- March 9, 2023

- Posted by: Shane Daly

- Category: Trading Article

As an options trader, you probably already know that there are two main types of trades: credit spreads and debit spreads. But which one is better? Which one should you use?

Let’s break down the differences between credit spreads and debit spreads to help you decide.

What We Will Cover:

What Is a Credit Spread?

What Is a Debit Spread?

Differences Between Credit And Debit Spreads

Credit Spread Example

Debit Spread Example

Conclusion

What Is a Credit Spread?

A credit spread is a type of options strategy in which a trader sells a higher premium option and simultaneously buys a lower premium option with the same expiration date. By selling the higher premium option, the trader receives a credit (payment) from the buyer. The goal of this strategy is to generate income through the credit received while limiting the potential loss to the difference between the strike prices, less the credit received.

Credit spreads are considered to be a limited risk and limited reward strategy, as the potential profit is limited to the credit received, while the maximum potential loss is limited to the difference between the strike prices, less the credit received. These are very conservative option trades to take.

However, credit spreads are generally considered to be less risky than debit spreads, as the trade is entered into for a net credit, meaning that the trader starts in a profitable position.

There are different types of credit spreads, such as Bullish credit spreads and Bearish credit spreads, the former is used in a bullish market and the latter in a bearish market.

What Is a Debit Spread?

A debit spread involves buying a high-premium option and selling a low-premium option in the same security, resulting in a debit from your account.

By buying the higher-priced option and selling the cheaper one, you offset the cost of the trade. You pay the premium for the option you buy and receive the premium for the one you sell.

Debit spreads are considered to be a limited risk and limited reward strategy, as the potential profit is limited to the difference between the strike prices, less the premium paid, while the maximum potential loss is also limited to the cost of trade.

However, debit spreads are generally considered to be riskier than credit spreads, as the trade is entered into for a net debit, meaning that the trader starts in a losing position.

Similar to Credit spreads, there are different types of debit spreads, such as Bullish debit spreads and Bearish debit spreads, the former is used in a bullish market and the latter in a bearish market.

Main Differences Between Credit And Debit Spreads

The main difference between the two types of spreads is that a credit spread is entered into for a net credit, meaning that the trader receives a payment for selling the higher-strike option, while a debit spread is entered into for a net debit, meaning that the trader pays a premium for buying the higher-strike option.

Risk vs Reward

Credit spreads generally have a higher potential reward but lower potential risk compared to debit spreads. The potential profit from a credit spread is limited to the credit received, while the maximum potential loss is limited to the difference between the strike prices, less the credit received.

On the other hand, the potential profit from a debit spread is limited to the difference between the strike prices, less the premium paid, while the maximum potential loss is also limited to what you paid to put the trade on.

Does Volatility Matter?

When volatility is low, the prices of options are also typically cheap. This allows for your investments to have more potential profit and require less capital when you purchase and put on trades.

Selling a Credit Spread is made much more profitable when volatility in the market is high. The increased price of options allows you to collect more money upfront, thus enabling greater potential profits from the spread. Although it’s possible to sell spreads with low levels of volatility too, these will not yield as many rewards as those sold during times of higher market instability.

Traders will generally use a 50% implied volatility cut-off to determine whether to use credit or debit spreads. Above 50%, consider credit spreads and below that, consider debit spreads.

Market Outlook

Credit spreads are generally used in a bearish market outlook, while debit spreads are used in a bullish market outlook.

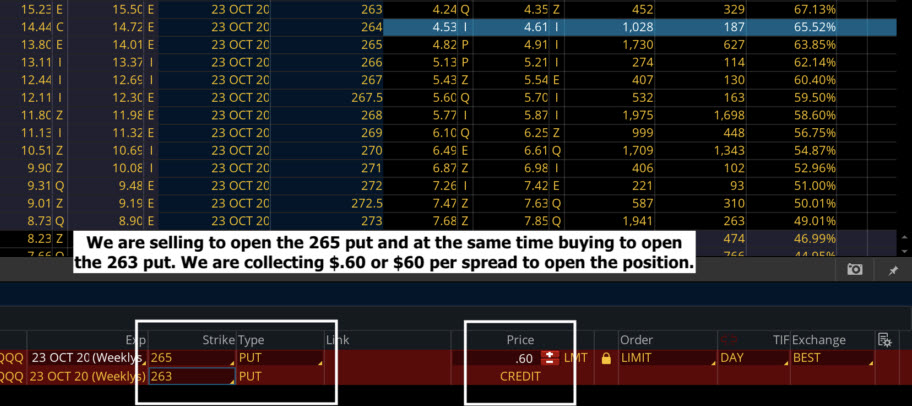

Credit Spread Example

Sell 1 June call option – strike price of $30 for $4

(You receive the $4.00 in premium)

Buy 1 June call option – strike price of $40 for $2

(You pay the $2.00 in premium)

The net you would receive is $2.00/share or $200/contract. That is the maximum you can make on this trade.

Debit Spread Example

Buy 1 June put option – strike price of $20 for $5

Sell 1 June put option – strike price of $15 for $2

You paid $3.00 or $300 per contract and that is the most you can lose on the trade

Conclusion

This is just a brief overview of credit and debit spreads and there are different variations for both of them.

Options traders can use strategies such as credit and debit spreads to diversify their trading. The main takeaway should be that credit spreads involve netting premiums by selling a high-premium option and buying a lower-premium option, while debit spreads involve netting premiums by buying a high-premium option and selling a lower-premium option.

These strategies may seem complex at first, but with a basic understanding of when and how to use them, they can be easy to employ.

8 Minute Options Trading Cookbook

Packed with powerful strategies that will help you generate income. Discover our secret recipe for winning big in the market – reveal five different paths to success on every trade.

Start achieving success now and enjoy life-changing rewards!