- September 15, 2021

- Posted by: Shane Daly

- Category: Trading Article

Momentum traders look for price movement that is heading for higher prices in a bull market, and lower prices in a bear market.

The question becomes: “How do you know price is about to set up momentum trades?”

The easiest way is to find an instrument such as a stock that is in a consolidation phase. This is also called a trading range.

You would then trade the breakouts anticipating more buyers or sellers would step in.

How do you find these types of potential momentum stocks/trades?

Technical Indicators For Momentum

There are a few indicators you can use to find trading ranges.

You can use chart patterns such as triangles to find price movement that is compressing. You’d then look to trade the breaks.

However, trading indicators simplify finding these types of price conditions.

Moving Averages

A simply way is to look for coiling price action around a moving average such as a 20 EMA.

Price action is whipping back and forth around a central price point. There is not a sustained trend direction and you can define support and resistance levels. When price breaches the horizontal line, you can determine how to enter the market.

Price action is whipping back and forth around a central price point. There is not a sustained trend direction and you can define support and resistance levels. When price breaches the horizontal line, you can determine how to enter the market.

The main issue with moving averages is it does not truly reflect volatility.

For momentum trades, we want to have a measure of volatility that tells us:

- volatility is not present

- volatility is present

For that purpose, the moving average does not quite cut it.

Relative Strength Index

A popular technical indicator, the RSI is generally used to show overbought or oversold conditions in the market.

Using the 50 line, we can use the RSI much the same way as we do the moving average.

On this chart, the RSI is not hitting either of the oversold or overbought levels. The line is essentially hugging the middle line (level 50) and when seeing that, you could determine price is not trending.

The same issue applies to the RSI. We want to see a market with low volatility and then a move to higher volatility.

Is This The Best Momentum Indicator?

One of my favorite ways to get a better read on momentum/lack of momentum, is the TTM Squeeze technical indicator.

This indicator takes the Keltner Channel/Bollinger Band indicators, and combines them into one.

Using the TTM Squeeze, we can see:

- When momentum s not present in the market

- Direction of the trend

- In which direction price momentum is headed

- The moment when volatility is picking up

A momentum trading strategy that uses the TTM Squeeze makes it a more objective way to trade.

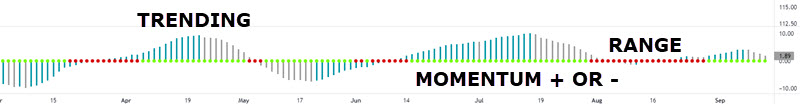

- The red dots show when the market is in a consolidation phase (range)

- Green dots show that volatility is increasing and a momentum trade may be forming

- Histogram shows the trend direction – Above the line is bullish. Below the line is bearish

- Rising or falling histogram bars shows increase or decrease in momentum

It’s a simple indicator to read and you can, at a glance, decide if this instrument is worth trading.

Momentum Trading Strategy

Whether you are day trading or swing trading, the TTM indicator can be used as part of any momentum strategy.

We can use the indicator to give us a signal as to the state of the market. We will add in price action to assist us in getting in and out of a trade.

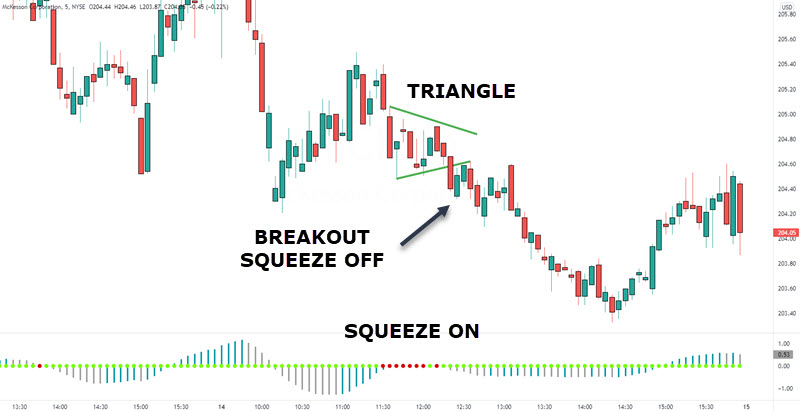

In this day trading example using a 15 minute time frame, we will look at setting up a short trade.

Let’s break the stock chart down:

- Price has just come from an uptrend in price. The histogram is getting smaller which tells us momentum is running out of steam.

- Red dots indicate we are in a low momentum state

- The horizontal lines contain both swing lows and swing highs. We are in a trading range

- The dots turn green. I have zoomed in however at normal size, the lower histogram had started to move lower at the first and second green dot

- You can enter on the break of the horizontal line. In this case, price formed a smaller range and you could enter a bearish position upon breakout. You would be expecting the downward trend to continue

As long as you see the histogram moving higher for bull markets or lower for bear markets, strong momentum could be at play. Learn to ride those moves.

You can use price action to see a trading range. When a market is no longer putting in a trending structure such as higher highs and lows (lower highs and lower lows), a trading range is present.

![]()

Taking a Long Position

We are going to look for the stock price to consolidate and use the TTM to confirm both the consolidation and the return of momentum to take advantage of a higher price.

The stock market has many stocks to choose from and using the TTM squeeze, I quickly found this price chart of Pfizer.

Price has continued to climb and then we find ourselves with declining momentum.

- The red dots indicate low momentum and we draw two horizontal lines containing price action

- We see the red dots go away but we do not see higher prices outside of our lines. Here, we get the “squeeze” signal again. We are waiting for a break.

- We did see a series of green dots but like earlier, we never saw higher prices. Here, the red is back on while price bases under resistance

When you see price basing below resistance or above support, that is a sign that a breakout could be near.

At the arrow, we see momentum increasing, the dots turn green, and price breaks about the horizontal resistance line. A one red candle pullback could be your entry and the upward trend resumes.

Price Patterns

There are certain price patterns that not only do I prefer, they are very obvious to see:

- Flags

- Triangles

Let’s use a day traders time frame:

The triangle chart pattern is a price series of lower highs and higher lows. It will often continue in that pattern compressing price into the apex (where the lines converge).

In this example, a trader can look at the red dots to see an instrument in a consolidation. Scanning up to price, the consolidation alert via the TTM is confirmed with the chart pattern.

Stops and Targets

Any successful trader knows what has to happen to exit a trade in a bull market or bear market.

Exits are a lesson by itself but let’s touch on a simple approach: Average true range and reward risk ratios.

Using the ATR, you would simply calculate 1 or 2 times the ATR for that period. Your stop can be set that distance from entry.

Using reward to risk ratios, you would simply exit your position (or scale out) at 1,2,3 times your initial risk.

Conclusion

The TTM Squeeze for trading momentum moves in the market is a solid approach.

Wrap in proper risk management, exits and entries, into your trading plan.

Like all technical indicators, they lag price. Ensure that price action is monitored for strong adverse moves against any position you have.