- December 4, 2021

- Posted by: Shane Daly

- Categories: Trading Article, Trading Indicators

Combining trend lines and the Awesome Oscillator gives you a trading strategy that is built on how markets move.

- Awesome Oscillator is a measure of momentum in the instrument you are trading

- Trend lines help determine not just trend, but also the rhythm of the market

Once we see a change of state in the market via trend line breaks plus a shift in momentum, it gives us an opportunity.

I have a complete Guide to Trading the Awesome Oscillator that you can refer to if interested in how this indicator is built.

There are also the “purists” who can’t think outside the box when it comes to trading indicators. You can find a use for an indicator outside the main strategy that was originally designed by the developer.

Traders will also want to ensure they have a set way of drawing trendlines.

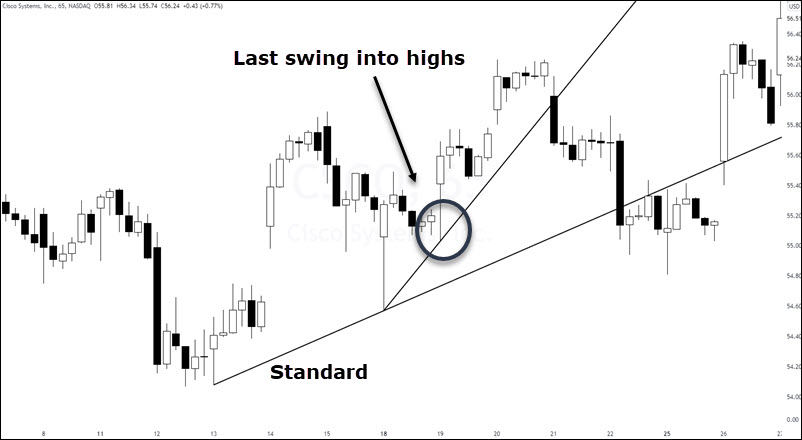

You can read the article about trendline drawing rules but in brief, I try to ensure the last swing into the high (or low) is touched if drawing trend lines by connecting swing points.

Setting Up The Charts

It doesn’t matter the time frame you use. Keep in mind that lower time frames, in any instrument, have more noise than the higher time frames.

There are no settings to adjust with the AO indicator unless you are using a custom built indicator.

Refer to this daily stock chart to see how I drew these trendlines. Yours may not be exact and you may have some areas where price poked below the trendline. That is fine as long as there is no price acceptance and significant price action below the trend line for an uptrend. The reverse is true for downtrends.

Awesome Oscillator/ Trend line Strategy Rules

What are we looking to accomplish with this strategy?

At it’s most basic form, we are trading reversals into, hopefully, a new trend direction. We can also use it to trade continuations back in the direction of the trend.

What does the basic form look like?

- A trend line break

- Momentum to the upside or downside increasing as shown by the oscillator

Buy Setup and Trigger

We are looking for price action to be showing a down trending market.

- Price breaks over the down sloping trend line to the upside

- The oscillator turns green and begins to rise

- A buy stop is place above the high of the candlestick indicated by the green bar on the oscillator

Our sell setup and trigger is the opposite.

Sell Setup and Trigger

- Price breaks under the trend line

- The oscillator turns red and begins to fall

- A sell stop is place below the low of the candlestick indicated by the red bar on the oscillator

Let’s take a look at the same chart as above.

Our first sell is on the left at $260.58 when price breaks below the trend line while the oscillator is red and heading down.

In the middle, at $230.19, the entry price has been scaled down as price retraced. It found support at the trendline, the oscillator is green and the buy stop placed and triggered.

The last setup and trigger is at $261.60. On the break of the trendline, the oscillator was still green and price retraced. Price did not break back over the trendline, the Awesome Oscillator turns red and falling as price action triggers the entry.

Bitcoin Buy

If you are a perma-bull with Bitcoin like I am, you look for entries into the uptrend.

Trend line break after a corrective move down, AO turns green and rising and a $42500 entry into Bitcoin.

Shorter Time Frame

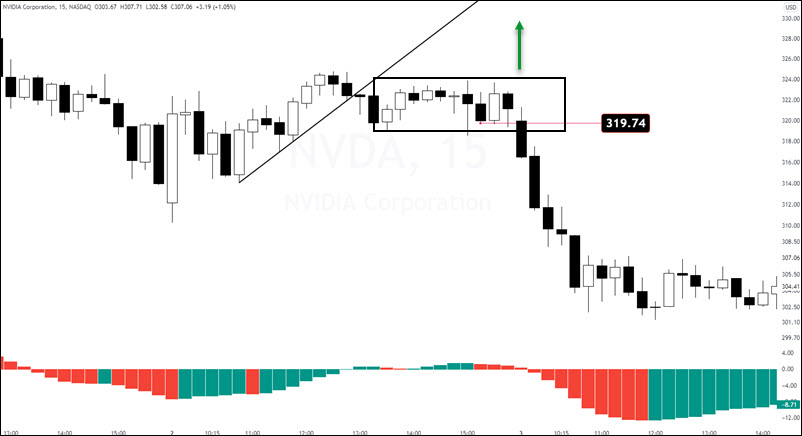

If you trade options, here is a recent play on NVDA where you would have used puts looking for further downside.

Price broke the trendline and the AO turned red with no trigger short. As price rallied back up, the oscillator turns green and our entry is off the table.

After a brief range, we get a red oscillator and we look to trade the break of $319.74.

Trading Ranges

This condition of the market, a trading range, is where you can get chopped up as whipsaw takes place. This is more obvious on shorter time frames and you can easily scan charts and discard ones in a current range.

This one however, we do expect some consolidation after a break and the good things is, we are only looking for breaks short.

We discount any trade to the upside.

For example, we would not bracket the range like this and play anything to the long side as short plays are in force:

When scanning for instruments to trade, you may decide to skip any that are currently in consolidations. There are plenty of instruments out there that you can trade.

Protective Stop Placement

There are a number of ways to place your protective stop.

For this strategy, you may want to consider a location that respects what is behind these trades: momentum and change of direction.

We expect some positive price excursion once we enter a trade because:

- Momentum is increasing

- Change of rhythm has occurred

- Our entry is only trigger when price moves in our direction

The logical location is below the low or above the high (for shorts) on our setup candle.

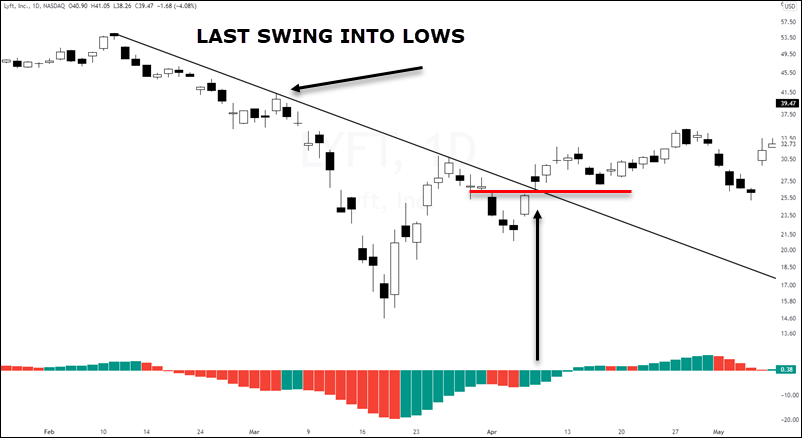

The run into lows was a series of lower highs so the trendline break will be far from the low of the swing down.

Once price broke the trendline to the upside and we trigger into the trade, our stop would go below of the setup candle.

Price advanced and a pullback occurred that challenged our stop but did not trigger it.

Some traders would already be out of this trade depending on how they set profit targets or manage the trades.

Profit Targets

Like the stop, there are many ways to set your ultimate price target.

In a momentum setup like this, shooting for a 1:1 reward to risk ratio can work well.

In fact, depending on how you manage trades, you may not take a full 1R loss.

Let’s take a look at an example.

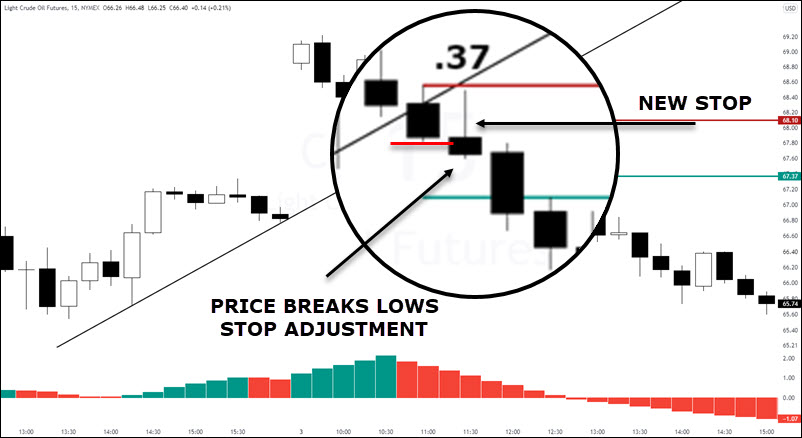

Assume you are day trading crude oil and price action overall, is bearish.

The next morning gaps up and until proven wrong, you are looking to short.

Our setup and trigger occurs and using the high of the setup candle, we have a .37 stop.

Our profit target would be .37 plus commission, to the downside.

Once the trade is heading in your direction by breaking new lows, you could inch down your stop. This ensures you don’t take a 1R loss at any time.

This trade pays out a full 1R win.

Managing Trades

Many traders that set profit targets have a tough time when price runs while they are sitting in cash.

You may want to explore a trailing stop method the begins once the trade has gone to it’s 1R target.

Trade can go to breakeven and your trailing stop method is triggered.

Ensure you test to see if a trailing stop loss helps or hinders your ability to make profits. You may find you get breakeven results before your trailing stop moves enough to lock in profits.

Final Example

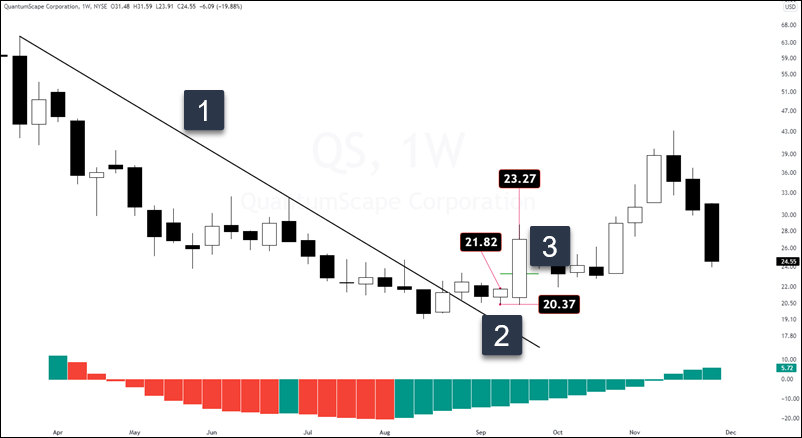

Let’s look at one more example using a weekly stock chart.

- Price is in a bigger picture down trend

- Price breaks above the trendline with a green and rising Awesome Oscillator. Trade entry follows the lower highs until triggered, breaks below the trendline, or the oscillator turns red

- This is an example of a 1R target that is met on the day the trade triggered

You may find taking your 1R profits a much more relaxed and successful way of trading. Test it out and let me know how that goes.

Very Important

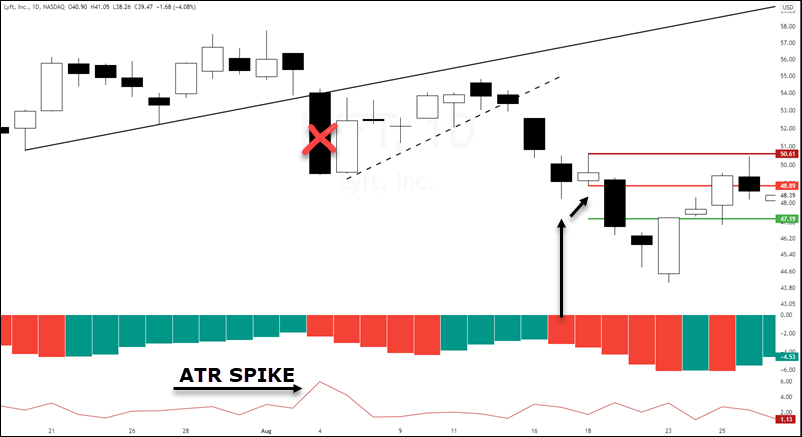

One thing to be mindful of is “big bars”.

Whenever price makes a large move in one direction, we often see mean reversion occur.

On this chart of LYFT, price breaks the trendline and the setup is valid.

Note the size of the candlestick and the 1 day ATR spike. This is a perfect example of when to expect some type of rally as mean reversion begins.

You could take the trade and end up scaling your entry under the high lows of each candle.

I do not recommend that.

Remember, we are trading momentum in the direction of the break. Given the size of the candle that breaks, assume the momentum has “blown off” and wait for a new setup.

We can use an upsloping trendline under the lows and as long as the main signal is valid, look to play a new momentum trade.

Summary

I like momentum trades and understand the need for taking profits before mean reversion beings.

This is why for this strategy, I would not use a trailing stop method of exit.

Give me my 1-1.25R profits and very rarely will there be a full 1R loss.

There are some nuances that you will learn as you investigate this strategy.

The swings noted with the dashed lines are not very clean. Would you use these swings to trade from or wait until the overall direction line breaks?

Even worse, look at the spikes on the right. How would you manage those?

There are a few things you have to decide as you make this strategy your own.

In my opinion, it is based on sound concepts. Map out some rules and give it a try.