- February 9, 2023

- Posted by: Shane Daly

- Category: Trading Article

Trading options can feel intimidating and risky, but the truth is that there are several myths about this form of trading that can lead beginner traders to ignore the opportunity. In this article, we’ll explore some of the most common myths about options trading so that you can make informed decisions when it comes to your investments.

Myth One: Options Trading Is Complex

This myth is perpetuated partly because sophisticated financial terms and calculations often come up in conversations around options trading. When we start talking about time decay and implied volatility with options pricing, it can be intimidating for many traders. In reality, the basics of options trading are quite straightforward and logical. Yes, some complex option trading strategies involve multiple contracts and that gets confusing but with time, you can learn them as well.

You don’t need to jump into strategies like vertical spreads right away. Getting your feet wet by simply buying calls and puts is not a bad idea.

How simple are they?

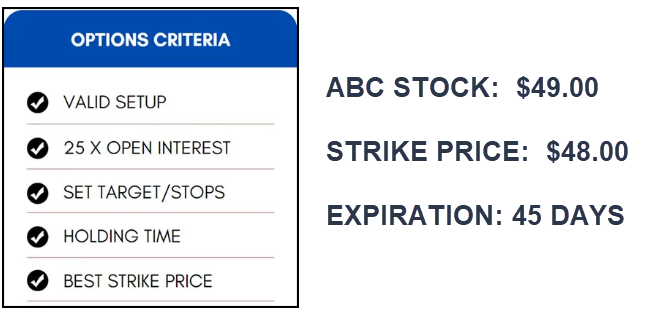

Imagine you are bullish on ABC stock which is currently trading at $49.00. Through your trading strategy, you see momentum coming into the stock and a target price of $60.00 within a few weeks.

You decide to buy a call option that is one strike price in the money at $48.00. This contract expires in 45 days. While you could buy the shares of ABC at $49/share, you would need $4900 to buy the 100 shares an options contract covers.

Instead, you see the premium is $2.45 for the contract and only requires $245.00 to be involved in the trade. The most we can lose is what it cost us to open the trade: $245.00.

Our profit potential, in theory, is unlimited.

Our profit potential, in theory, is unlimited.

If you’re correct with the trade and the stock goes to $60.00, you have the right to buy 100 shares of ABC at $48.00 and could then sell those shares for the current market price of $60.00.

The reality is that only about 7% of contracts are exercised. What usually happens is you would see the stock rise along with the premium especially if this move is happening fast.

You see that you could sell to close the contract at the current premium of $5.50 ($550.00).

You close the contract and after subtracting the cost to set up the trade (245.00), you bank $305.00.

While this is just an illustration and other factors do come into play, this is a simple strategy you could learn in a day.

Myth Two: You Need A Large Account

You do not need a large account to trade options. Many brokers offer more accessible commission fees and flexible contracts than ever before, making it easier for even beginner traders to get involved in the world of options trading.

Some brokers will allow you to open an options trading account for $500.00 although that is not an amount we would ever suggest. We suggest a starting balance of $3000 – $5000 where you could start trading by buying calls and puts. Other strategies will require a margin account.

Myth Three: You Can’t Make Money With Options

Options traders can and do make money on their trades. The key is to understand the risks associated with options trading and to develop a sound strategy for managing them. Learning how options work, how they move in correlation with the stock market, and which strategies are best suited to different kinds of market conditions will help you become a successful options trader over time.

One key we have found is not holding until the expiration date. As options get closer to that date, we lose extrinsic value (time) for the stock to make the move we want. There are various methods of taking profits including closing when you’ve made a percentage of what you risked.

Options are not the same as looking for a reward-risk ratio of 3:1. In fact, closing trades at 1:1 or less is a common method.

It’s not a get-rich-quick scheme, and anyone who promises quick and easy profits from options trading is likely not being truthful. Successful options traders understand that it takes time and effort to develop a profitable trading strategy, and they are willing to put in the work to achieve their investment goals.

Quick Summary

Buying calls and puts is a simple strategy that requires a relatively small amount of capital to start trading with.

Options trading does not necessarily require a large account size – some brokers allow accounts to be opened for $500.

It is possible to make money with options, but traders need to understand the risks associated with the trade and develop a sound strategy for managing them.

It is not a get-rich-quick scheme, and success takes time and effort to achieve profitable trades.

Taking profits at 1:1 or less is a common method of options trading – holding until the expiration date should be avoided as much as possible.

Trading Options Can Be Profitable

…….but it’s hard to know where to start and how to succeed.

Most people give up after a few losses or they don’t have the time to trade options for hours each day.

Our 8-Minute Options Trading Cookbook will show you how to win 5 different ways on every trade in just minutes per day! You’ll get a free strategy that shows you how this is done.