- February 6, 2023

- Posted by: Shane Daly

- Category: Trading Article

Understanding the difference between intrinsic and extrinsic values in options trading is essential for any trader looking to take advantage of the markets. In this blog post, we’ll dive into what these two values are, provide examples of them in action, discuss factors that can affect their movements, and offer insight as to why option traders should keep a close eye on them.

By the end of this post, you’ll have a better understanding of how to use both intrinsic and extrinsic values to your advantage in options trading.

Quick Hits

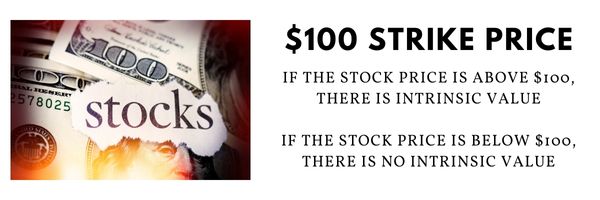

Intrinsic value is the amount by which the option is in-the-money, meaning the difference between the underlying asset’s market price and the option’s strike price.

Extrinsic value reflects the time value and volatility of the underlying asset, as well as the option’s expiration date.

In-the-money options (ITM) have intrinsic value, whereas out-of-the-money options (OTM) do not.

The extrinsic value of an option is time-sensitive and decreases as the option gets closer to expiration.

At Netpicks, we recommend mostly using option strike prices that are 1-2 strikes ITM.

Introducing Intrinsic & Extrinsic Values in Options Trading

One of the key concepts in options trading is the distinction between intrinsic and extrinsic value. The intrinsic value of an option is the amount by which the option is in-the-money, meaning the difference between the underlying asset’s market price and the option’s strike price.

For example, if you have a call option with a strike price of $100 and the underlying asset’s market price is $105, then the intrinsic value of the option is $5.

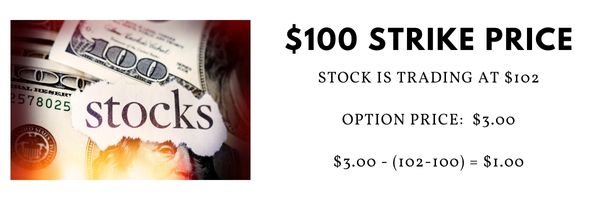

On the other hand, the extrinsic value of an option is the amount by which the option is out-of-the-money, or the difference between the option’s market price and its intrinsic value. In other words, the extrinsic value reflects the time value and volatility of the underlying asset, as well as the option’s expiration date.

For example, if the option has a market price of $3 and an intrinsic value of $2, then the extrinsic value is $1.

Overview of the Difference Between the Two

In options trading, it is important to understand the difference between intrinsic and extrinsic value because the two types of value can affect the option’s price and the potential profit or loss from the trade. For example, if the underlying asset’s market price increases, the intrinsic value of the option will also increase, while the extrinsic value may remain the same or decrease.

This means that the option’s market price may also increase, potentially resulting in a profit for the option holder.

However, it is also important to keep in mind that the extrinsic value of an option is time-sensitive, meaning it decreases as the option gets closer to expiration. This means that if the underlying asset’s market price does not move in the expected direction before the option expires, the option’s extrinsic value will decrease, potentially resulting in a loss for the option holder.

What is In-the-Money and Out-of-the-Money?

There are two main types of conditions regarding your options you should know.

In-The Money Options (ITM)

An in-the money option (ITM) is an option whose strike price is below the current market price of the underlying asset. Put simply, this means that if you were to exercise your ITM option right now, you would make a profit.

For example, let’s say you purchase a call option on IBM, with a strike price of $100 and IBM’s current market price is $105. This means that your call option is in the money because it has an intrinsic value ($5). It also means that if you were to exercise your call option right now, you would make a profit.

Out Of The Money Options (OTM)

An out-of-the-money option (OTM) is an option whose strike price is above the current market price of the underlying asset. Put simply, this means that if you were to exercise your OTM option right now, you would not make a profit; in fact, you would take a loss.

Going back to our previous example, let’s say IBM’s current market price is $95 instead of $105; this would mean that your call option is out of the money because it does not have intrinsic value ($0). It also means that if you were to exercise your call option right now, you would take a loss.

At Netpicks, we teach our traders to mostly use option strike prices that are 1-2 strikes ITM. This allows our positions to have value even if there is a slight negative move against the position.

In Summary

Understanding the difference between intrinsic and extrinsic values in options trading is important for making informed decisions about when to buy or sell an option.

In general, having an option that is ITM can help reduce risk and increase potential profits, while an OTM option will have a higher extrinsic value but also greater risk.

Netpicks makes sure to teach our traders strategies to maximize profits while minimizing risk. By understanding these concepts, you can make more informed decisions when trading options and have a better chance of making profitable trades.

Your Free Options Guide

To get started with options trading, download our free 8 Minute Options Cookbook guide. You will learn how we can generate profits in 5 different ways in only a few minutes a day.

1 Comment

Comments are closed.

Excellent job you’re doing, keep it up!!