- April 11, 2020

- Posted by: CoachMike

- Categories: Options Trading, Stock Trading, Swing Trading, Trading Article

After a big wave lower in stocks due to the initial reaction to the coronavirus spreading, markets have recovered off the lows in a big way.

We saw stocks rally 25% over the last 2 weeks on hopes that the worst of the virus spread is over with and also a sign the measures taken by the Fed to prop markets up will continue to prevent any further damage from being done.

Turn on financial media this weekend like CNBC, Bloomberg, or Fox Business and they all will have experts on talking about how now is a good time to put money to work. How stocks are at a discount and ready to move back towards the highs as soon as companies start opening back up.

However, is the bottom really in for stocks long term?

We don’t like to base trading decisions off headlines or what financial media has to say. We like to focus on what the technicals on the carts are telling us. Let’s take a look at what levels we are keeping an eye on going into next week.

Daily SPY Chart – Our Barometer

We like to use the daily chart of SPY (S&P 500 ETF) to gauge overall market strength/weakness.

Looking at that chart below you can see the big rally over the last 2 weeks off the lows.

As we wrapped up the shortened trading week on Thursday we saw price stall out right at the 50 period exponential moving average which is at $280.47. This is a key line in the sand going into next week.

Should this level break higher we could see an extension up to our next cluster of moving averages between $290-$300.

If the $280.47 level holds as resistance we would be looking for a move lower down to the 8 period exponential moving average down at $264.36. This is the path that I’m looking for going into early next week.

Volume

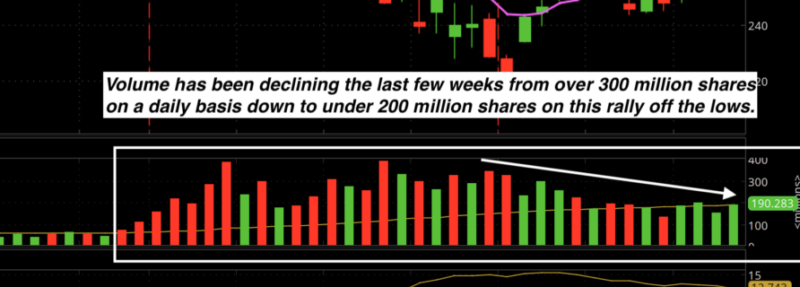

With the big moves back and forth that we have seen over the last month, overall volume has been impressive. Going back to 2019 we would struggle to see 50 million shares trade on a daily basis on SPY.

Over the last month we have seen many sessions with well over 200 million shares traded. This big volume certainly is good for traders.

However, we have seen volume decrease over the last 2 weeks as markets have moved higher. There hasn’t been as much conviction behind this move higher. With volume continuing to trend lower as equites bounce, we think it will be difficult for this move higher to continue at this pace.

If price is to continue moving higher, we would like to see volume start trending higher again which would indicate more commitment from traders. On the flip side, if volume picks back up should price roll back over lower next week that could give us a quick move lower towards the deeper support level which is at the 20 period moving average on SPY at $252.33.

Volatility

Here is one are of concern with the calls for a market bottom the last week. With equities up 25% over the last 2 weeks you would expect volatility to get crushed. While it has come down we are still looking at the VIX trading at 41.67. This is an elevated leave historically which shows the fear level in this market still high.

We expect the VIX to find support at $40.00 and move higher next week. This would correspond with a move lower in equities.

Big Week Of Earnings

Next week is a big week as earnings season begins to kick off in a big way. The Financial sector will lead the charge with names like:

- Citigroup (Symbol: C)

- Back of America (Symbol: BAC)

- Goldman Sachs (Symbol: GS)

- JP Morgan (Symbol: JPM)

It will be very interesting to hear from these companies how much of an impact this global shut down is having on their numbers.

The overall market will take notice of these numbers and we could see big reactions in either direction. We will be watching these numbers closely as it can impact our outlook for the market in a hurry.

Best Trading Strategies For Next Week

With volatility remaining high and SPY touching some key resistance levels last week we are looking to position ourselves for a move back lower next week. While this might seem like a good opportunity for long put options be careful as the option premiums are still extremely high.

I would rather focus on using more vertical spreads again next week. Using credit spreads with volatility so high will provide more forgiving trades. They will tie up less capital and also give us 5 ways of making money on the trades.

In this environment where big moves are possible in either direction I would rather focus on trades that will give me multiple ways of making money.

I continue to focus on options that have 20-40 days left to expiration. This has me most interested in the May 1 and May 8 weekly options as well as the May 15 monthly options.

Stocks and ETF’s To Watch For Next Week

Bullish Opportunities:

-VXX

-MSFT

-UAL

-WYNN

Bearish Opportunities:

-QQQ

-EA

-DIA

-CAT

-XLF

-AAPL

-AMZN

I’m not ready to call the bottom in place long term.

With the current conditions outlined above I do believe the market will continue to stay very active in both directions. In the near term after this big move higher the last 2 weeks we are looking for another push lower going into next week.

That could set conditions up for another wave to the upside going out the next month.

The key in these markets continues to be to keep the risk small and diversify with different options strategies as much as possible. Now is not the time to load the boat in either direction. Focus on creating the consistent smaller winners in this market and you will be far better off.