- November 28, 2022

- Posted by: Shane Daly

- Category: Trading Article

A short straddle options position is a bearish strategy that involves selling both a call and a put option with the same strike price and expiration date. The goal of this strategy is to profit from a decrease in volatility and/or a small move in either direction.

Quick FAQ

What is a short straddle options position?

A short straddle options position is when you sell a call and put at the same strike price.

What is the maximum profit for this trade?

The maximum profit for this trade is equal to the premium collected when entering the trade.

What is the maximum loss for this trade?

The maximum loss for this trade is equal to unlimited downside risk less any premiums collected when entering the trade.

What are some tips for trading this strategy?

Some tips for trading this strategy include picking less volatile stocks, choosing expiration dates wisely, and capping your profits at 30-50% of max profit.

What Is A Short Straddle Options Position?

A short straddle options position is a bearish strategy that involves selling both a call and a put option with the same strike price and expiration date. The goal of this strategy is to profit from a decrease in volatility and/or almost zero price moves in either direction.

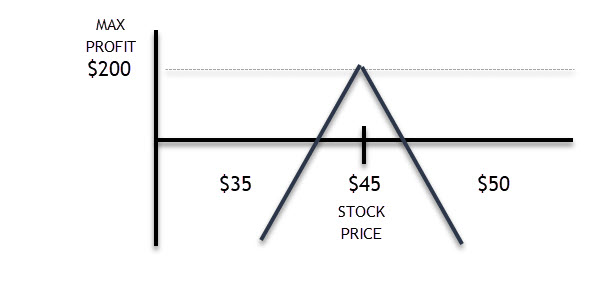

In this example, let’s assume the stock price is hovering around $45.00 and we are selling both a call and a put at $45.00. We will imagine we are taking in a $100 premium for each contract ($1.00 per share).

How Can Traders Profit From Short Straddle Trades?

Traders can profit from a short straddle options position only by collecting the premium from selling the call and put option. If the stock price moves lower than the strike price of the options contract, then the trader will make a profit.

However, if the stock price increases above the strike price, then the trader will incur losses. Those losses, unlike trading vertical spreads, are not defined. How much you can lose is unknown and that is why these plays are extremely risky.

The maximum profit for this trade is equal to the premium collected when entering the trade. This full profit is achieved when the stock price expires at or below the strike price of the contract.

In our example, $200 is the most we can make on this trade.

The maximum loss for this trade is equal to unlimited downside risk less any premiums collected when entering the trade. This loss is realized when the stock price expires above the strike prices of both contracts.

Traders want time decay to add up and for the underlying to not increase in volatility. In essence, you want that stock to remain flat and ignored.

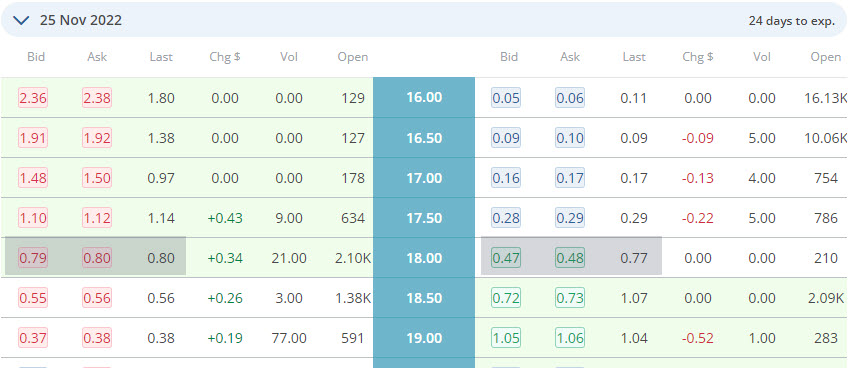

Let’s consider a real example at the $18.00 strike price.

For simplicity sake, imagine the last price is the premium you received. When selling the call (on the left), you would receive 0.80 x 100 or $80.00. On the put side, you’d receive 0.77 x 100 or $77.00. The most you could make on this trade are those premiums combined: 77 + 80 = $157.00.

Where Do We End Up Breakeven?

Sometimes volatility will increase and you should know where you’d end up breakeven.

The breakeven points are simple to calculate:

The breakeven points are simple to calculate:

On the upside, we take the price of the call and add the premium received when we opened the trade: $45.00 + $1.00 = $46.00.

On the downside, our breakeven point is the strike price of $45.00 – $1.00 = $44.00.

Risks Associated With A Short Straddle Options Position

The risks associated with this trade are unlimited downside risk and limited upside potential. This limited upside potential exists because all you can make is the premium received when selling the call and put.

If there’s an unforeseen event that causes volatility to spike or if there’s an unexpected move in either direction, you could lose money quickly.

How Can Traders Manage The Risks Of A Short Straddle Position?

There are several ways traders can manage risk when trading this strategy:

Use stop-loss orders: A stop-loss order is an order placed with your broker to buy or sell once your stock reaches a certain price point—this helps you limit your losses if things don’t go as planned.

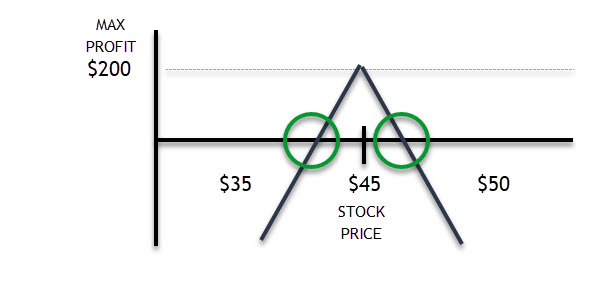

Hedge your positions: Hedging is when you take offsetting positions to mitigate your risk exposure. Using our example, if the underlying is moving up from the $45 price, you could buy a call at $50 – $55 to limit your losses to that strike price.

On the downside, you’d think of buying a put option at $40 – $35 to limit the downside to that strike price.

Tips For Trading Short Straddle Options Positions?

Some tips for trading this strategy include:

Pick less volatile stocks: This will help you minimize losses if there’s an unexpected spike in volatility or an unexpected move in either direction.

Choose expiration dates wisely: If you pick an expiration date that’s too far out, then you run the risk of volatility coming into the market.

Cap your profits: Although the premium is the most you can make if held to expiration, consider holding to 50% of the potential.

Look for stocks that made big moves: Often a stock will make a large run in price and then begin to consolidate.

Trading a short straddle options position can be profitable if done correctly but it also comes with some risks that need to be managed carefully. By following some simple tips, you can help mitigate some of these risks and give yourself a better chance for success.

You could be making more money in less time!

Imagine if you had a list of the 101 best dividend stocks to own today. That would give you a major head start when it comes to finding high-yielding investments that could help you achieve your financial goals. And we’ve got just that – a free download that will get you started on the right foot.

Imagine how great it will feel when you finally have enough passive income coming in to cover all your bills and then some. With our list of top dividend stocks, it’s easier than ever to make that dream a reality.

So don’t wait – download our free report now!

Click here to get your free copy of our report on the 101 top dividend stocks!