- January 15, 2018

- Posted by: Mark S

- Categories: Cryptocurrencies, Options Trading, Trading Article

With all of the excitement on Bitcoin these days it’s important as traders to look into how we can profit from the movement. We have not seen something this volatile and potentially lucrative in the long and short term as we have with cryptocurrencies.

- Is Bitcoin going to $1,000,000?

- Is it going to $0?

- Are there other cryptocurrencies on the sidelines looking to challenge Bitcoin?

Do a Google search and you will find opinions all over the place on the future of these products and while Bitcoin is the biggest and most popular product of all the Cryptocurrencies, there are many other ways of playing the craze.

The most straightforward way way of trading Cryptocurrencies is to open a Coinbase or GDax account and trade the coins directly. This appears to be the most popular method of benefiting from this trading opportunity.

However, as an options trader that doesn’t work for me.

I don’t want to miss out on this opportunity, so I took a different route by looking at other products that are influenced by the Cryptocurrency trading and investing opportunity. We have to be creative to look for any correlation that certain stocks have with the Cryptocurrency space.

6 Stocks That Piggyback On Cryptocurrencies

I will give a brief overview of my favorite products and why they are worth a look and then transition into how we can utilize the options to profit from these unique stocks.

NVIDIA (Symbol: NVDA)

With all of the media attention on Bitcoin, it’s easy to forget about how much computing power it takes to mine these products. Since we don’t have the ability to trade the Cryptocurrencies directly with stock and options, one route to go is to trade companies that provide the hardware required to mine the coins.

NVDA and AMD are 2 stocks that have had very impressive movement directly related to the popularity of the Cryptocurrency markets.

Both stocks have good liquidity in the shares of stock as well as the options and while we prefer to focus more on a stock’s technicals, NVDA is a good long term play based on fundamentals as well.

Not only do they provide the graphics processors necessary for Bitcoin mining, the graphics cards are great for gamers as well. With the advance of more Artificial Intelligence technology, the NVDA graphics cards will be in great demand.

While we aren’t interested in a buy and hold strategy, with all of the potential new technology that NVDA will be involved in we should have a great opportunity to trade the moves back and forth with the options strategies taught in the NetPicks Inner Circle program.

Out of these 2 names I prefer to trade NVDA.

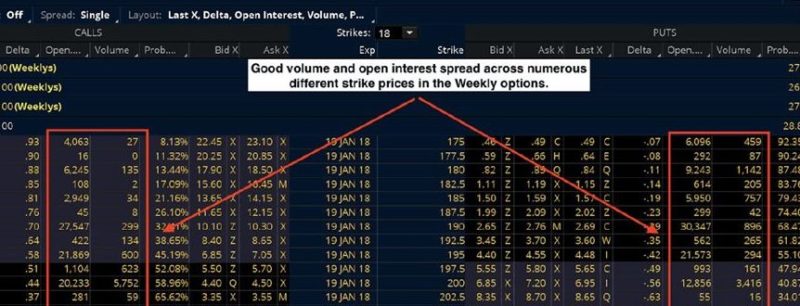

While it is an expensive stock at $200+ per share,it provides the volatility that we are looking for when trading options. NVDA options have good liquidity spread across many different expiration cycles (weekly and monthly options) which gives us more flexibility with the strategies that we use.

We have had nice success using long and short options strategies on NVDA and with the great volatility in the options I see the nice trading continuing long term.

Advanced Micro Devices ( Symbol: AMD)

This is another play on the hardware side of the Cryptocurrency boom. It is an attractive stock for many traders as it is much lower priced at $12 per share.

While not a hot new tech name, AMD does provide the technology necessary for the cryptocurrency mining that we have been talking about.

As we mentioned earlier, we aren’t concerned with the fundamental side of AMD. We won’t be taking a look at product lines and income statements. We are more concerned with how the stock trades in the near term.

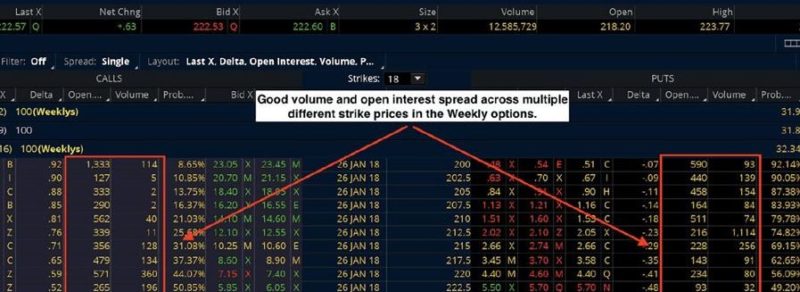

It has shown some nice volatility in recent months and has plenty of liquidity in the options for us to use any strategy we want.

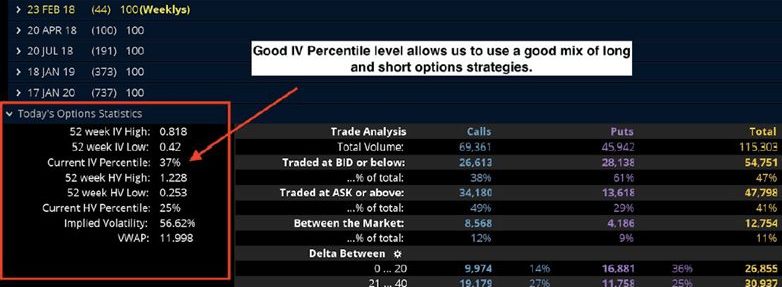

With good options volume and open interest as well as a good level of Implied Volatility in the options, AMD provides a nice vehicle to use a variety of different options strategies. For those of you with a smaller account size, AMD will provide an easier product for you to trade while properly managing your risk.

Overstock.com (Symbol: OSTK)

While most traders know Overstock as an online retailer, they are now heavily involved in the cryptocurrency world as they are one of the first online retailers to accept Bitcoin as a form of payment.

You will want to be careful with companies like this as we are seeing a flood of companies change their name or focus to include Blockchain technology. As a result, it’s not uncommon for these stocks to be up 25-100% in a matter of days.

Does this bring back memories of the tech bubble for anyone?

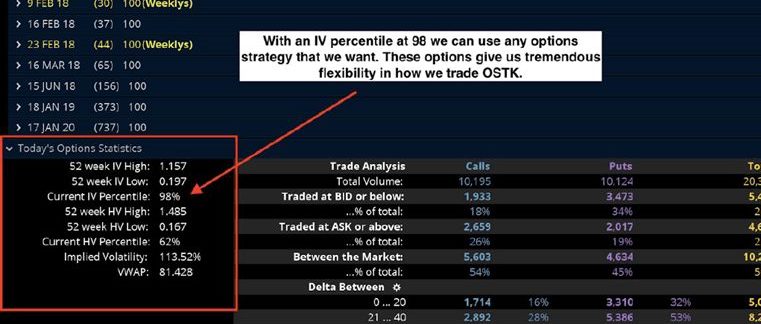

The main attraction for OSTK is their exposure to tZero which is a subsidiary that allows them to accept payment in the form of Cryptocurrencies. Again, we are not concerned with the fundamental side of the company. We want to take advantage of the volatility in the stock.

Over the past 12 months it has become one of the more active names to trade.

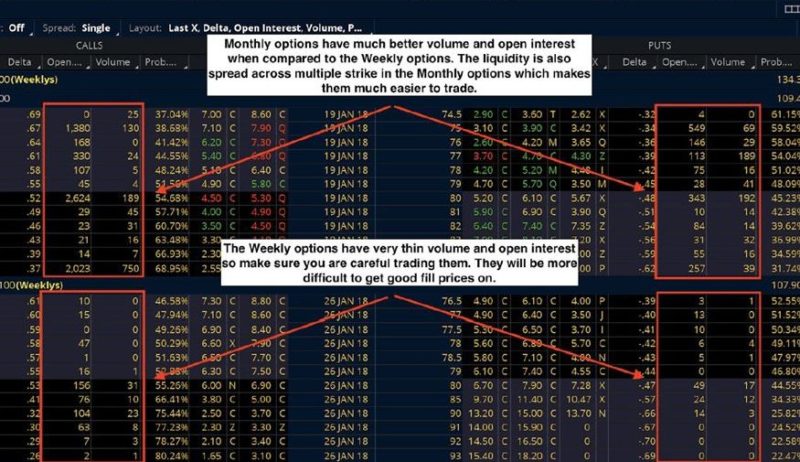

While the options aren’t as liquid as a product like NVDA, there is enough activity for us to be active on a regular basis. I will trade the monthly options over the weekly options on OSTK as they typically have tighter bid/ask spreads. This makes it easier for us to get in and out of trades quickly and at good prices.

I have found that I will have to adjust the prices of my orders at times. It’s very difficult to get filled on any options trades at the mid price between the bid and ask prices. When buying options I typically have to pay up a few pennies while on the sell side I have had to accept less.

The trade off here is that we have seen really great volatility in the stock and it has shown to provide nice swings back and forth. This allows us to be very active on the options side with a variety of different strategies. OSTK is one of my new additions to my personal watch list for 2018.

Square (Symbol: SQ)

As we discussed with OSTK, there will be a rush from companies going forward to accept different Cryptocurrencies as a form of payment. This provides different opportunities for traders that you might not think of initially.

Square actually came out and announced that users can buy and sell Bitcoin on it’s platform. While not an official Bitcoin exchange, it does provide us with another trading vehicle that gives us good volatility and liquid options.

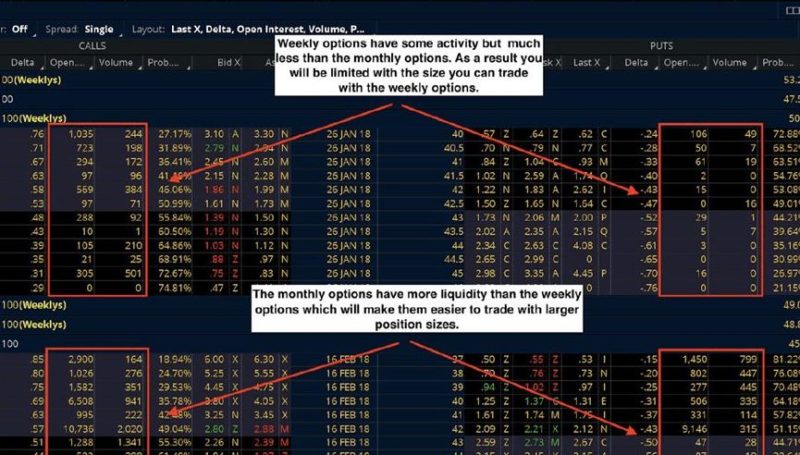

This is another one that is easier to trade with the monthly options rather than the weekly options. The volume and open interest in the monthly options will make them much easier for us to trade without having to give much up on our fill prices.

Riot Blockchain (Symbol: RIOT)

Riot is a perfect example of a company that has made a big transition in its focus which is directly related to the Cryptocurrency boom. It previously was a company focused on providing equipment in the Biotech space.

They are now solely focused on providing technology to support the block chain technology.

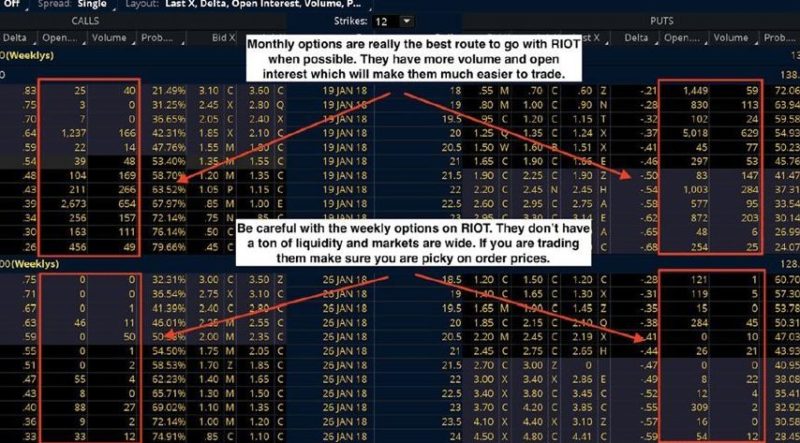

On the trading side, Riot can be a very difficult product to trade. This is not due to a lack of liquidity but more so an issue with the wild volatility.

It is more of a day trading vehicle as we do see some big swings intra-day. This might be attractive to those traders that can be focused on the charts all day.

For the swing traders, you will want to be careful. I would prefer the names mentioned earlier as they will be better products to hold positions for days at a time.When trading the options, you will want to stay clear of the Weekly opportunities on Riot. The monthly options have far better liquidity which will make them easier products to trade.

Other Trading Approaches To Take Advantage of Cryptocurrencies

Stocks like CME and CBOE would give you exposure to the exchanges that are now supporting the Bitcoin futures. The problem with CME and CBOE is the Bitcoin futures really haven’t taken off as expected. The trading volumes on the futures side are low enough that the exchanges really aren’t seeing an impact on their bottom line yet.

You could also look into names like DPW or GBTC (which is the Bitcoin Investment Trust). The problem with names like DPW or GBTC is they don’t give us the ability to trade options.

We would much rather trade products that offer options as we are better able to control our risk and react to different types of market environments.

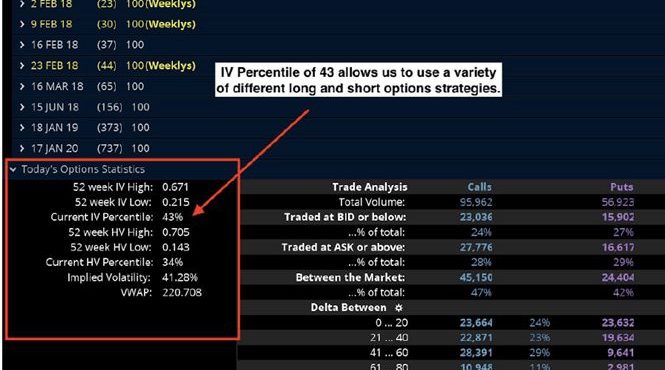

High Volatility Options Strategy

With the unique characteristics that come with trading some of these Cryptocurrency names, it also means we can adjust the way we utilize the options. In previous training sessions in our Inner Circle, we have talked about preferring to use the longer term monthly options that are in the money.

This allows us to better control our risk.

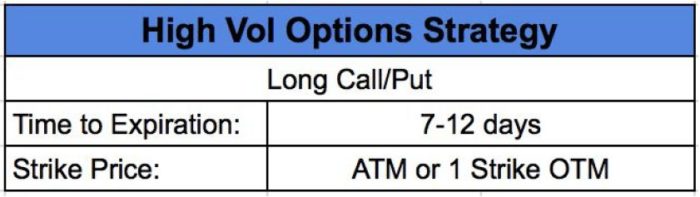

However, with the short holding times that can come with some of these volatile names, we can also use a new approach with the options.

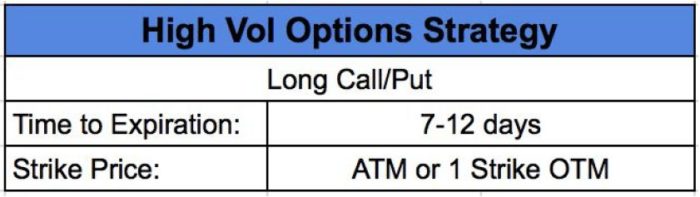

- are willing to trade the shorter term weekly options on many of these names.

- We like to see 7-12 days left before expiration with the options we are trading.

- We are making a change by looking at the options that are either At the Money or 1 strike Out of the Money. These changes allow us to see higher returns on the shorter trades.

- These options have a higher Gamma which means they will react faster to changes in stock price.

You will want to be aware that there are some increased risks as well.

The increased Gamma can allow us to make more money when the trades move in our favor. However, they will also have larger percentage losses from the trades that don’t work for us. You will want to make sure you are trading stocks that have a history of quick moves when using this High Volatility Options strategy.

Don’t use this strategy just to save money with the cheaper Weekly options.

Make sure you go back and test the stocks you are trading to make sure they have a typical holding time of 1-3 days. If they don’t, then you will be far better off with the monthly options.

The short term Weekly options will have higher time decay so you can’t afford to hold these trades very long without the time decay hurting you.

The Weekly options in many cases will have lower liquidity when compared to the Monthly options. If you find it difficult to get fills on these names then moving to the Monthly options will be a better choice. Even though they will cost more, the Monthly options will allow you to get in and out faster and at better prices in many cases.

When used properly and in the right environment this High Volatility strategy can produce some impressive returns. Just make sure this is only a small portion of your overall trading portfolio.

The Opportunity Is Now – For Now

We all know markets will change over time. The hot names trading a year from now could be completely different from the ones we are trading today. The key is to be flexible with your watch list. You will want to take advantage of new opportunities when they present themselves.

No one knows how long the Cryptocurrency craze will be here for.

While these names are active we want to have some exposure to the space. The stocks covered earlier are a few ways to can take advantage of the volatility and add in another layer of diversification to your trading.

As long as you are managing the risk with these names and taking small trades there are tremendous profits to be made. Enjoy the ride while it lasts!

Are You Taking Advantage?

This was a long article and I hope that you have some takeaways from it.

If this all seemed a little confusing, that’s normal. Unless you’ve had experience with other methods of trading and taking advantage of the opportunity markets can give us, this can be overwhelming.

But if you are a trader and looking to diversity your market approach, you can’t ignore this without a little deeper study.

The worse thing to do is to find interest in what you just read, and move on without taking another step to seeing if it is the right fit for you.

1 Comment

Comments are closed.

“WEALTH” I’m 74 years old man with (still) some dreams. My lifelong savings are not impressive and current health conditions push me to looking for changes. The only way I see are the share market. I start looking for somebody, something which will help me in. It is tragic, today i;m surrounded by costly advices which claim that they are the best. May be, but I’m totally lost in this avalanche of advices which only have interest in my money. YOU!! as I think are THE BEST. I’m constantly learning, more and more and NOBODY YET ask me for penny! More, you still offering me FREE support, FREE education, FREE advice. I do not believe that all those are happen here in US. WOW!

Thank You, I’m green,I do not have much, but with NetPicks I do have mood to learning and I start dream pinkish. Thanks!