- March 17, 2020

- Posted by: CoachMike

- Categories: Options Trading, Swing Trading, Trading Article

The last few weeks as the coronavirus crisis has evolved, have produced some of the most volatile markets we have ever seen.

5% moves in the S&P 500 used to take days and are now taking a matter of a few hours. As a result of these quick big moves back and forth, it has been a challenge to get options orders in fast enough.

I want to walk you through how I place orders for my options trades on a regular basis to produce the best results.

Options Orders – Best Practice

I like to use both the Thinkorswim and TastyWorks platforms for my options trades. I will show the screenshots below showing the process in the Thinkorswim platform. Even though the mechanics might be different depending on your broker platform, the steps for determining the best price are the same.

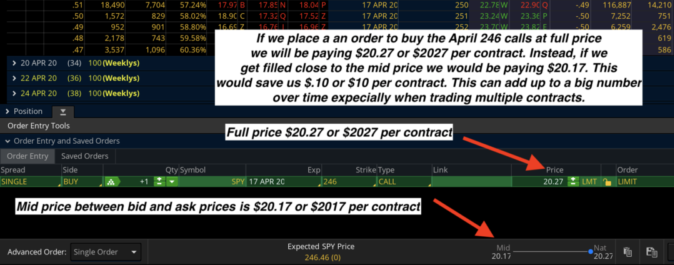

Whether you are trading an individual call or put option or a vertical spread, you will always see a bid and an ask price for those options. One of the issues with this active market right now is the spread between the bid and ask prices have widened out. Markets that normally have a $.01-$.02 difference between the bid and ask prices are now seeing a $.20 difference between the bid and ask.

The wider the bid/ask spreads are, the more difficult it can be to get filled quickly and at a good price. What you don’t want to do is rush into or out of a trade if it means paying full price. Following a few simple steps can lead to big cost savings over time.

Steps To Saving Trading Costs

Make sure you are using limit orders

Using market orders should be your option of last resort. If you switch to a market order you are at the mercy of the market as to where you get filled at. This can lead to bad fill prices which can add up to a huge cost long term over dozens of trades

Always start the price of your order at the mid price between the bid and ask prices

While you aren’t guaranteed to get filled at this price it’s a good starting point. We can always adjust the price higher or lower if we are not filled at the mid price.

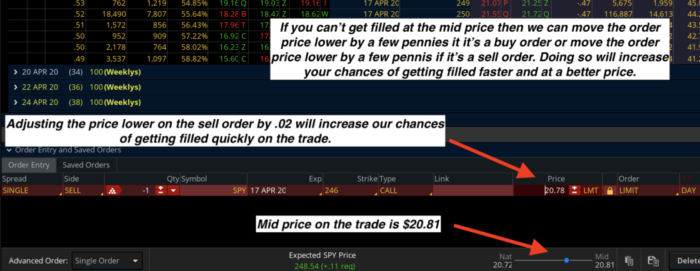

If using an order to buy an option and you aren’t filled at the mid price start moving your order up $.01 at a time until filled

There are times you need to let the order work for a few minutes up to a few hours before getting filled. You need to be open to letting the orders work before make adjustments too quickly. Using a broker that offers a mobile platform makes this much easier as you can make adjustments to your orders from anywhere you have a cell phone connection.

If using an order to sell an option and you aren’t filled at the mid price start moving your order down $.01 at a time until filled

There are times you need to let the order work for a few minutes up to a few hours. You need to be open to letting the orders work before make adjustments too quickly. Using a broker that offers a mobile platform makes this much easier as you can make adjustments to your orders from anywhere you have a cell phone connection.

If you don’t have time to be patient and let orders work,start out using a higher price on a buy order or lower price on a sell order

You will get a faster fill price on the trade. However, keep in mind if you have to pay $.05 higher for an option or sell an option for $.05 lower that is $5 that you are giving up per contract or spread to get filled on the trade. This can add up over a whole series of trades.

Always Another Trade

Remember there will always be another trade. In the heat of the battle it is easy to feel like if you don’t get filled on a trade you are going to miss out on the move of the century. In reality it’s more important long term to be picky on where you get filled on your orders. If you run the numbers on the trades that you take all year long saving a few pennies here and there will add up to a big number in the long run.

Follow the steps above will lead to better performance long term. It might take some getting used to in your broker platform to adjust the prices on orders but in the end you will be a much more profitable trader for doing so.