- January 12, 2023

- Posted by: Shane Daly

- Category: Trading Article

Are you an options trader looking to capitalize on short-term market volatility? Short-call calendar spreads are a great way to do just that. By combining two options in the same underlying asset with different expiration dates, these options strategies offer the potential for profit/income while limiting your risk depending on how you manage your trades.

In this article, we’ll explain the ins and outs of short call calendar spreads, from what they are to how you can use them to generate profits. We’ll also discuss the maximum profit potential and maximum risk of these options strategies so that you can make informed trading decisions. Read on for all the details about short call calendar spreads!

What Are Short Call Calendar Spreads

Short call calendar spreads involve the purchase of an options contract with a near-term expiration date and the simultaneous sale of an options contract with a longer-term expiration date. Both options are on the same underlying asset with the same strike price.

In this example, assume you are interested in VERTEX PHARMACEUTICALS INC (VRTX) that at the time of this example was trading at $322.54.

We would use short-call calendar spreads when we think price movement will be sharp but uncertain in what direction. Such options strategies are often employed before the release of important news, such as a company’s earnings report or any announcement that could increase volatility in the underlying instrument.

We would use short-call calendar spreads when we think price movement will be sharp but uncertain in what direction. Such options strategies are often employed before the release of important news, such as a company’s earnings report or any announcement that could increase volatility in the underlying instrument.

In our example, VRTX is in sustained uptrend and has yet to clear new highs. We are using a technical reason for the trade as we anticipate a break but it could easily drift into a range.

Setting Up VRTX

You decide to set up the short call calendar spread and look to collect premiums as potential income.

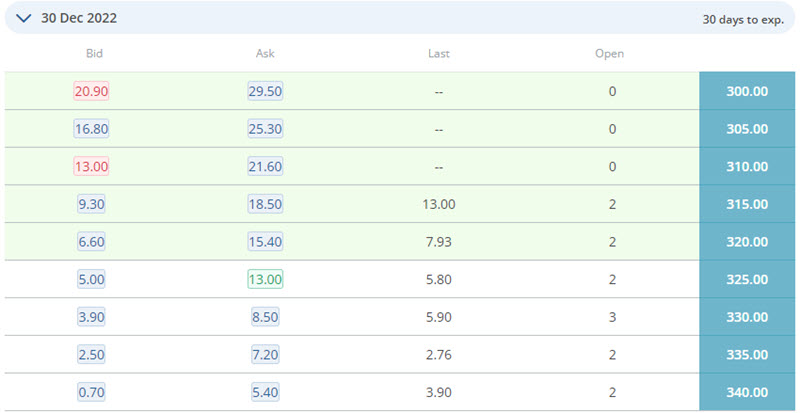

First step is to buy a call option with a near term expiration date of 30 days for the $320.00 call option. I would look at the $325 strike however that strike is not available for the second part of this trade. For the example of buying, we will use the bid price of $6.60. This contract will cost you $660.00

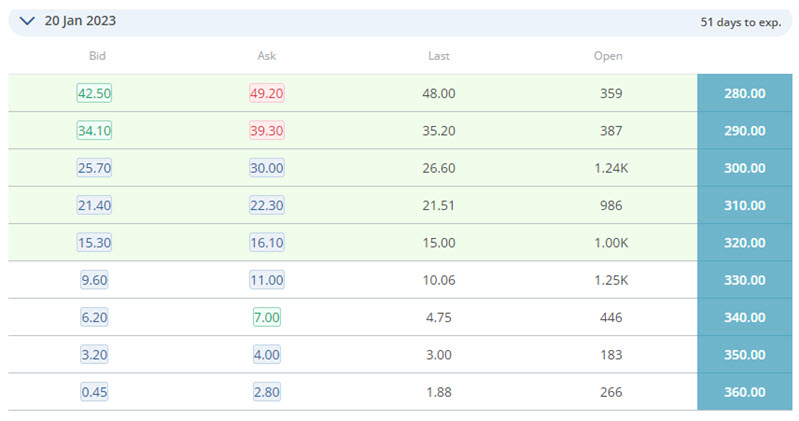

The next half of the trade is selling a further out expiration date and you head out 51 days. We are going to use the ASK price for the premium you’d receive for selling the call.

You sell the $320.00 call and receive $16.10 in premium or $1610.00.

You would end up with a credit of $1610 – $660 = $950.00 when you place this trade.

The Maximum Profit Potential

So, what’s the maximum profit potential for this strategy? It largely depends on factors such as the time until expiration, interest rates, and implied volatility. However, in general, the maximum profit potential for this strategy is limited.

This is because your maximum profit will always be equal to the premium you received when you sold the option minus the premium you paid when you bought the option. So, if you sell an option for $1 and buy an option for $0.50, your maximum profit would be $0.50 per share.

In our example, the max profit you can make on this trade is $950.00 minus commissions.

What Is Our Max Risk?

While our profits are limited, our risk is potentially unlimited if the long call expires worthless but the short call, the one you sold further out, is still open. This is why it’s so important to monitor a short calendar spread position as expiration date number one approaches—because once that date arrives, there’s always a possibility that both options will remain alive and expose our trader to additional risk.

Imagine both contracts are still active, the maximum risk to you is if the strike price is virtually the same as the underlying stock price when the near-month expiration date rolls by.

The short call, the one you sold, still has time value (Theta) because it is currently at the money. Because the expiration date is further out, there is time for the stock to increase in value which lends itself to a higher premium. Remember, at the expiration of the first contract, the long call is worthless and the difference in premiums between the long and short call, is large.

In short, we don’t know what our maximum risk can be. The best we can do is manage our trade and close out when we can see the reward is not in our favor.

For safety sake, closing out this position before the expiration of the front month contract would be prudent. Holding the obligation to sell shares at a strike price lower than the actual share price, could be a disaster.

Breakeven Prices For Short Call Calendar Spreads

There are two breakeven points for a calendar spread–one above the strike price and one below.

The “breakeven points” are the stock prices on the expiration date of the long call combined with the original price of the calendar spread—at which point, you break even.

Since the worth of a short call is based on volatility, it’s impossible to know what the stock prices would need to be to become breakeven.

Quick Hits

Short call calendar spreads have limited potential but can be potentially high risk.

The maximum profit is realized if the stock price is far above or far below the strike price on the expiration date of the long call.

The maximum risk of a short calendar spread with calls is unlimited if the long call expires worthless and the short call stays open.

There are two breakeven points at which the time value of the short call equals the original price of the calendar spread.

Short calendar spreads with calls are often used when a forecast is for a big stock price change but the direction is uncertain.

Are you looking for a way to make money during these volatile times?

You’re in luck! Our free guide reveals a secret options strategy that can help you profit from the stock market’s ups and downs. Download your free copy now to learn how to make money no matter what the markets are doing. Click here to download your free guide now!