- January 9, 2023

- Posted by: Shane Daly

- Category: Trading Article

A long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. This strategy is used when the trader thinks the underlying asset will experience little price movement in the near term but will increase in price over the longer term.

In this blog post, we will discuss how a long calendar call spread works and the potential benefits and risks associated with this strategy.

How a Long Calendar Call Spread Works

A long calendar call spread consists of two different option positions – a long call and a short call. The long call (you pay premium) gives you the right to buy the underlying asset at the strike price, while the short call (you receive premium) obligates you to sell the underlying asset at the strike price if the option contract is exercised.

The long call is purchased with a later expiration date than the short call. For example, if you are using a long calendar call spread on XYZ stock, you might buy a December XYZ 20 call and sell a November XYZ 20 call. Both options have a strike price of $20 and expire in different months, but they are both XYZ 20 calls.

Real Life Hypothetical Example

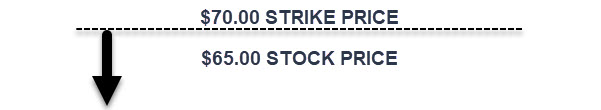

You believe that that OXY ($69.48 at time of writing) is going to experience limited price movement over the next few weeks but start to rise after that.

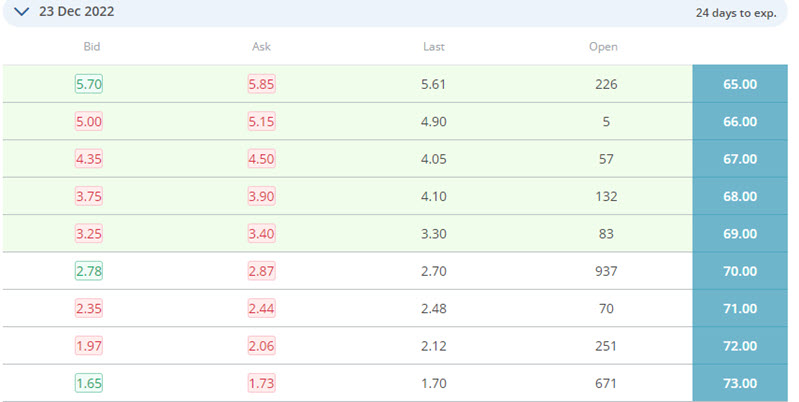

For the call option you will sell, you choose to use the expiration date 24 days out – Dec 23/2022 – with a $70.00 strike price. When selling a call option, you are not expecting much upwards movement before the expiration date.

For example purposes, we will use the ASK price and you receive $2.87 in premium or $287.00 for 1 options contract.

For example purposes, we will use the ASK price and you receive $2.87 in premium or $287.00 for 1 options contract.

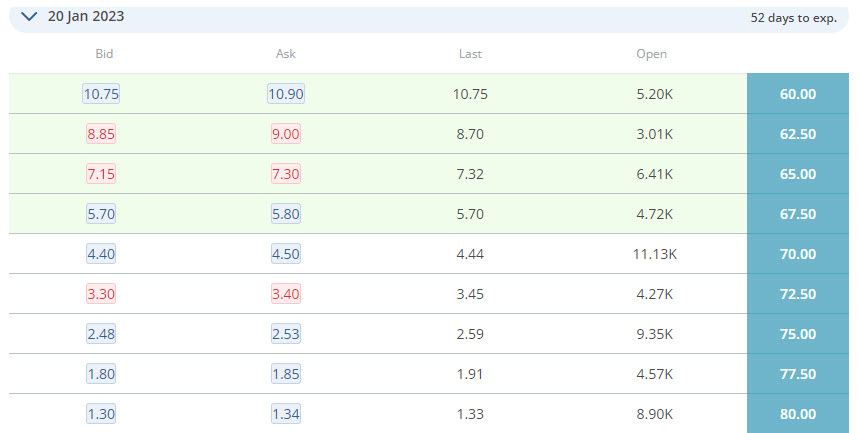

Now, you need to buy the same strike price and decide to go out to the Jan 20/2023 expiration date. When buying a call option, you expect some upwards price movement prior to the expiration date.

For simplicity sake, you get filled at the BID price of $4.40 on this horizontal spread and this costs you $440.00 for 1 contract.

Total cost to set up the position (minus any fees) is $440 – $287 = $153.00.

Calculating Profit and Loss

The most important part of a trading strategy is knowing what your maximum risk is on a trade. In the case of our calendar call spread, your risk is the amount paid to put the position on. In our example, the most you can lose on this trade is $153.00.

Remember that we wrote a call option and bought a longer term call option. The call option we wrote should lose the extrinsic value – time – faster than the one we bought. This being the case means the prices of the contracts that we sold should fall faster than the call options we own. We don’t want to see the price of the underlying move too much prior to expiration of the near term contract.

Scenarios

Using our example, assume that on Dec 23 (expiration date for call you sold), the underlying stock price is at or near the $70.00 strike price.

The call you sold would expire virtually worthless but the call you bought is ATM with time value still present. It is possible that the premium for the call option with the later expiration date is higher than what you paid. If, for example, the premium was now $6.40 and you paid $4.40, you could close your position and make a profit of $2.00 ($200) on the sale. You’d subtract how much it cost you to open the position ($153.00) and you’d net $47.00. Keep in mind that you may want to hold the longer call option if you expect to see upwards price movement heading into January (in our example).

It is also possible that the stock price will rise above the strike price.

While only a fraction of the all options are exercised, if the stock price is above the strike price, it could be. This would force you to have to sell 100 shares of OXY at the strike price of $70.00. The good thing is you also have the right to buy 100 shares at the same strike price leaving your loss at the $153.00 it cost to open the trade.

We could see the stock price fall as well.

In this case, the call you sold would expire worthless and the call you bought with the further expiration date, may still have value. By selling the call you hold, you could offset the max loss by whatever the premium is when you close the position. As an example, if the premium is now $2.02 and you paid $4.40, you could offset your cost by $2.38.

Advantages of Long Calendar Call Spreads

One advantage of using a long calendar call spread instead of simply buying or selling an option is that it can help limit your risk. By selling an option as well as buying one, you’re effectively hedging your bet. In our example above, if you had only bought 1 Jan 2023 contract, your maximum possible loss could be 100 % of the cost to put the trade on ($440.00)

But, by also selling 1 December contract, your maximum possible loss was limited to the cost of the call you bought minus the premium you received for selling the December call ($287.00)

Furthermore, this strategy provides you with limited downside risk while still giving you unlimited upside potential. If done correctly, a long calendar call spread can be an excellent way to speculate on future movements in an underlying asset’s price while limiting risk.

Disadvantages of Long Calendar Call Spreads

Of course, no strategy is perfect and there are some disadvantages associated with using long calendar spreads.

First of all, because you are buying and selling options, there are going to be commission costs associated with this trade. These costs can add up quickly, eating into any potential profits.

Second, if done incorrectly, this trade can still lead to substantial losses. As we saw in our example above, if there was no movement in underlying asset prices after entering into our spread, you will lose most if not all of the amount risk. This is assuming you don’t close the trade prior to expiration.

All things considered, despite some drawbacks, long calendar spreads can still be an excellent way to speculate on future movements in an underlying asset’s price while limiting risk.

Quick FAQs

Q: What is a long calendar call spread?

A: A long calendar call spread is an options trading strategy that involves buying and selling two calls with different expiration dates at the same strike price. The goal of this strategy is to limit risk while still allowing for potential profits if the underlying asset’s price moves in the desired direction before the expiration of the further out contract.

Q: How does a long calendar call spread work?

A: To execute a long calendar call spread, you buy one call with a later expiration date and sell another at the same strike price but with an earlier expiration. If the stock does not move in either direction, you can close your position for whatever gain or loss the premiums have achieved. However, if the underlying asset’s price does move in your favor, you could potentially realize a profit up to the difference between strike prices minus the cost of putting on the spread.

Q: What is the main advantage of using a long calendar call spread?

A: One advantage of using a long calendar call spread is that it helps to limit your risk. By buying and selling both calls, you are essentially hedging your bet which can help protect against a large loss if the stock does not move in either direction. Additionally, this strategy provides limited downside risk while still providing unlimited upside potential.

Q: What is the main disadvantage of using a long calendar call spread?

The main disadvantage is a stock the exhibits no price movement or too much movement to the downside.

Are you looking for a way to make money during these volatile times?

You’re in luck! Our free guide reveals a secret options strategy that can help you profit from the stock market’s ups and downs. Download your free copy now to learn how to make money no matter what the markets are doing. Click here to download your free guide now!