allow us to book 50-75% of the $.70 that we collected to put the trade on.

Trade Example

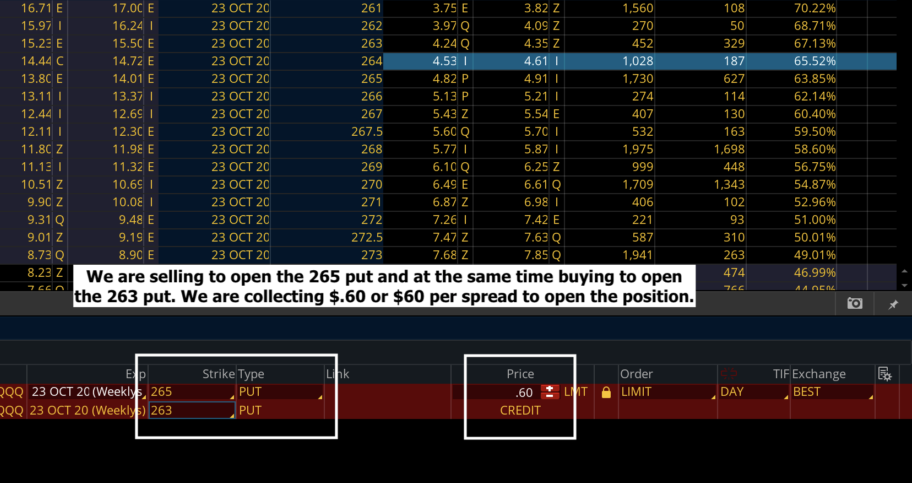

Looking at QQQ, we determine that we want to place a neutral to bullish position using a Put Credit Spread. We decide to go with the Oct 23 weekly options that have 20 days left to expiration.

We go to the 265 out of the money put option that has a 64% chance of closing out of the money and sell that option as part of the spread. We will also buy the 263 put at the same time to make sure we are in a risk defined trade.

There is a $2 difference between the strike prices which means we want to collect between $.60 and $.80 as that will allow us to collect between 30-40% of the $2 difference between the strikes.

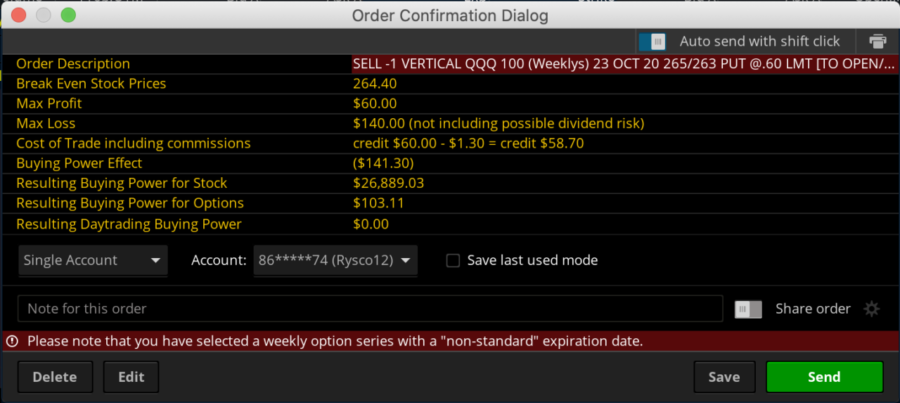

Selling this spread to open for $.60 will allow us to collect $60 per spread. This $60 is the most we can make on the trade.

Our max risk on the trade is $1.40 or $140 per spread which is calculated by taking the $2 difference between the strike prices of the options and then subtracting the $.60 that we collected to open the trade.

Our breakeven point on this trade is $264.40. This is calculated by taking the 265 put strike of the option that we are selling and subtracting on the $.60 that we are collecting to open the trade. We make money if QQQ moves higher, lower, or sideways as long as the stock price stays above $264.40. We also make money from time decay adding up and from volatility decreasing.

While we could hold to expiration hoping to keep the full $.60 or $60 profit per spread, we don’t like the risking of holding all the way to expiration. We prefer to close the trade out early when we can keep between 50-75% of what we collected to open the trade.

In this case, we would look to buy the spread back for between $.15-$.30.

Using proper position sizing is crucial on this trade. While we do have high odds of making money on this trade, it’s still just an individual trade that could win or lose for us. Loading the boat on one big trade is a recipe for disaster.

We recommend keeping the risk on each individual trade at between 2-5% of your account. This way if you do have a losing trade it’s not going to wipe your account out. If you get your sample set of trades big enough you will absolutely make money over time.

Having A Toolbox

Having a diversified toolbox of options strategies is crucial in today’s market environment. You need to be able to adjust to anything the market throws your way. The Put Credit Spread is a great way to place a more conservative bullish trade that gives you a nice profit potential but with defined risk.

You will have a high probability of success on the trade and the position will be much more forgiving. You don’t need to be perfect on your market direction to make money. It’s a much lower stress approach which is why it’s a go to strategy for most successful options traders.