- January 16, 2023

- Posted by: Shane Daly

- Category: Trading Article

A Short Calendar Put Spread is an options trading strategy that involves buying and selling two sets of puts with different expiry dates to create a net credit for the trader. It is used when traders expect there to be a significant movement in the price of the underlying security, but are uncertain whether it will go up or down.

Key Info

Looking for the gist of this tutorial?

What is Short Calendar Put Spread?

Short Calendar Put Spread is an advanced options trading strategy that involves buying and selling two option contracts with different expiration dates but the same strike price. It is used when you expect a breakout or large move in the near future and are looking to collect premium as income from the spread.

How does Short Calendar Put Spread work?

Short Calendar Put Spread works by buying a near-term put option and selling a further out of the money put option for the same underlying security at the same strike price. The difference between what you pay for the near-term put and what you receive from selling the further out put is your net credit.

What are the risks involved in Short Calendar Put Spread?

The main risk with Short Calendar Put Spread is time decay and limited moves in the underlying security. Time decay works against you and if there isn’t enough time for the stock price to move away from the strike price, then the spread gets too close and the credit received is reduced. Additionally, Short Calendar Put Spreads have limited profit potential and if the underlying security doesn’t move away from the strike price, then you may not make any profits with this strategy.

How can I mitigate risks with Short Calendar Put Spread?

You can mitigate the risk by closing the short put when the long put expires. This may not guarantee a maximum profit but it will help reduce your losses. Additionally, you should have the appropriate risk capital to trade this strategy and have a plan in place for closing out positions before they expire. Keeping an eye on time decay and taking profits when they come can help you make profitable Short Calendar Put Spread trades.

Short Calendar Put Spread Overview

Setting up the short calendar put spreads requires using two puts that you either buy or sell.

The first step is buying an “at the money” put with a near term expiration date.

The first step is buying an “at the money” put with a near term expiration date.

Your second step is to sell (write) an “at the money” put with the same strike price but a further out expiration date.

You would receive a net credit when you set up this trade. Profits are made if there is significant movement in the price of underlying security

Short position must be closed out once the options bought have expired. If not, there is a risk of unlimited losses.

The Short Calendar Put Spread is an advanced strategy and can be very profitable when traded correctly. However, it does require careful monitoring with the short position needing to be closed out once the options bought expire in order to avoid potentially unlimited losses.

Example of Short Calendar Put Spread

Imagine that you are expecting a big move from ROYAL CARIBBEAN CRUISES LTD (RCL) that is currently trading at $60.60. The stock is currently trading in a range and you anticipate a breakout in the near future.

You choose to put on a calendar spread and look to collect a premium as a form of income.

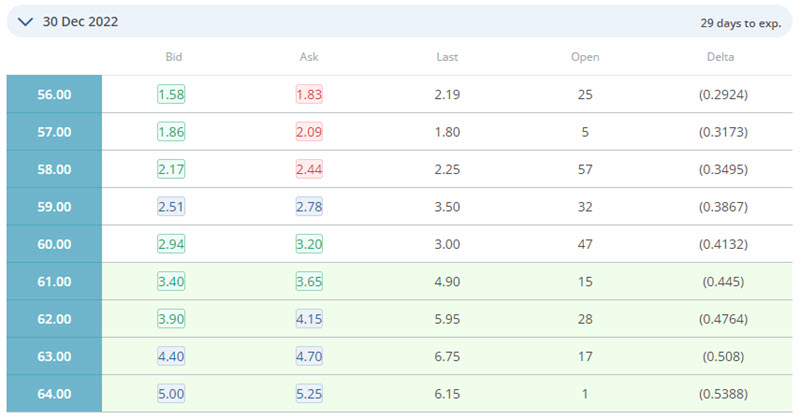

You choose to buy the ATM strike of $60.00 with a Dec 30 2022 expiration date and are filled at the BID price of $2.94. Cost of the trade is $294 per contract. At Netpicks, we like to see at least 25-30 X the open interest per contract. In this case, we would only buy 1 contract as OI is 47.

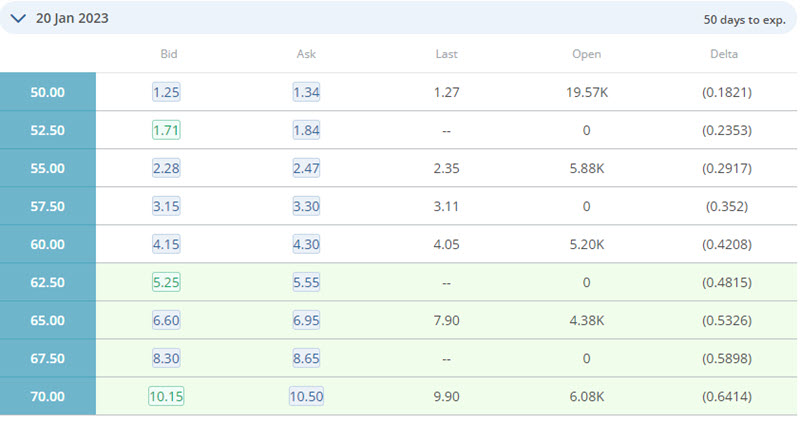

We need to also sell an ATM put and we go out to Jan 20 2023.

We sell the same strike price of $60.00 and the sale is at the ASK price of $4.30. You would receive $430.00 in premium for selling this put contract.

You receive a net credit of: $430.00 – $294.00 = $136.00. This is the difference between what you paid for the near term put and what you received for the further out put that you sold.

Calculating Potential Profit

The maximum potential profit from Short Calendar Put Spread is the net credit received, minus any commissions your broker charges. In our example, the most you can make on this trade is $136.00.

Your profit is made if the stock price moves significantly above or below the strike price of the calendar spread at expiration of the put contract you bought with the early expiration date.

If the stock price falls or rises away from the strike price, then the difference between the two puts approaches zero, and your income comes from the full amount of premium that you received for this Put Spread.

Risk Involved in Short Calendar Put Spread

The main risks with Short Calendar Put Spreads are time decay and limited moves in the underlying security.

Time decay works against you and if there isn’t enough time for the stock price to move away from the strike price, then there is potential for the premium spread of both puts to get too close and the credit received will be reduced.

The Short Calendar Put Spread also has limited profit potential and if the underlying security doesn’t move away from the strike price, then you are unlikely to make any profits at all on this trade.

Another risk is if the early expiration date contract expires worthless as the underlying stock price is close to the strike price and you fail to close the Put contract you sold.

Mitigate this risk by closing the short put when the long put (the one you bought) expires. The short put still have time value in it but you don’t know what that will be. It is hard to determine your maximum risk because many variables go into the pricing of an option.

Short Recap of Short Calendar Put Spread

The Short Calendar Put Spread is an advanced strategy that can be profitable when executed correctly. You should have the appropriate risk capital to trade this strategy and have a plan in place for closing out short positions before they expire.

Keep an eye on time decay and make sure to close out the short position at expiration if there isn’t any movement in the underlying stock or market. Short Calendar Put Spreads can provide a nice return if you make sure to take profits when they come and don’t wait too long for the price action of the underlying security to move away from the strike price.

Learn to trade without all those overused technical indicators!

Discover Price Action Patterns and find ideal, low risk entry points. No indicators required!

Trade successfully with precision accuracy. Absolutely Free Download available now!

2 Comments

Comments are closed.

Interesting. Do you have a service that

Makes recommendations? If you do

what is its cost?

Hi Richard. Appreciate you reaching out. We do have an Options service you may be interested in. You can reach out to our specialist Mike with any questions you may have. mike@netpicks.com