- August 15, 2022

- Posted by: Shane Daly

- Category: Trading Article

Making money with stock trading is not as complicated as some people might think. In fact, if you are armed with the proper information and have a good trading strategy, you can be on your way to generating a second income.

Stock trading is available to anybody with an internet connection, money to fund their account, and a few minutes to spare during the day. You do not need to be a professional trader to take advantage of the opportunity that stock trading offers.

In this blog post, we will discuss some of the basics that you need to know in order to get started in stock trading. I will also include a few other ways to benefit from the market outside of just buying shares.

How Much Money Do You Need To Start ?

You don’t need much money to get started trading stocks. In fact, you can open an account with some online brokers for as little as $500.

You can easily find online brokers by doing a quick Google search. Once you find one that suits your needs, you can open a brokerage account and begin trading. An example of popular online stock trading brokers are E-Trade, TD Ameritrade, Interactive Brokers, and Robinhood.

Of course, you are limited in the amount of shares you can buy depending on your account size. For instance, lets say a stock is trading for $100 per share. If you only have $500 in your account, you can in theory, only buy 4 shares due to trading costs you need to pay.

If trading higher price stocks, you may only be able to purchase a single share of a stock.

This also does not take into account your risk tolerance.

If you buy these shares and price declines, how far are you will to let it drop before you exit your trades? Protecting your capital is job number one for a stock trader.

Fractional Shares

A fairly new advance in stock trading is the ability to purchase fractional shares of a stock.

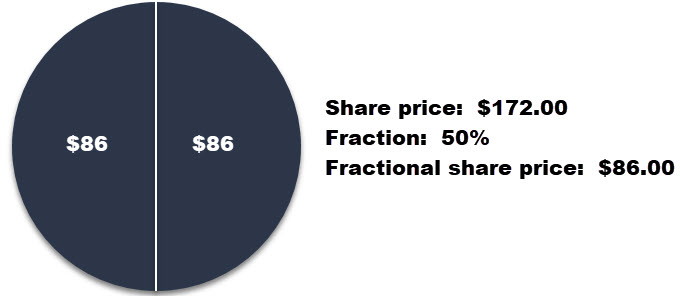

Fractional shares allows retail investors or even day traders that ability to purchase a percentage of an individual share. For example, if a small account trader wanted to buy Boeing, the price is around $172.00. If a trader wanted to buy 50% of a share, they would pay $86.00.

Fractional shares allows retail investors or even day traders that ability to purchase a percentage of an individual share. For example, if a small account trader wanted to buy Boeing, the price is around $172.00. If a trader wanted to buy 50% of a share, they would pay $86.00.

As mentioned, the stock market is accessible to virtually everyone including those with a small trading account.

Stock Trading With Margin Accounts

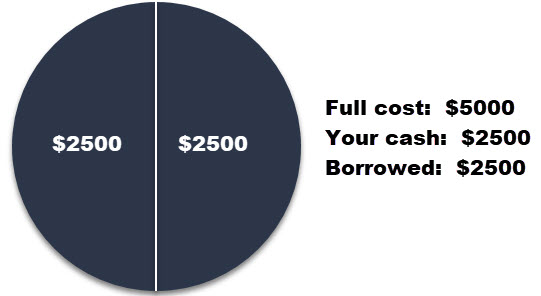

You can trade on margin (leveraging your capital) which allows you to trade with more money than you actually have in your account. You are borrowing money from the brokerage to help fund the purchase of a stock.

For example, you want to buy $5000 worth of stock ABC. You use $2500 of your cash and borrow the other $2500 from the broker. The stock makes a huge leap in price and the investment grows 20% to $6000.00. However, you only used $2500 of your own cash so your return is actually 40%!

The benefit of trading with margin is it can lead to greater profits because you are holding more shares. However, the risk is also much higher as you can lose all of your money if the stock price falls even a small amount. This becomes much worse if the small bit of selling quickly leads to many positions being unwound.

If this same stock dropped 20%, you actually lose 40%.

When trading on margin, you also have to contend with the Pattern Day Trading Rule (PDT). The pattern day trading rule is a regulation put in place by the Financial Industry Regulatory Authority (FINRA) that states that traders who make 4 or more day trades in a 5 business day period using a margin account will be flagged as a pattern day trader.

When trading on margin, you also have to contend with the Pattern Day Trading Rule (PDT). The pattern day trading rule is a regulation put in place by the Financial Industry Regulatory Authority (FINRA) that states that traders who make 4 or more day trades in a 5 business day period using a margin account will be flagged as a pattern day trader.

The main restriction with being flagged as a pattern day trader is that your account must have at least $25,000 in it. If it doesn’t, your broker will limit the amount of trades you can make until you bring the account up to the $25,000 minimum.

Margin Calls

If your stock is taking a dip in price and your equity is falling below the minimum margin trading requirement, your broker will request more money be added to your account. If you fail to fund your account, your broker has the right to sell some of your holdings. Depending on the condition of the market, this sale could result in a huge loss to you.

Buying Stocks

By buying stocks, you are investing in a company with the thought that the company will do well in the future (fundamentals of the company), the stock price is attractive, and others buy also take a position.

If the company does well and the stock price goes up because of the demand for shares, you can make money from your position when you sell.

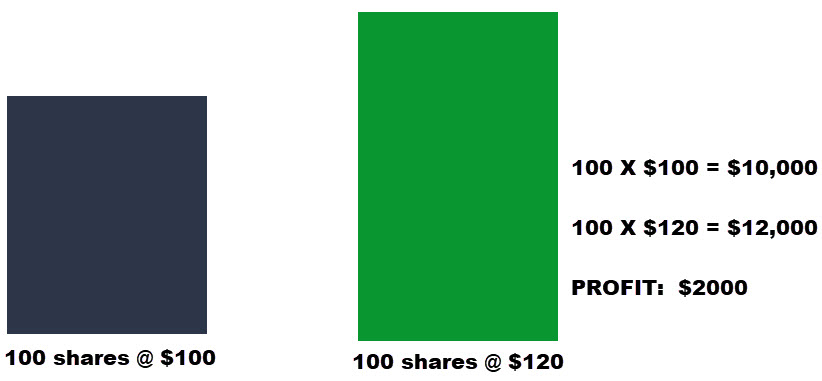

For example, let’s say you buy 100 shares of Apple stock at $100 per share. After a year, the stock price goes up to $120 per share. When you sell your shares, you will make a profit of $2,000 (100 x $20).

For example, let’s say you buy 100 shares of Apple stock at $100 per share. After a year, the stock price goes up to $120 per share. When you sell your shares, you will make a profit of $2,000 (100 x $20).

If the company does poorly and the stock price goes down because sellers are stepping in, you will lose money on your position and will need to sell to protect your trading account.

Short Selling Stock

This is when you sell a stock you do not own because you think it is going to drop in price. What do you do then? If the stock does what you thought it would, you can buy it back at a lower price and pocket the difference.

As an example, let’s say you think the stock price of XYZ company is going to fall. You could borrow 100 shares of XYZ stock from a broker and sell it immediately for $10 per share.

If the price falls to $8 per share, you can buy it back, return the shares to the broker, and pocket the $200 difference. However, if the price goes up to $12 per share, you will have to buy the shares back at a higher price and will lose money on the deal.

We will discuss a different way of profiting from falling stock prices when we discuss trading stock options.

Get Your Dividends

You can also make money from dividends. This is when companies pay out payments to shareholders out of their profits.

As an example, let’s say you own 100 shares of Apple stock and the company pays a dividend of $1 per share. You will receive $100 in dividends (100 x $1) from your investment.

Dividends are usually paid quarterly, so you will receive 4 payments of $25 each year ($100 total). Not only that, you make money on not only the dividends, but also if the share prices rise in the future.

Some of the suggested stocks to hold for good dividend gains are: FAF, JPM, PKG (Forbes)

Here is the kicker though: Once we are in an era of rising interest rates, the rate of return that is risk-free and guaranteed, may be more attractive to these same investors.

Trading Stock Options

Trading stock options is way to trade stocks without buying/selling the actual stock at the offered price.

An option on a stock gives you the right but not the obligation to buy or sell a stock at a certain price in the future. If the stock price goes up, you can make money by selling the option for more than you paid for it.

As an example, let’s say you buy a call option for ABC company at $10 per share. This gives you the right to buy 100 shares of ABC stock at $10 per share anytime in the next year.

As an example, let’s say you buy a call option for ABC company at $10 per share. This gives you the right to buy 100 shares of ABC stock at $10 per share anytime in the next year.

If the stock price goes up to $15 per share, you can sell your option for $500 and make a profit.

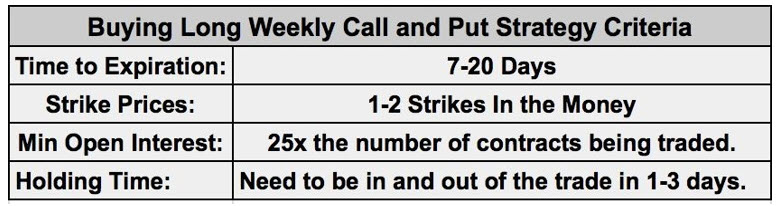

There are other ways to make money trading stock options. Our in-house Options expert Mike has a technique that allows traders the opportunity to profit 5 different ways in Options.

Risks Of Trading

Of course, there are risks involved with trading stocks or any instrument. The stock market can be volatile and prices can go up and down quickly. You could lose money on your investment if the stock price falls and sometimes, you can be wiped out in the blink of an eye.

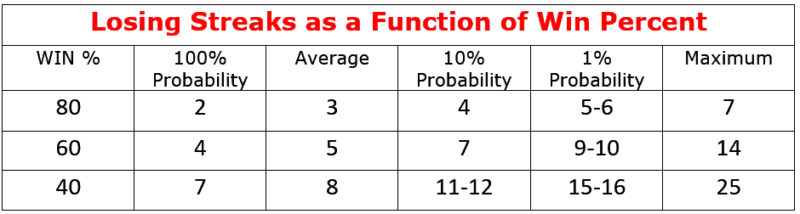

It doesn’t matter how good your trading strategy is. All strategies will have losses and many times, you will be on a streak of losing trades.

Having risk parameters in place when trading is important because it can help limit the amount of money you are risking in the market at any time.

Having risk parameters in place when trading is important because it can help limit the amount of money you are risking in the market at any time.

Traders will have trade risk and portfolio risk. Trade risk is the risk involved with any one trade and portfolio risk is the overall risk of all the positions you hold as a percentage of your account.

A rule of thumb for risk per trade is no more than 2% of your account. So, if you have a $10,000 account, you shouldn’t be risking more than $200 on any one trade.

As for portfolio risk, most traders will keep it at 10% or below. So, if you have a $10,000 account and are comfortable with 10% risk, your entire portfolio shouldn’t be more than $1,000 in the market at any time.

Conclusion

There are many ways to make money trading stocks. You can buy and hold for the long term, trade options, or even day trade stocks. The key is to find a method that works for you and stick with it.

The most important thing to remember is that there is risk involved in all forms of trading. It’s important to have a plan in place to limit your risk and protect your capital.

If you’re interested in learning about our favorite way to trade Stocks, download this free Options Cookbook to get an inside track on the Netpicks approach.