- April 13, 2023

- Posted by: Shane Daly

- Category: Trading Article

Are you strongly bearish? When it comes to trading options, there are several strategies you can use to make money even when the market is going down. Here we will look at a few simple strategies that you can use when bearish.

Table of Contents

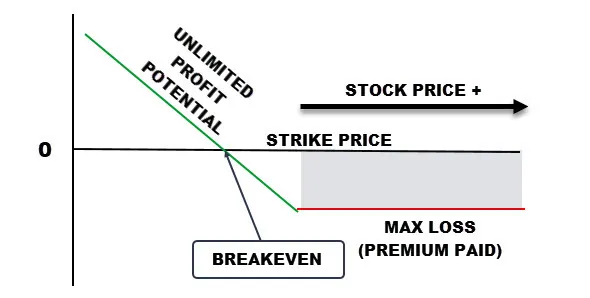

Buying Puts

Whether you’re a seasoned options trader or just starting out, individual puts may be the perfect strategy for bearish markets. Put simply, individual puts are options that give you the right (but not obligation) to sell 100 shares at a specific price within a specified time frame. If you’re expecting a quick move downward in the market, this strategy could be just what you need.

Individual puts are bought when a trader is bearish on an underlying asset but does not want to short-sell it by borrowing stock. When individual puts should be used depends on what kind of market is being traded. This strategy works best when traders expect prices to go down quickly.

Imagine you buy a put option for ABC stock with a strike price of $50 for $1.30. This means you have the right, but not the obligation, to sell 100 shares of ABC stock at $50 per share by a certain time (options expiration date).

To have this right, you pay a premium of $1.30/share X 100 = $130.00 to the seller of the option who must buy the ABC stock from you at $50/share if you decide to sell it by exercising the option.

If ABC stock drops down to $40 per share, you could then exercise your option and sell the stock at $50 per share, and then buy it immediately at the current market price of $40 per share. This would give you a profit of $10 per share.

The fact is that less than 10% of contracts are exercised.

However, if ABC stock goes up to $60 per share, you would not exercise your option because you could sell the stock for more than the strike price. The contract would therefore be worthless.

The most you can lose on this trade as the buyer of the put option is $130.00

The main advantage of using individual puts is that they allow traders to benefit from quick moves downward without having to short-sell stocks or futures contracts—which have their own set of risks and implications.

Buying puts is an expensive way to short but they do offer good profit potential (essentially unlimited with buying calls) and your risk is limited to what you paid to put the trade on.

Time decay is the enemy of buying puts as the longer it takes the stock to make the move to the downside, the more you lose on the options contract.

| BIG LIST: Bearish Strategies for Option Traders |

|---|

| Short selling: Selling shares you don’t own, in the hope of buying them back later at a lower price. |

| Long puts: Buying put options that give you the right to sell a stock at a specific price before the expiration date. |

| Bear put spreads: Buying a put option with a higher strike price and selling a put option with a lower strike price at the same time, to limit potential losses. |

| Synthetic short: Combining a long put option with a short call option at the same strike price, to mimic the profit and loss characteristics of short selling. |

| Protective puts: Buying a put option to protect a long stock position from losses. |

| Short call options: Selling call options that give the buyer the right to buy a stock at a specific price, hoping stock price will not rise above strike price. |

| Bear call spreads: Selling a call option with a lower strike price + buying a call option with a higher strike price to limit potential losses. |

| Short straddles: Selling both a call option and a put option at the same strike price, in the hope that the stock price will not move much. |

| Short strangles: Selling both a call option and a put option at different strike prices, in the hope that the stock price will not move much. |

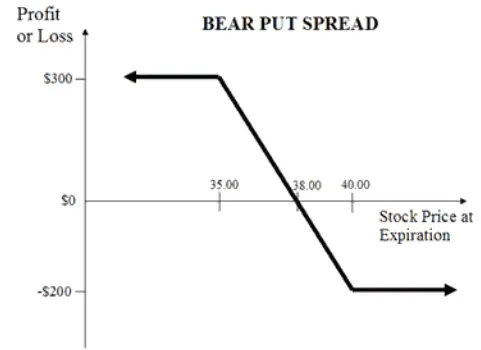

Long Put Vertical Spread

A long put vertical spread is an options trading strategy in which a trader purchases 1 OTM put option and then sells another OTM put option). This means that the strike price of the sold option is lower than that of the purchased one, which helps to limit losses by reducing the net debit taken on when entering the trade.

Your maximum loss is restricted by how much farther out of the money your short strike is compared to your long one.

This strategy is ideal for traders who anticipate trading for an extended period and want to reduce their initial costs. It’s also great for those who wish to benefit from small price movements in either direction; if there’s not much movement in either direction, then both legs will likely end up near expiration value, resulting in minimal losses or gains overall.

Finally, this strategy can be used when volatility is low—as it reduces risk by limiting potential losses—or when volatility is high, as it allows traders to benefit from potential large profits with limited capital outlay.

For a more detailed look:

ABC stock is trading at $40.00 and we buy 1 put option at a $40.00 strike price for $3.00. At the same time, we will sell 1 put option at the $35.00 strike for $1.00.

What does this mean: We have the right to sell 100 shares of ABC stock at $40. We have an obligation to buy 100 shares, if the buyer of this contract exercises their right, at $35.

Unlike buying a put, our profit potential is limited to the difference between the short and long strike ($5.00) minus the cost of the trade ($2.00) or $3.00.

At the same time, our risk is defined to the debit we paid and in this case, $2.00. We also can’t forget that because we receive a credit when we set up this trade, these tend to be cheaper than buying a put option.

Utilizing a long-put vertical spread comes with many advantages for traders who are looking for ways to reduce their initial costs while still being able to capitalize on potentially significant market movements.

While this strategy does require some knowledge and understanding of options trading and risk management practices, it can provide traders with an excellent way to control their exposure levels while still being able to profit from market volatility over time.

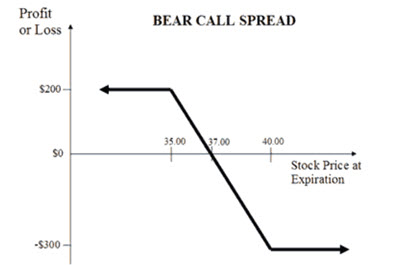

Short Call Spread

If implied volatility (IV) is above 50th percentile then it might make sense to sell a call spread.

A short call spread is a bearish options strategy that involves two calls with the same expiration date and different strike prices.

What Is Implied Volatility?

Implied volatility (IV) is a measure of how much investors expect an underlying stock to fluctuate over a certain period. It is determined by analyzing the current price of options contracts on that particular stock.

The higher the IV, the more expensive options contracts are—which means that investors are expecting greater volatility in the stock’s price.

The goal of this strategy is to profit from an expected increase in the volatility of the underlying asset (or not go lower), or for the underlying asset to remain below the higher strike price at expiration.

This involves selling an out-of-the-money (OTM) call option and buying an OTM call option with a higher strike price. By doing this, you can take advantage of an increase in IV and potentially benefit from any downward movement in the stock’s price.

Imagine XYZ was trading at $37.00 and you are strongly bearish.

Setting this example up would look like this:

Sell 1 40 Call for $4.00

Buy 1 45 Call for $1.00

You are obligated to sell 100 shares at $40 if that contract is exercised.

We have the right to buy 100 shares at $45 if you chose to exercise.

Because you sold a call, that premium is a credit and in this case, you net $3.00 after paying for the call you bought.

Your profit is capped at what you keep as the credit for the trade: $3.00/share or $300/contract.

The most you can lose on this trade is the difference between the strike prices minus the credit received from selling the spread

45 strike – 40 strike = $5 difference.

$5 – $3 (credit received) = $2. This is your maximum loss

The main pro of using short-call spreads is that they are relatively low-$ risk trades that offer a decent reward if done correctly. While your profit potential is limited, these are less expensive trades to set up and you can profit from two different market movements. As long as we stay below or right at the short strike price, we can make money.

However, there are some cons as well—namely, if volatility decreases or if there isn’t enough downward movement in the stock’s price, then your position may not benefit as much as anticipated.

Additionally, if there are sudden changes in market conditions, then your position may be at risk as well. So make sure to do your research before entering into any positions!

Conclusion

No matter what kind of trader you are—bearish or bullish—there are always options trading strategies that can help you make money even when markets are not performing as expected.

Whether it’s individual puts, short call spreads, long put vertical spreads or short call vertical spreads there is something for everyone and every market condition!

Make sure to do your research and understand all risks before getting started so that you can maximize profits while minimizing losses on bearish trades!