- December 16, 2022

- Posted by: Shane Daly

- Category: Trading Article

Trading options can be a great way to make money, but it’s not without its risks. If you’re new to options trading, there are a few mistakes that you’ll want to avoid if you want to be successful. In this blog post, we’ll discuss three of the most common mistakes that options traders make, and how you can avoid them.

Not Having an Exit Strategy for Your Trades

One of the most common mistakes that options traders make is not having an exit strategy for their trades. Before you enter into any trade, you need to know when you’re going to sell. This may seem like a no-brainer, but it’s something that a lot of traders don’t do. They get caught up in the excitement of the trade and forget to set an exit point. As a result, they end up holding onto losing positions for too long and taking unnecessary losses.

An exit strategy is important because it also helps you manage your risk. By knowing when you’re going to sell, you can prevent yourself from holding onto a losing position for too long. You also need to have an exit strategy so that you can take profits off the table when your trade is successful.

Let’s say, for example, that you buy a call option with a strike price of $50, and the stock price rises to $63. If you don’t have an exit strategy, you may be tempted to hold onto the position until the stock price reaches $100. However, if the stock price then starts to fall, you could end up losing all of your profits. On the other hand, if you have an exit strategy in place, you can sell at $63 and book your gains.

Let’s say, for example, that you buy a call option with a strike price of $50, and the stock price rises to $63. If you don’t have an exit strategy, you may be tempted to hold onto the position until the stock price reaches $100. However, if the stock price then starts to fall, you could end up losing all of your profits. On the other hand, if you have an exit strategy in place, you can sell at $63 and book your gains.

Use Market Clues

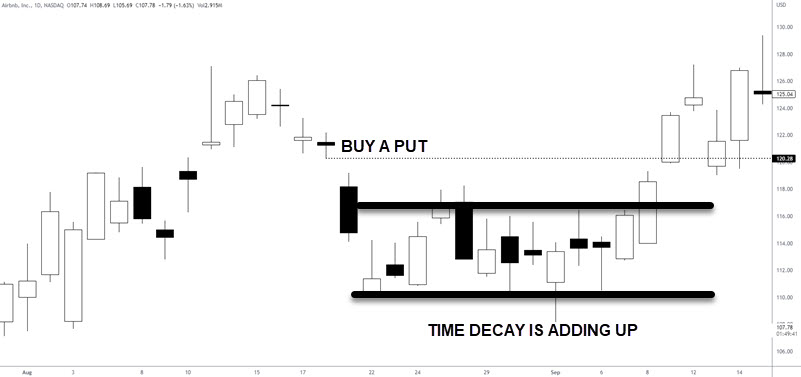

If we are trading calls or puts, we will have a price target in mind but price action dictates when we exit. With calls/puts, time decay adds up the moment you enter the trade. If we are in a position that starts to go sideways, we won’t hold very long watching our profits erode.

Of course, any move against our position is generally an exit signal. We do not want to hold a position that has to make up lost ground toward the strike price.

Of course, any move against our position is generally an exit signal. We do not want to hold a position that has to make up lost ground toward the strike price.

When we consider trades such as a put credit spread, we look to keep 50-75% of the premium we collected to put the trade on. For example, if we collected $.70 to open the trade, then we will look to close the trade when we can buy it back for between $.17 and $.35.

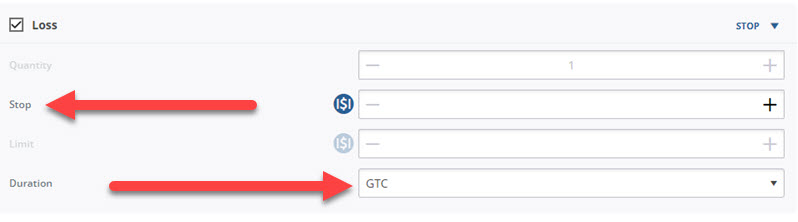

Use Physical Stops

There are two main types of exit strategies: mental stops and physical stops. A mental stop is simply a price at which you’re comfortable selling. For example, let’s say that you buy a stock for $50 and place a mental stop at $40. This means that if the stock price falls to $40, you’ll sell regardless of whether you think it will continue to fall or not. A physical stop is a stop-loss order placed with your broker. This type of stop will automatically sell your position when the stock price hits your specified price.

For our money, placing a physical stop is the safer option. This allows your position to constantly be protected if price goes hard against you.

For our money, placing a physical stop is the safer option. This allows your position to constantly be protected if price goes hard against you.

Trading Contracts with Low Open Interest

Another mistake that options traders make is trading contracts with low open interest. Open interest is the number of contracts that are currently outstanding for a particular option.

One of the dangers of trading options with low open interest is that there may not be enough buyers to absorb all of the contracts being sold. This can lead to what’s known as a “flash crash” in the options market. A flash crash is when the price of an option suddenly drops due to a lack of buyers. This can happen in any market, but it’s especially dangerous in the options market because options are often leveraged instruments. This means that a small price movement can have a big impact on your account balance.

If you’re holding an option with low open interest and there’s a flash crash, you could find yourself losing a lot of money very quickly.

Hard To Exit

Another danger of trading options with low open interest is that you may have difficulty exiting your position. If there aren’t many people trading the contract, it can be hard to find someone willing to buy it from you at a reasonable price. You may find yourself having to accept a lower price than you wanted just to get rid of the contract. This can eat into your profits or even turn your trade into a loss.

As a rule of thumb, consider trading 1 options contract per 25 contracts of open interest. This way, you are almost guaranteed to get your orders filled both in and out of the position.

Therefore, it’s generally best to avoid trading options with low open interest. There are plenty of other contracts out there with higher open interest that will be easier to trade. Sometimes just moving to a different expiration date or strike price will solve this issue.

Buying Only Calls and Puts

Many new options traders make the mistake of only buying calls and puts. While these are the two most popular types of options, other types, such as vertical spreads, can be more profitable in certain situations.

If you are biased to one direction in a high-momentum stock, calls, and puts can work very well. With unlimited profit potential, you can grow your trading account quickly.

On the flip side, the losses can be massive as the underlying drops to $0.00. When buying calls and puts, time decay starts eating into your position at the start of the trade.

Therefore, don’t limit yourself to only buying calls and puts; learn about all the different types of options so that you can use them to your advantage.

Conclusion

Options trading can be a great way to make money, but only if you avoid making common mistakes like these three. Remember to always have an exit strategy for your trades, trade contracts with high open interest, and don’t limit yourself to only buying calls and puts. Do all this and you’ll be on your way to success as an options trader!

To get started with options trading, download our free 8 Minute Options Cookbook guide. You will learn how we can generate profits in 5 different ways in only a few minutes a day.