- April 6, 2023

- Posted by: Shane Daly

- Categories: Stock Trading, Trading Article

Are you a trader who is making these common mistakes in stock trading?

Whether you’re an amateur or experienced trader, there are some mistakes that have you losing money that can be avoided when trading online. From failing to have a clear trading plan and overtrading, to letting emotions drive decisions and neglecting risk management strategies – all of these issues can cause serious harm when trading stocks.

This post looks at the common pitfalls made by those who trade stocks, and ways to avoid them. Traders lose money when doing things right. Let’s not have losing trades due to avoidable errors.

10 Most Common Stock Trading Mistakes

- Failing to Have a Clear Trading Plan

- Overtrading and Taking on Too Much Risk

- Not Having a Proper Risk Management Strategy

- Letting Emotions Drive Their Trading Decisions

- Focusing Too Much on Short-Term Gains and Losses

- Trading Low Volume Stocks

- Chasing Hot Stocks or Trends Without a Proper Analysis

- Not Using Stop-Loss Orders to Protect Their Positions

- Following the Herd Mentality and Not Making Independent Decisions

- Neglecting to Track and Review Their Trading Performance Over Time

- Conclusion

Failing to Have a Clear Trading Plan

Having a clear trading plan is essential for any trader, whether they are just starting out or have been trading for years. Without a strategy, traders may be vulnerable to poor practices and commit costly mistakes that could cause major financial losses.

Before buying stocks, you should have a trading plan that includes:

- risk management

- entry and exit point

- position sizing, and more.

Risk management is key when it comes to protecting your capital from large losses. It’s important to set limits on how much you are willing to lose per trade so that you don’t blow your account with one bad trade. The ability to accept losses is the hallmark of a professional trader.

Entry and exit points refer to the stock price at which you enter or exit a trade; and should be predetermined before entering a trade.

Position sizing refers to how many shares of a stock or contracts of an option you buy; this helps ensure that your trades aren’t too big relative to your account size.

It’s also important not to get too attached emotionally with any particular trade; instead focus on following the rules laid out in your trading plan. If things start going south quickly, having an established stop-loss order will help protect against further losses while allowing some room for potential recovery if conditions improve.

Tracking performance over time is crucial for identifying areas where improvement may be needed as well as understanding what strategies work best under different market conditions (e.g., bull vs bear).

Overtrading and Taking on Too Much Risk

Overtrading is a common mistake among traders, especially those who are new to the markets. Overtrading is usually a result of greed, the fear of missing out, and revenge trading.

Traders should focus on quality trades instead of quantity. Taking fewer trades with higher probability setups will help reduce risk and increase potential profits over time.

It’s important for traders not to get caught up in the moment or chase hot stocks that fall outside of your trading plan.

It’s also important for traders to track their performance over time by keeping records of all trades they make as well as reviewing them so they can identify mistakes and learn from them.

Not Having a Proper Risk Management Strategy

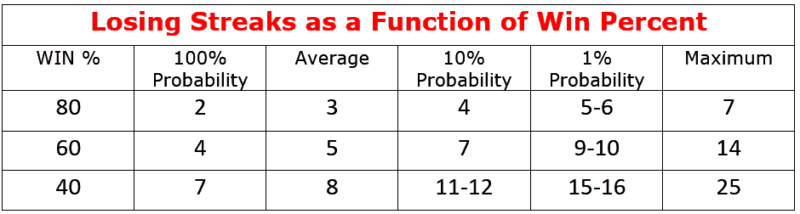

Having a risk management plan in place is indispensable when trading stocks, options, and other financial instruments. Risk/reward ratios are one of the most important aspects of any successful trading plan. Understanding the potential reward versus the potential risk before making any trade can help traders make better decisions.

You must realize that every trade carries a certain level of risk. Remember that no matter how well-developed your trading strategy/plan may be, there is still a chance for losses. It’s critical for traders to have an understanding of their own risk tolerance and develop strategies accordingly.

One way traders can manage their risks is by setting stop-loss orders on each position they enter into. This allows them to limit their downside exposure while still allowing for the opportunity for profits if prices move in their favor.

Traders should also consider using trailing stops which adjust as price moves in order to lock in gains. This allows a trader to have the opportunity to profit from extended price runs.

Letting Emotions Drive Trading Decisions

Traders can be their own enemy when they let emotions cloud their judgement and decision-making, leading to errors that could have been avoided had discipline been maintained. It is important for traders to stay disciplined and stick with the plan they set out before entering any trade.

Fear

One of the most common emotional traps traders fall into is fear. Fear can cause a trader to hesitate when making trades or even worse, not make them at all. This fear-based hesitation often leads to missed opportunities as well as losses from holding onto positions too long or exiting them too soon due to the fear of loss.

Greed

Another emotion that can get in the way of successful trading is greed. Greed causes traders to become overly aggressive with their positions and take on excessive risk in order to try and maximize profits. This type of behavior usually ends up backfiring as markets tend not move in straight lines which means there will always be some volatility along the way.

Traders should also avoid letting excitement cloud their judgment when it comes time for them enter or exit a trade; this often leads inexperienced traders down a path filled with poor decisions based on wishful thinking instead of trusting their plan. Traders must remain levelheaded during winning streaks and losing ones if they want any chance at success over time.

Regret

Another emotion that has no place in trading is regret; regretting past trades and mistakes does nothing but distract you from focusing on what matters most: future performance improvement through proper analysis and discipline.

We must strive for discipline, objectivity and clarity when it comes time for us to execute our strategies; otherwise we will find ourselves spinning our wheels as we make mistakes that could cost us our trading account.

Focusing Too Much on Short-Term Gains and Losses

One common mistake that stock traders make is focusing too much on short-term gains and losses. It is tempting to try to make a quick profit buying shares but successful traders tend to take a long-term perspective. Short-term gains made during a momentum move in price may be nice, but they are not the normal.

When traders focus too much on short-term gains, they tend to forget other aspects of trading, such as risk management and tracking their performance. Risk management strategies are crucial for managing potential losses, while tracking performance over time can help traders identify areas of strength and weakness in their trading strategies.

By taking a long-term outlook and making risk management and performance tracking/review important, traders can make better decisions about their trades, their strategy, and improve their chances of long-term success. Whether you are looking for long-term capital appreciation or consistent returns each month, focusing on these essential components of trading can help you achieve your goals over time.

Trading Low Volume Stocks

Trading in stocks with low liquidity is a recipe for disaster, a quick way to lose money, and should be avoided.

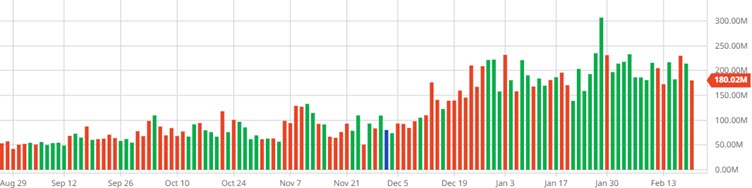

What Is Volume?

Volume is the amount of shares transacted over a certain period. It’s an indication of how actively a stock is being bought and sold.. High trading activity makes it simpler to enter or exit positions without having a great effect on price changes or encountering slippage. Low volume indicates that there are fewer buyers and sellers in the market for that particular stock. From gaps to slippage, low volume stocks should be avoided by most traders.

Why Is Volume Important?

Volume provides a glimpse into both liquidity levels and trader sentiment of a particular stock. When dealing with low-volume stocks, traders may find it difficult to enter and exit a stock without slippage. This can cause getting in at worse prices than expected and when it’s your stop loss being hit, you can take larger losses.

Lower-volume instruments may not follow the broader trend of the market and are also easy to manipulate. Pump and dump is very common with low volume stocks as it takes very little buying interest to drive the price up.

Risks Associated With Trading Low Volume Stocks:

Lower Liquidity – As mentioned above, lower volumes mean less liquidity which could make entering/exiting trades difficult (especially during times when markets become volatile). This could also lead to wider spreads between bid & ask prices which would increase transaction costs associated with each trade executed

Low-volume stocks are more prone to volatility than higher ones due to the lack of participants providing stability through buying and selling activity. This can lead to sudden swings in price, both up and down.

Due to limited participation compared with higher volume securities, there is a heightened risk of manipulation.

Chasing Hot Stocks or Trends Without a Proper Analysis

Chasing hot stocks or trends without a proper analysis can be a dangerous game for traders. Think of AMC or GME and the huge moves they made, both up and down.

One mistake many investors make when chasing hot stocks or trends is failing to analyze whether it fits into their overall trading strategy. A good trader will have an established plan with specific goals and objectives they want to achieve through trading, such as long-term capital appreciation, income generation, diversification etc., so they need to ensure that any trade they make fit within this framework.

Another mistake traders make when chasing hot stocks is neglecting to assess risk versus reward potential of each trade. Before entering into any trade position, it’s important for traders to understand how much money they could lose and consider what kind of returns could be expected if everything goes right. This helps them decide whether taking on additional risk makes sense given their financial situation and goals.

When assessing potential trades related to hot stocks, traders should be aware of market sentiment; if everyone is bullish on a particular stock then there may not be much upside potential but still considerable downside risk associated with buying at current levels.

On the other hand, if everyone is bearish, while there could potentially be some upside opportunity present, there would also be significant downside risk depending on liquidity and other factors.

Whenever something is bull or bear heavy, expect the opposite price movement especially after extended runs.

Not Using Stop-Loss Orders to Protect Positions

A stop-loss order is a type of order that automatically closes out your position when it reaches a certain price level. This helps protect you from large losses if the stock or option moves against you.

Many traders fail to use stop-loss orders on losing trades because they don’t understand how they work or because they think it will limit their potential profits. This could be a costly mistake as failing to use stop-loss orders can lead to huge losses in the event of an unexpected market move.

For example, let’s say you bought 100 shares of XYZ at $50 per share with no stop loss in place. If the stock suddenly drops to $30 per share due to some unforeseen news or events, then you would have lost $2,000 on your trade without any protection from a stop loss order.

On the other hand, if you had set up a 10% trailing stop loss (example only) at $45 per share prior to buying XYZ stock then your position would have been closed out before it dropped below that price level.

Traders should be aware of the potential benefits of stop-loss orders, how they work, and strive to take advantage of them in order to better manage their trades. Stop-loss orders help minimize potential losses by closing out positions once they reach predetermined levels, making them an invaluable tool for any trader looking to maximize their returns while minimizing their risks in the markets.

Following Herd Mentality and Not Making Independent Decisions

This is when traders fail to make independent decisions and follow what everyone else is doing. Traders may be making decisions without sufficient information, leading to bad choices if they follow the crowd (AMC). Traders who rely on the herd mentality could end up making bad trades that don’t align with their own goals and objectives.

What Is Herd Mentality In the Stock Market?

Herd mentality refers to people’s tendency to think and act in a similar way as those around them without considering any other alternatives or options. Traders may opt for particular stocks without assessing the company or the technical setups and copy what other traders are doing.

Why Is Following the Herd Dangerous?

Following the herd can lead to disastrous results because you are relying on someone else’s opinion instead of forming your own conclusion about the ticker.

If everyone starts buying a certain stock due to its recent success, then prices will likely increase until eventually reaching unsustainable levels where they will crash back down again once people start selling off their shares to bank profits. This phenomenon is known as “herding behavior” which has been linked with numerous financial crises throughout history including Black Monday (1987) and The Great Recession (2008).

How Can Traders Avoid Falling Prey To Herd Mentality?

Ignore social media and newsletters. Learning how to trade is the best defense against jumping on the bandwagon with other traders.

Neglecting to Track and Review Trading Performance Over Time

Trading performance review is an essential part of any successful trading strategy. Without keeping tabs and reflecting on your trades, you may be left in a position where you miss obvious errors or areas that require development.

Neglecting to track and review your trading performance can lead to costly errors that could have been avoided if proper analysis had been done.

What Are the Benefits of Tracking Your Trading Performance?

Tracking and reviewing your trading activity can reveal patterns in decision-making and trade execution, giving insight into strengths, weaknesses, opportunities for improvement, and potential to increase profits.

Evaluating and monitoring your trading performance can offer insight into the effectiveness of your trading strategies, as well as any potential areas for growth.

How Can You Track Your Trading Performance?

The most effective way of tracking your trading performance is by using a spreadsheet program such as Microsoft Excel or Google Sheets. Traders can monitor their results and assess which strategies work best for them.

There are many software programs available that provide automated solutions for analyzing your trade data with detailed charts and graphs that allow users a deeper look into their trading stats.

What Should You Look For When Reviewing Your Trades?

When examining prior trades, traders should concentrate on recognizing patterns in their decision-making rather than simply looking at the outcome (whether they profited or not).

- Taking note of factors such as risk management techniques used during each trade (i.e., stop losses),

- Technical indicators utilized (i.e., moving averages) etc.

- Your state of mind on the trading day

These will go a long way in showing you how effective your trading strategy is and your mental game during the trading session.

Common Mistakes In Stock Trading – Conclusion

The key to successful stock trading is understanding the common mistakes that traders make and avoiding them. Temptation to go after a popular stock or follow trends may be strong, yet it is essential to take the time for an accurate evaluation, making informed decisions, and good risk management if you wish to achieve lasting success.

Creating a well-thought-out strategy, managing risk, utilizing stop losses and monitoring your trades will help you to avoid errors that could prove expensive in stock trading. With patience, discipline, and avoiding these common mistakes in stock trading, you can become an experienced trader who profits from their trades without falling victim to common pitfalls.

8 Minute Options Trading Cookbook

Packed with powerful strategies that will help you generate income. Discover our secret recipe for winning big in the market – reveal five different paths to success on every trade.

Start achieving success now and enjoy life-changing rewards!