- November 1, 2022

- Posted by: Shane Daly

- Category: Trading Article

You’re an experienced options trader who is always looking for new ways to profit from the market. You’ve been trading for a while and have had some success, but you’re always looking to improve your performance outside of the basics of trading calls and puts.

You decide to do some research on put credit spreads and find out that they can be a great way to profit from a bullish market. You also like the fact that they have defined risk, which is important to you as a trader.

Using put credit spreads (and other vertical spread choices) is a great addition to your toolbox and in this article, let’s explore how you can get started.

Brief Summary

Put credit spreads offer fully defined risk and can be attractive for potential gains.

The maximum risk in a credit spread is the difference between the option strikes minus the credit received for placing the trade.

Credit spreads can be profitable if the stock goes up, down, or sideways, but only if the stock stays above the strike price.

Properly managing the position by adjusting or closing out as necessary can help mitigate risk.

We prefer to not hold until the expiration of the contracts and will look to close the trade when we can buy it back for between 50-75% of the maximum profit.

When To Create And Use Put Credit Spreads

A Put Credit Spread is created by selling an out-of-the-money put option and buying a further out-of-the-money put option at the same time. This strategy can be used when a trader expects the underlying asset to stay relatively stable or increase in price slightly.

Put credit spreads offer limited downside risk while still providing the potential for a decent return. The risk for a trader is limited by the width of the spread minus the credit the trader receives when opening the trade.

Put credit spreads may be the right strategy for you if you are looking for a neutral to bullish position with defined risk. This type of spread can be beneficial when volatility is high, as it allows you to take advantage of higher-priced options.

When compared to other strategies, put credit spreads typically perform better in higher volatility markets.

Should I Use Weekly Or Monthly Options?

The answer depends on your time frame, experience, and what you are looking to achieve with the trade.

This strategy can be used with weekly or monthly options, but we recommend starting with monthly options that are not only liquid but also have 20-40 days left until expiration. As you become more comfortable with the strategy, you can move into trading the weekly contracts.

If you are looking for a quick trade, then weekly options may be the best choice. You will need to be comfortable with the underlying asset movement exaggerating changes in the options price as weekly options are more sensitive to price changes. The effect of time decay increases as you get closer to expiration as well so be mindful of that.

Deciding which option to use comes down to your trading style and what you are looking to achieve.

Setting Up Your Put Credit Spread

When constructing a put credit spread, a trader sells a put option at one strike price and simultaneously buys a put option at a lower strike price. The maximum profit we can make on this trade is whatever price we collect when we put the trade on.

The goal is for the underlying asset to not fall below the strike price of the option that we sold. We make money on the trade as long as the stock price or ETF price stays above the strike price of the option that we are selling to open the trade.

If I sold a put credit spread for $.60, then the maximum profit I can make is $60/spread.

Our criteria in choosing the options we will use are:

Selling the put options contract that has a 65% chance of closing out of the money.

Buying a put option further out of the money allows us to put on the trade for 30-40% of the width of the strikes.

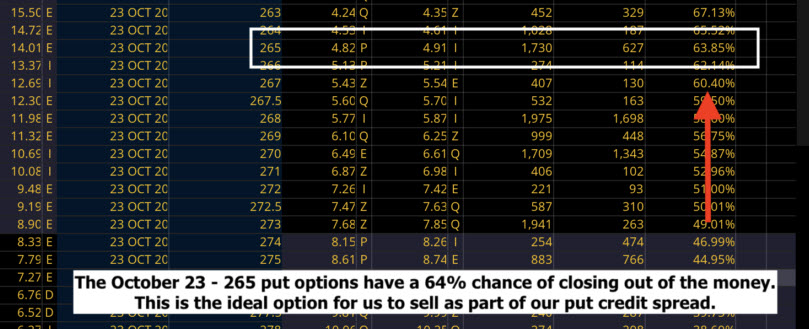

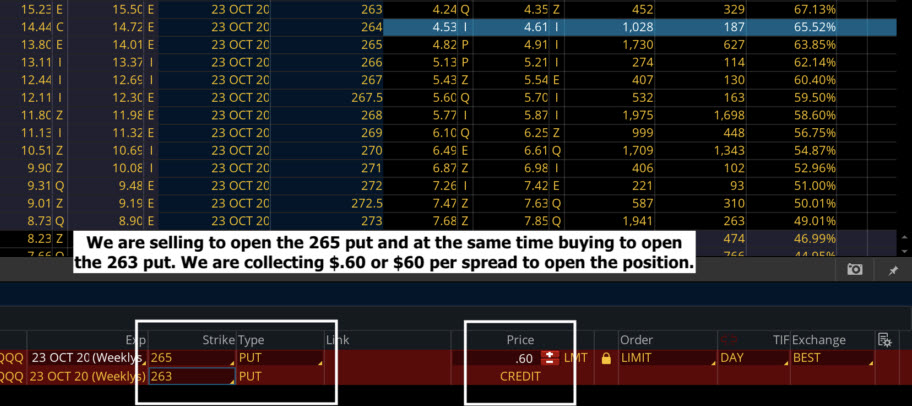

Looking at QQQ above, we determine that we want to place a neutral to bullish position using a Put Credit Spread. We go with the Oct 23 weekly options that have 20 days left to expiration.

We go to the 265 out-of-the-money put option that has a 64% chance of closing out of the money and sell that option as part of the spread.

We will also buy the 263 put at the same time to make sure we are in a risk-defined trade.

There is a $2 difference between the strike prices (265 – 263) which means we want to collect between $.60 and $.80 as that will allow us to collect between 30-40% of the $2 difference between the strikes.

Selling this spread to open for $.60 will allow us to collect $60 per spread. This $60 is the most we can make on the trade.

What Are The Risks With Put Spreads

While the potential gains from these trades can be attractive, they come with risks that must be carefully considered. The maximum risk in a credit spread is the difference between the option strikes minus the credit received for placing the trade.

It is important to remember that credit spreads offer fully defined risk and do not have unlimited loss potential like naked option positions do. This means that if the market moves drastically against the position, your loss is capped at your maximum risk.

Using the QQQ example:

Our max risk on the trade is $1.40/share or $140 per spread which is calculated by taking the $2 difference between the strike prices of the options and then subtracting the $.60 that we collected to open the trade (the contract we sold).

Always keep in mind that each option contract contains 100 shares of stock.

It is always important to thoroughly analyze market conditions before entering into a credit spread to minimize potential losses. In addition, properly managing the position by adjusting or closing out as necessary can also help mitigate risk.

How Do We Profit

When we sell a put credit spread, we will make money if the stock goes up, down, and sideways but only if the stock stays above the strike price that we sold.

Time decay adds up and with every day that passes, the options will get cheaper. Decreasing volatility also allows us to make money.

Essentially, our goal is for the options to get as cheap as they can get so we close the position at a cheaper price than we sold to open it.

Using the QQQ example, the profit potential of the trade is limited to the credit received which was $60.00

Breakeven On The Trade

Things don’t always go as planned and there will be losing trades and breakeven trades.

To calculate the breakeven point, take the 265 put strike of the option that we sold and subtract the $.60 that we are collecting to open the trade.

We need the stock to stay above $264.40 to make a profit.

Hold To Expiration Date?

At Netpicks, our preferred approach is to not hold until the expiration of the contracts. While we can only book the full potential profits if we hold, we prefer a more conservative approach. When we can keep 50-75% of the maximum profit on the trade, we will close the position.

For the above example, if we collected $.60 when we opened the trade, we will look to close the trade when we can buy it back for between $.15 and $.30.

That allows us to bank 50-75% of the $.60 that we collected to put the trade on.

Wrapping Up

Credit spreads are a defined risk options strategy that can be attractive because of the potential for large gains. The maximum risk in a credit spread is the difference between the option strikes minus the credit received when placing the trade. These trades can be profitable if the stock goes up, down, or sideways, but only if it stays above the strike price.

Properly managing the position by adjusting or closing out as necessary can help mitigate some of the risks associated with this strategy. We prefer not to hold until expiration and will look to close the trade when we can buy it back for between 50-75% of its maximum profit potential.

If you’re interested in learning more about credit spreads and other options strategies, download our free 8 Minute Options guide today.

3 Comments

Comments are closed.

good information I would like to learn more

Thank you!

I really like put credit spread as well as call credit spread. Any trade alert service for theme?

Thanks for your infromation! It was useful to me!