- February 23, 2023

- Posted by: Shane Daly

- Category: Trading Article

Are you ready to level up your trading and get ahead of the curve? Learning different options strategies can help you become a more successful trader and maximize your returns.

Yes, you can do fairly well with an options trading business that only focuses on buying calls for bullish markets and puts for a bearish move. However, your results will not be consistent as they rely on a directional move rather quickly to profit. There are times of the year and market cycles when markets can get slow and choppy.

Time decay will be your enemy the longer price fails to make a move.

We can do better.

In this blog post, we’ll compare three of the most popular options strategies: long put options, long put spreads, short call spreads, and which strategy is best for your outlook on a stock. In this case and with these particular strategies, we are going to lean towards a bearish market condition.

Long Put Option

A long put option is a type of options contract that provides traders with amazing profit potential (stocks can go to zero) and limited risk. When buying a puts contract, you’re expecting the underlying asset to go down in price. If it does decrease in price, you can exercise your option and sell it at a higher premium than what you bought it for.

The profit potential is great (not unlimited like call options where stocks can go up to any price) but the maximum risk associated with this trade is limited to what you paid for the option (the premium). This makes long-put options attractive because they offer great reward-to-risk ratios compared to other strategies such as buying stock or futures contracts outright.

The big problem is you will only make money if the underlying instrument heads to the downside in a timely manner. We will lose money the longer it takes for the underlying to move. Another issue is they are the most expensive way to take a bearish position.

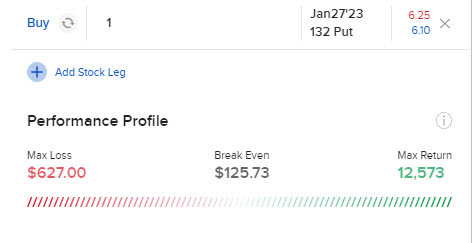

Let’s imagine you where bearish on META which was trading at $130.02 and wanted to buy a put option. You choose an expiration date 26 days out and 1 strike in the money at $6.25 OR $625 per contract which also happens to be your maximum loss on this trade.

How do I Calculate My Break Even Point?

Calculating your break-even point is easy! All you have to do is subtract the amount of the premium paid from the strike price. For example, in our META example, the strike price is $132.00 and the cost of the trade is $6.25. Your breakeven point on the trade is $125.73 (fees taken into account). So as long as META stays below the breakeven price, we make money.

Let’s say META drops down to $115.00 by expiration; 132 strike – 115 stock price = $17.00 – $6.25 in cost of trade = $10.75/share profit on this trade or $1075.00/options contract.

If done correctly, buying a long put option can be an incredibly profitable strategy with limited downside risk.

Long Put Spread

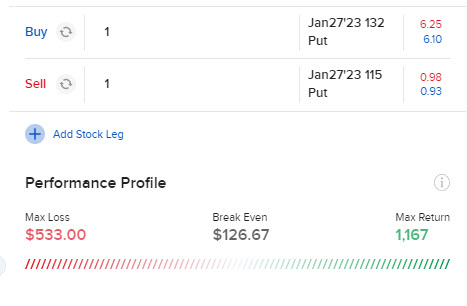

The long put spread is similar to a long put option but instead of buying one put contract, you are buying 1 put contract at one price and selling a put contract at another.

A long-put spread has limited profit potential because it’s capped at the difference between the two strike prices minus any premium paid. This trade also has a limited risk because it’s limited to what was paid for both contracts combined.

The break-even point calculation for this strategy is similar to that of a long put option; subtracting any premium paid from both strike prices combined.

The cost for a long put spread is cheaper than a straight put because we receive a credit by selling a put option.

Back to META trading at $130.02

Our trade would consist of:

Our trade would consist of:

1. Sell 1 META OPT JAN 27 ’23 115 Put (100)

2. Buy 1 META OPT JAN 27 ’23 132 Put (100)

Notice that the maximum loss is less than the potential loss on buying a put. 627 – 533 = savings of $94.00

We have the right to sell 100 shares of META stock at $132. We have an obligation to buy 100 shares, if exercised, at $115 by whoever purchased the put we were selling.

At Netpicks, we teach our traders the following structure for long put spreads:

Buy the put option that is one strike in the money.

Sell the put option that is close to the target price we have for the underlying.

While the profit potential will be lower than buying a put, we still take advantage of a bearish move at a lower cost and lower dollar risk amount.

Short Call Spread

A short call spread is a bearish trading strategy that involves selling a call option and buying a call option with a higher strike price. The difference between the two options’ strike prices is known as the spread.

Short call spreads are used when the trader believes that the underlying security will not rise above the strike price of the short call. The maximum profit for a short call spread is equal to the premium received from selling the call minus the cost of buying the call.

How Does a Short Call Spread Work?

To understand how a short call spread works, let’s look at our META example again.

We set this trade up as follows:

1. Sell 1 META OPT JAN 27 ’23 131 Call (100)

2. Buy 1 META OPT JAN 27 ’23 132 Call (100)

This trade is set up with a credit of $0.30/share or $30.00. This the amount we receive for selling the call minus the cost of buying it. That is the most we can make on this trade no matter what META does.

How much can you lose?

The risk calculation is the difference between both strike prices minus the amount we collect to put the trade on (remember we sold a call option and receive the premium)

$1.00 difference in strike prices minus the .30 we collected per share = max loss of $70.00

The break-even point on this trade would be $131.30. This number is calculated by taking the strike price of the option that we are selling (131.00) and adding on the $.30 that are collecting for putting the trade on. We do not care what this stock does as long as it stays below $131.30. If it does, we will make money.

Also, unlike buying a put, we benefit from time decay adding up as well as volatility drying up.

While this trade has the lowest profit potential of the three options strategies mentioned, is also gives us the highest probability of making money. Slow market? No problem. We can make money regardless of dead market action.

5 Quick Hits

A Long Put Spread uses two options, a put option bought and another sold with a lower strike price.

The maximum loss on this trade is equal to the cost of the spread while the maximum profit is limited to what was paid for both contracts combined.

A Short Call Spread involves selling a call option and buying one with a higher strike price.

The maximum profit for this trade is equal to the premium received from selling the call minus the cost of buying the call.

Short Call Spreads are used when the trader believes that the underlying security will not rise above the strike price of the short call. Time decay and lower volatility benefit traders who use the strategy.

Which Options Trade Is Best?

The best options trade depends on your outlook for a particular stock or market index – if you think the price is going to move down but may stall, then a call spread may be better than a put spread. If you are a strong bear and have a downside target, the put spread could be your play.

It also depends on how much time you have before expiration – if there isn’t enough time left before expiration, then putting on vertical spreads may not be wise since they require more time for profits to accumulate due to their lower risk/reward ratios compared to naked options (buy/sell calls or puts). This is why at Netpicks we teach our traders to look at expirations 20-60 days out.

Additionally, mixing different types of trades such as covered calls, straddles/strangles, and butterflies can allow traders to take advantage of different market conditions without overexposing themselves to too much risk at any given time.

Conclusion

Deciding which options strategy is best for your situation requires careful consideration; understanding all three strategies outlined above will help you make an informed decision and maximize your returns!

Keep in mind that vertical spreads tend to provide more consistent returns over time due to their low-risk/low-reward ratio which allows traders more flexibility when adjusting their positions according to changing market conditions without having too much exposure at any given time.

Keep learning and stay ahead of the curve!